-

Home values grew in all 50 states in February, but their appreciation is expected to slow within the next year, according to CoreLogic.

April 3 -

Mortgage borrowers collectively hold more equity in their homes than at any other time on record, but they've been slow to borrow against this newfound wealth, according to Black Knight.

April 2 -

Mortgage rates held largely steady for the week, dropping only 1 basis point, according to Freddie Mac.

March 29 -

Despite soaring home prices, other factors needed to inflate a housing bubble are absent from the real estate market. But experts warn falling home values and rising mortgage defaults are inevitable, even if conditions naturally cool off.

March 28 -

A limited number of properties for sale against a backdrop of steady demand helped keep home prices elevated in January, according to S&P CoreLogic Case-Shiller data.

March 27 -

Here's a look at the states where home purchasing power is improving, bucking the national trends of inventory shortages and rising prices.

March 26 -

Banks would welcome a proposal to loosen Basel III capital restrictions because it would make holding mortgage servicing rights easier and stem the recent exodus of depositories from the servicing business, executives said.

March 26 -

Mortgage rates posted a slight increase this week following the Federal Open Markets Committee's decision to boost short-term rates by 25 basis points, according to Freddie Mac.

March 22 -

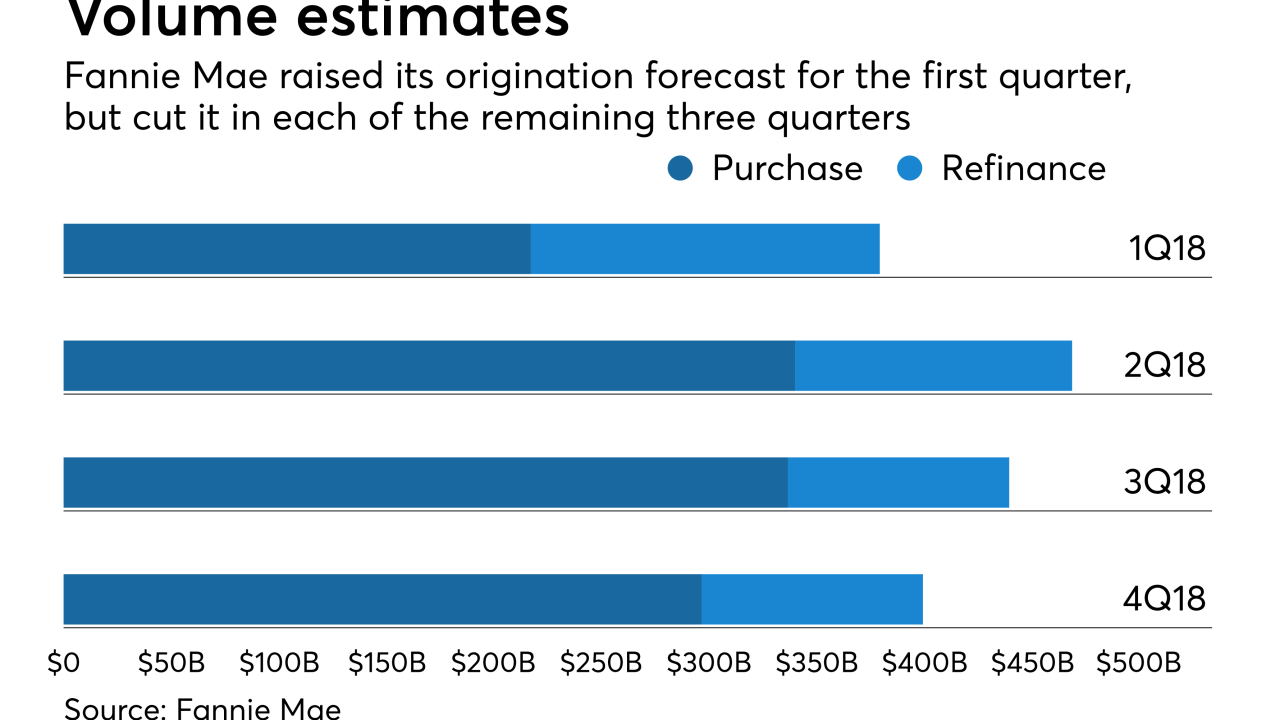

A stronger than expected refinance market led Fannie Mae to increase its origination projections for the first quarter by nearly 4% in its March outlook.

March 19 -

Only a small percentage of borrowers are deterred by the higher rates seen this year, even with the additional cost making it tough for first-time buyers to find affordable properties.

March 16 -

Residential mortgage originations fell 19% year-over-year in the fourth quarter of 2017, due primarily to a large drop in refinance volume, according to Attom Data Solutions.

March 16 -

Houston-area homebuyers face a tightening supply of homes just as the busy Spring home-buying season is about to hit.

March 16 -

After increasing for nine consecutive weeks, mortgage rates dropped for the first time in 2018, according to Freddie Mac's Primary Mortgage Market Survey.

March 15 -

Continued increases in mortgage rates caused the refinance loan application share to fall to its lowest level since September 2008, according to the Mortgage Bankers Association.

March 14 -

There's too much momentum and too little debt for rising interest rates to derail the U.S. economic expansion or drive up the cost of home ownership.

March 14 -

Thanks to low mortgage rates, homes in most metros are actually more affordable today than they were in 1990.

March 12 -

If GSE reform leads to the 30-year mortgage's demise, homebuyers' monthly payments could soar by $400, according to a recent Zillow estimate. But lenders aren't convinced this housing finance staple is in any danger of being replaced.

March 12 -

Employment in the nonbank mortgage lender and brokerage sector is falling in the face of rising interest rates and the limited supply of homes for sale.

March 9 -

Mortgage rates increased for the ninth consecutive week, moving in reaction to bond and stock market volatility.

March 8 -

Consumer confidence in the housing market fell in February, with fewer Americans sharing positive thoughts on mortgage rates, home buying and home prices, according to Fannie Mae.

March 7