-

United Wholesale Mortgage sees this branding partnership as an opportunity to recruit workers in its home market in the Detroit area, CMO Sarah DeCiantis said.

January 15 -

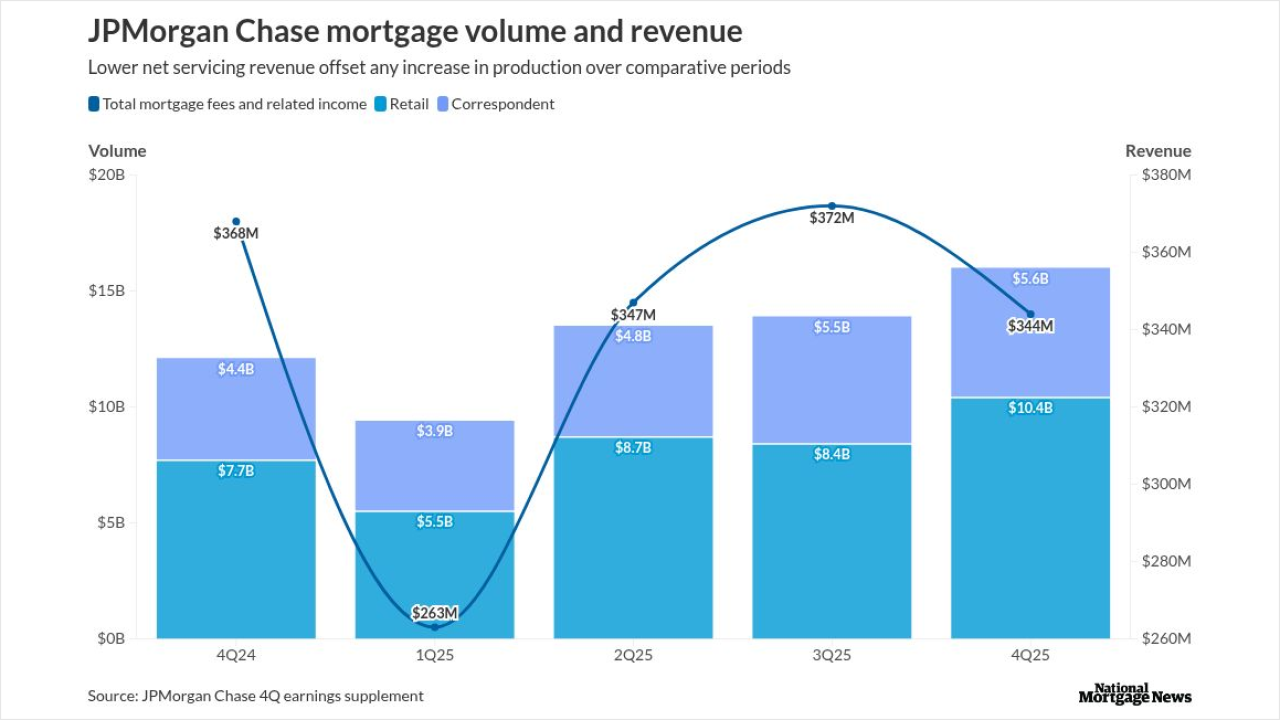

The bank did $16 billion of originations during the final three months of 2025, with the quarter-to-quarter increase beating industry-wide growth forecasts.

January 13 -

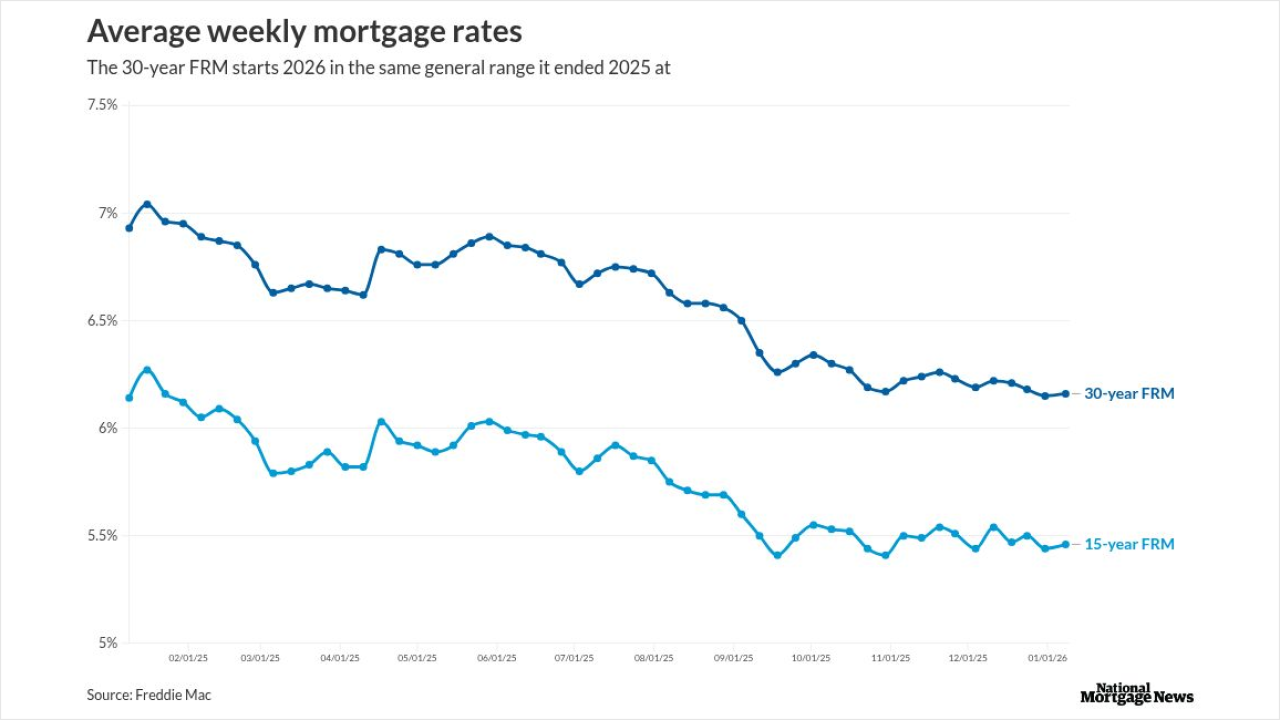

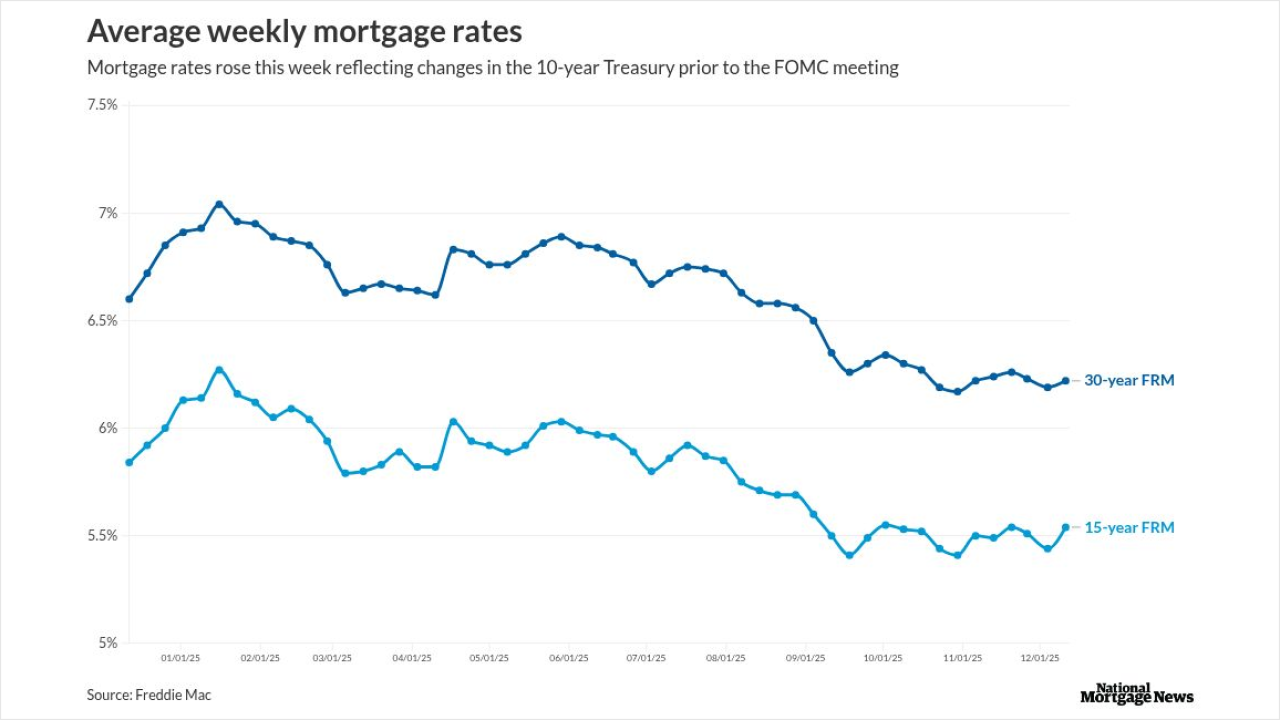

The 30-year fixed remains in its current range, but most expect the rate to reach 6% for 2026, and one observer feels it could actually break under this point.

January 8 -

The company was founded in 1986 by current CEO Mat Ishbia's father Jeff and became the No. 1 originator by dollar volume in the third quarter of 2022.

January 7 -

Although some of the cohort surveyed were flush with savings, others admitted having precarious debt situations and steadfast attitudes toward luxury purchases.

January 6 -

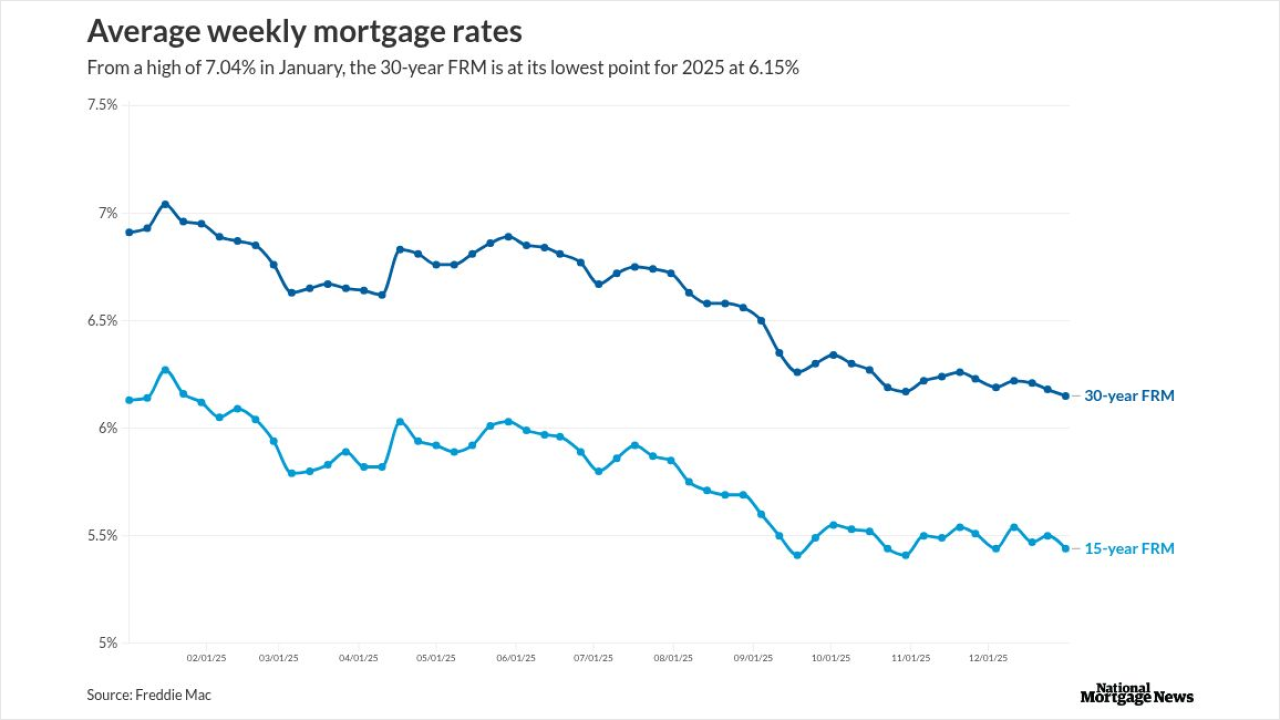

After piercing the 7% ceiling in January, the 30-year fixed trended lower the rest of the year, dropping 89 basis points from peak to trough, Freddie Mac found.

December 31 -

This year it took a homebuyer seven years to save for a typical down payment on a house, compared with 12, according to Realtor.com.

December 29 -

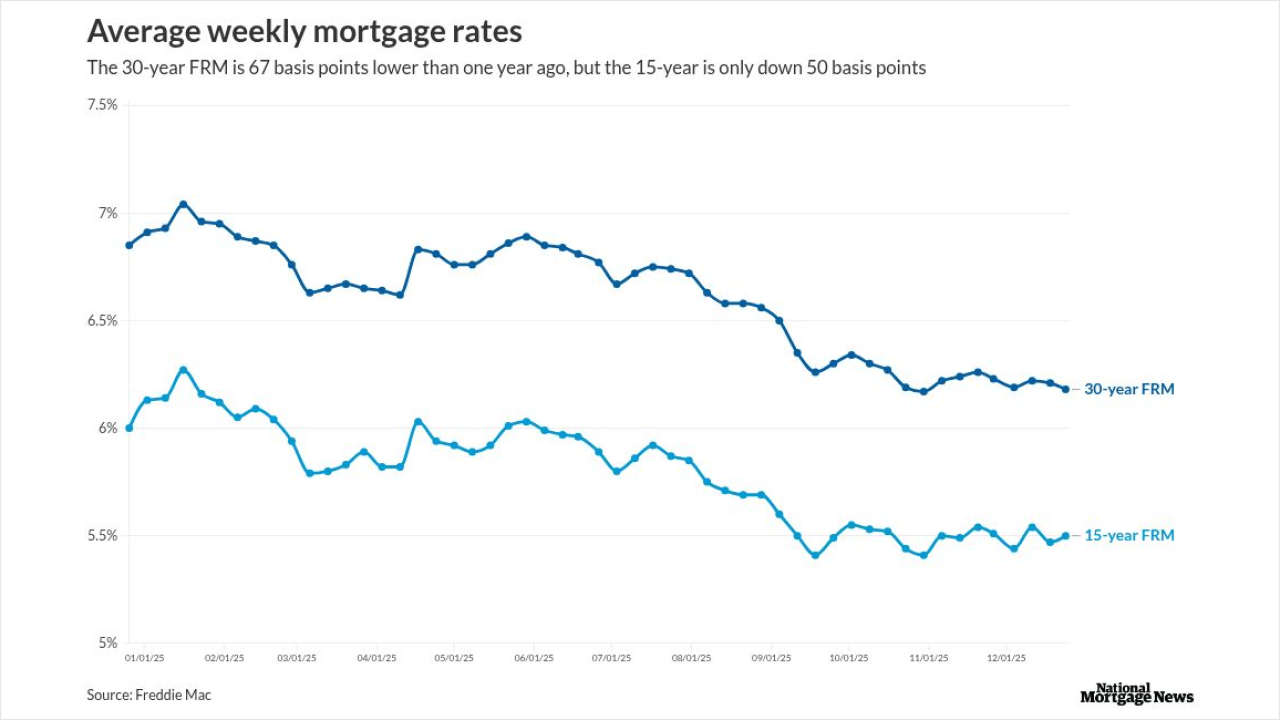

The 30-year fixed rate mortgage dropped 3 basis points this week, its lowest level since October and just over its 52-week bottom, Freddie Mac reported.

December 24 -

The announcement follows Realpha's two previous mergers with mortgage brokerages, as well as its purchases of AI firms and title businesses.

December 23 -

AI tools like ChatGPT are reshaping mortgage marketing, forcing lenders to rethink SEO, brand authority and how they show up as consumers turn to generative search for answers.

December 23 -

The inventory slowdown came as properties sold for 1.6% below asking prices, with some sellers opting to remove their listings altogether, according to Redfin.

December 22 -

Approximately 70% of home purchasers do not get more than one quote in the mortgage process, doing so could reduce their rate by 50 basis points, Zillow said.

December 11 -

The investor markets already set mortgage rates to include the 25 basis point reduction the FOMC announced, and it is too early to see the longer-term effect.

December 11 -

Forty percent of Americans planning to buy or sell a home in 2026 worry about a potential market crash, according to a new report from Clever Offers.

December 9 -

A recent Remax survey found 88% of respondents said they are "very" or "somewhat likely" to purchase a home next year.

December 5 -

The drop in mortgage rates as measured by Freddie Mac, came about even as the 10-year Treasury yield used to price loans moved higher since Thanksgiving.

December 4 -

Planet Home Lending, helped by growing recapture and distributed retail volume, did 64% more originations in the third quarter than one year prior.

December 1 -

Even with this week's increase, mortgage rates have remained within a 13 basis point band since mid-September, with industry pundits saying that's where they will stay.

November 20 -

For the second consecutive week, the 30-year fixed rate mortgage increased as investors were still sorting through the lack of information due to the shutdown.

November 13 -

These attempts to remove legit items from credit files are made with the aim of at least temporarily boosting the credit score in order to get a loan.

November 13