-

Mortgage rates jumped across the board to their highest point this year as 10-year Treasury yields rose in the past week over economic headlines, according to Freddie Mac.

April 19 -

From first-time homebuyers and real estate referrals to digital mortgages and back office execution, here's a look at the biggest concerns and highest priorities of the country's most successful loan officers.

April 17 -

After a strong kick-off to the 2018 housing market, only time will tell how rising interest rates will affect Staten Island, N.Y., residential real estate sales.

April 16 -

Automating the mortgage process will force tighter margins, but drive higher volume, for lenders.

April 12 HouseCanary

HouseCanary -

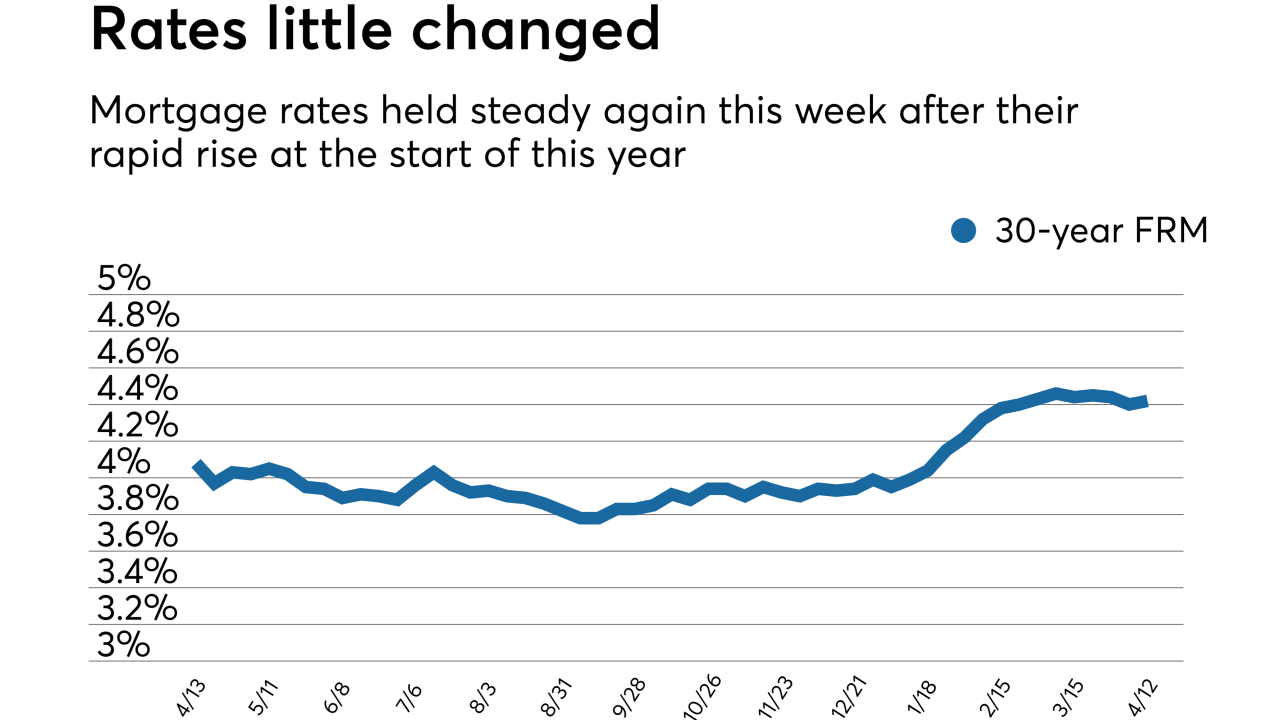

Mortgage rates increased a scant two basis points this past week, holding steady recently after their rapid rise at the start of this year, according to Freddie Mac.

April 12 -

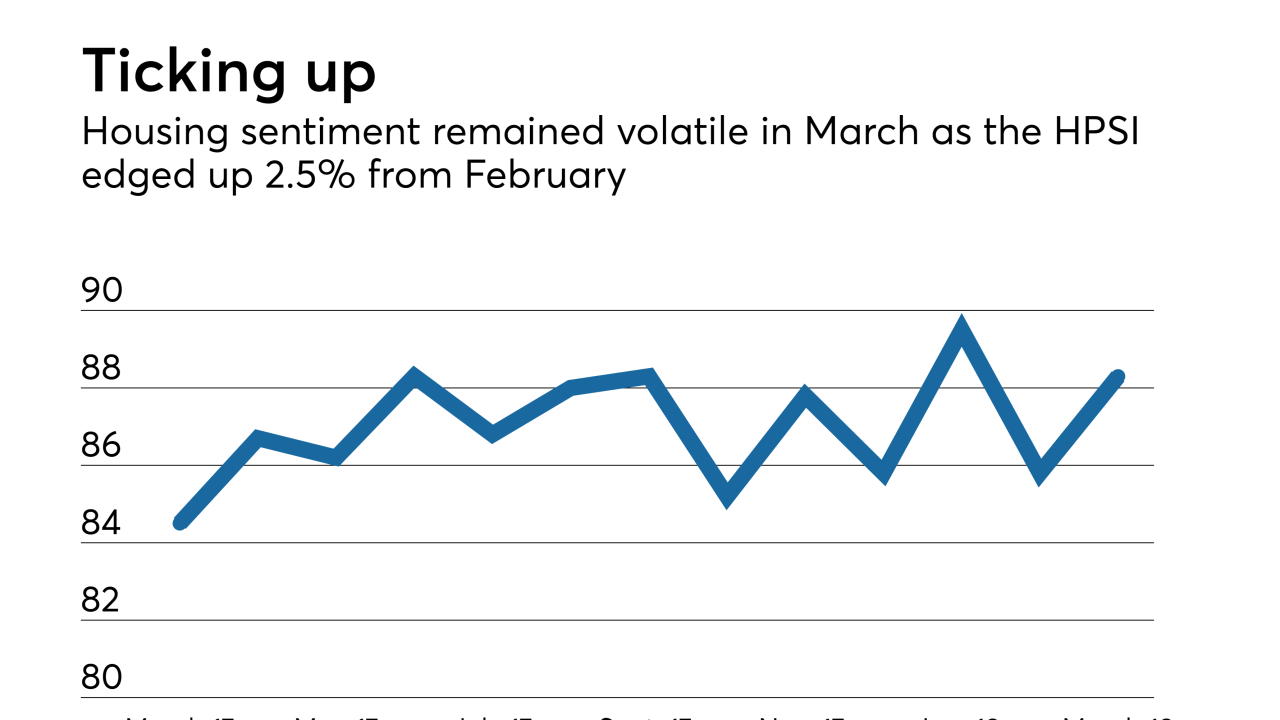

Housing sentiment remained volatile in March as consumers reporting that now is a good time to buy a home rose from the previous month, according to Fannie Mae.

April 9 -

An improved Colorado Springs economy helped propel buyer demand for new homes during the first quarter.

April 5 -

Mortgage rates dropped as the stock market downturn at the start of the week drove yields on the 10-year Treasury lower.

April 5 -

Purchase loans made to millennial mortgage borrowers rose month-over-month in February despite interest rates increasing at the start of the year, according to Ellie Mae.

April 4 -

Mortgage application activity decreased 3.3% from one week earlier as purchase and refinance volume fell prior to the start of the home buying season, according to the Mortgage Bankers Association.

April 4 -

Home values grew in all 50 states in February, but their appreciation is expected to slow within the next year, according to CoreLogic.

April 3 -

Mortgage borrowers collectively hold more equity in their homes than at any other time on record, but they've been slow to borrow against this newfound wealth, according to Black Knight.

April 2 -

Mortgage rates held largely steady for the week, dropping only 1 basis point, according to Freddie Mac.

March 29 -

Despite soaring home prices, other factors needed to inflate a housing bubble are absent from the real estate market. But experts warn falling home values and rising mortgage defaults are inevitable, even if conditions naturally cool off.

March 28 -

A limited number of properties for sale against a backdrop of steady demand helped keep home prices elevated in January, according to S&P CoreLogic Case-Shiller data.

March 27 -

Here's a look at the states where home purchasing power is improving, bucking the national trends of inventory shortages and rising prices.

March 26 -

Banks would welcome a proposal to loosen Basel III capital restrictions because it would make holding mortgage servicing rights easier and stem the recent exodus of depositories from the servicing business, executives said.

March 26 -

Mortgage rates posted a slight increase this week following the Federal Open Markets Committee's decision to boost short-term rates by 25 basis points, according to Freddie Mac.

March 22 -

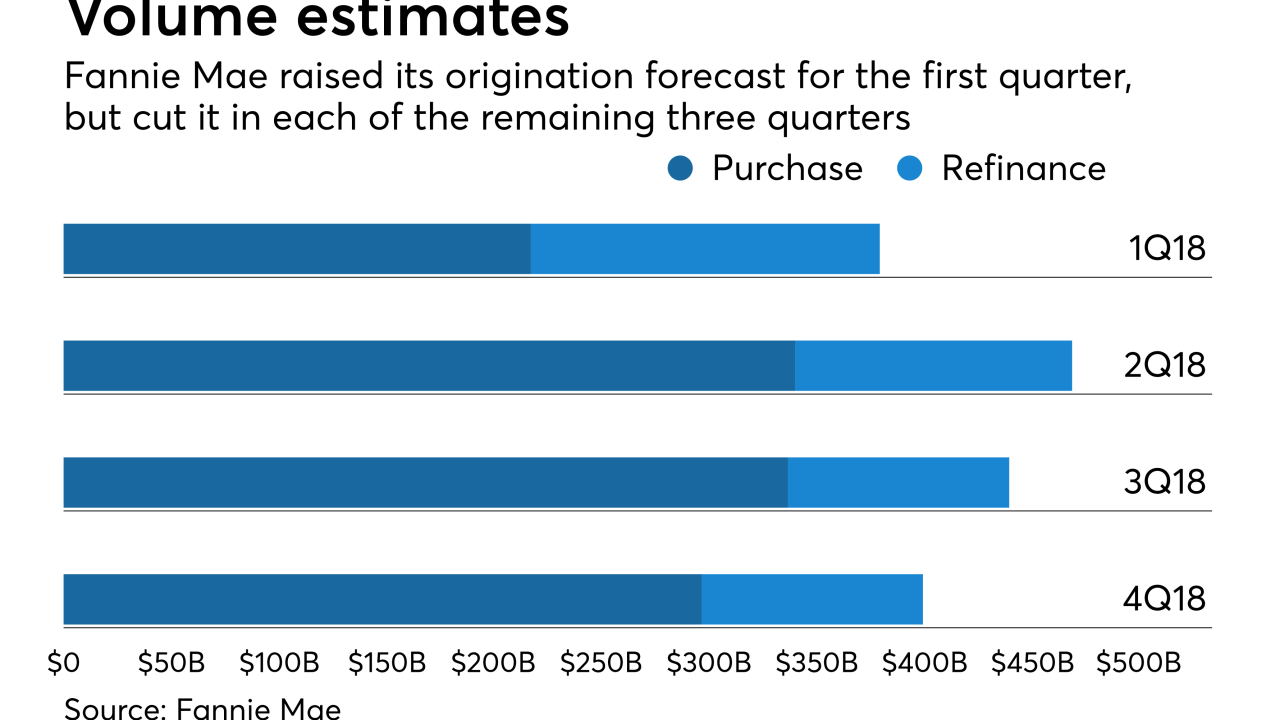

A stronger than expected refinance market led Fannie Mae to increase its origination projections for the first quarter by nearly 4% in its March outlook.

March 19 -

Only a small percentage of borrowers are deterred by the higher rates seen this year, even with the additional cost making it tough for first-time buyers to find affordable properties.

March 16