-

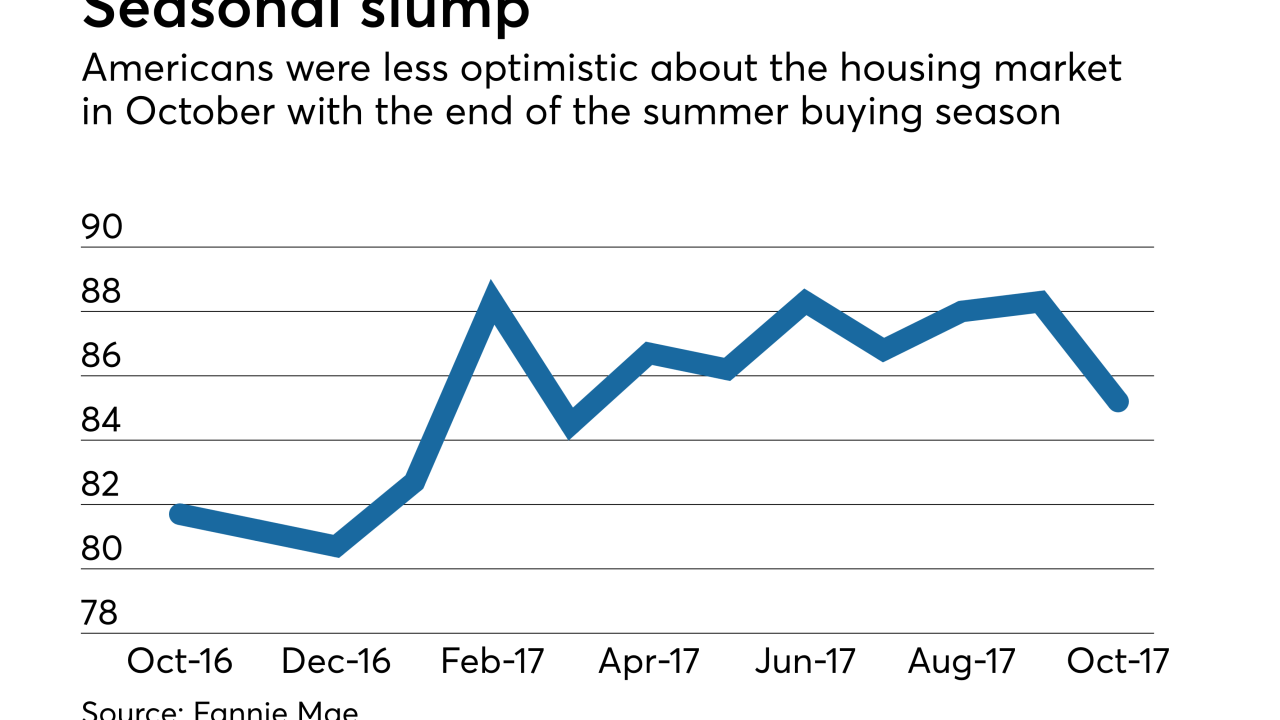

With the end of the summer home buying season, consumers were less optimistic that it was a good time to purchase or sell a home in October.

November 7 -

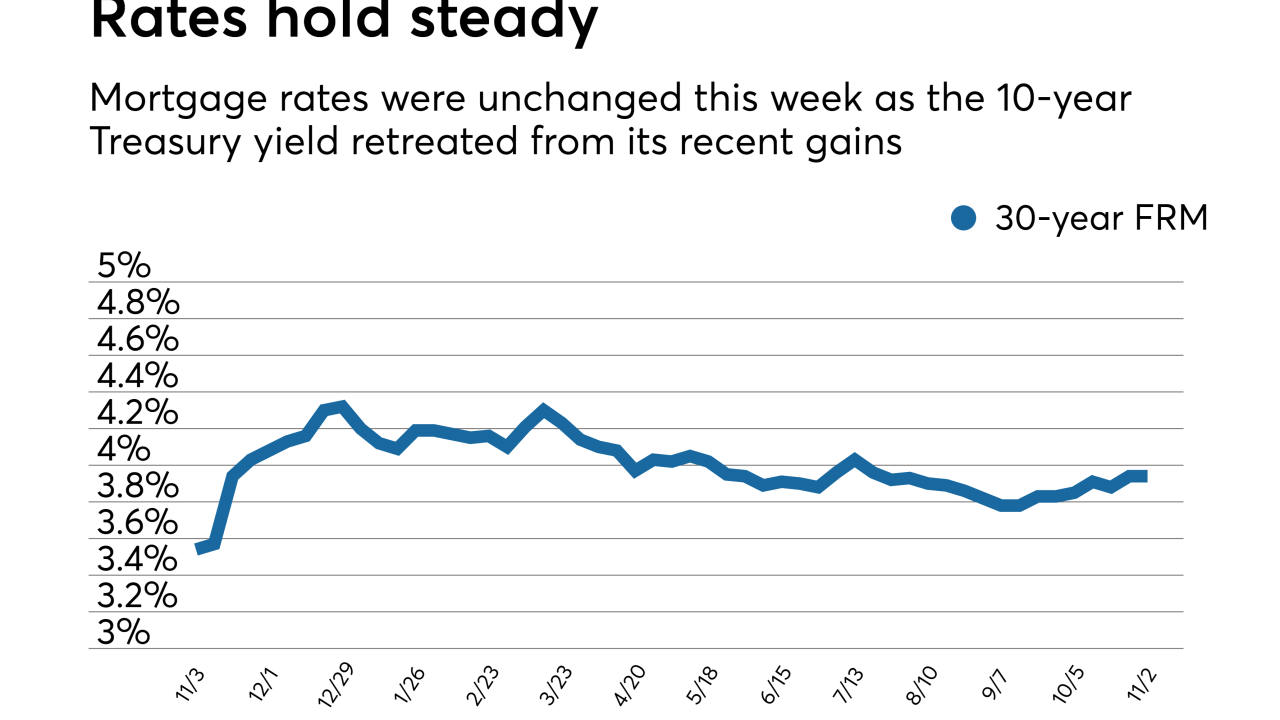

Mortgage rates were unchanged or up slightly this week even as the 10-year Treasury yield retreated from its recent gains, according to Freddie Mac.

November 2 -

Mortgage rates rose to their highest level since July, leading to a 2.6% decrease in loan applications from one week earlier, according to the Mortgage Bankers Association.

November 1 -

Mortgage rates reached their highest level since July and are closing in on 4%, according to Freddie Mac.

October 26 -

Mortgage applications decreased 4.6% from one week earlier because of higher rates for conforming and government loans, according to the Mortgage Bankers Association.

October 25 -

Mortgage rates ticked down for the first time in two weeks as the 10-year Treasury yield fell to its lowest point in October, according to Freddie Mac.

October 19 -

The percentage of refinance loans rose in September as interest rates dipped to a 2017 low, according to Ellie Mae.

October 18 -

Mortgage applications increased 3.6% from one week earlier even though rates remained mostly flat during the period, according to the Mortgage Bankers Association.

October 18 -

Government-sponsored enterprises Fannie Mae and Freddie Mac's guarantee fee pricing last year kept the playing field fairly level for different-sized lenders.

October 17 -

Mortgage rates posted their biggest week-over-week increase since July and the 10-year Treasury yield also rose, according to Freddie Mac.

October 12 -

The share of mortgage refinance applications dropped below 50% for the first time since the start of September, as interest rates rose to a six-week high.

October 11 -

Overall housing confidence rose in September, with renters becoming particularly optimistic, according to Fannie Mae.

October 10 -

Mortgage rates ticked up to their highest mark in six weeks, reflecting the 20-basis-point rise in the 10-year Treasury yield during September, according to Freddie Mac.

October 5 -

In housing markets dominated by young borrowers, millennials took an even bigger share of overall mortgage activity in August.

October 4 -

Mortgage rates remained unchanged from last week even through the 10-year Treasury yield first moved lower then spiked up during the period, according to Freddie Mac.

September 28 -

Mortgage application activity decreased 0.5% from one week earlier as a decline in refinance volume was only partially offset by an increase in purchases.

September 27 -

The percentage of newly originated loans that are used to refinance an existing mortgage could shrink dramatically in 2018 as rates rise and burnout continues.

September 22 -

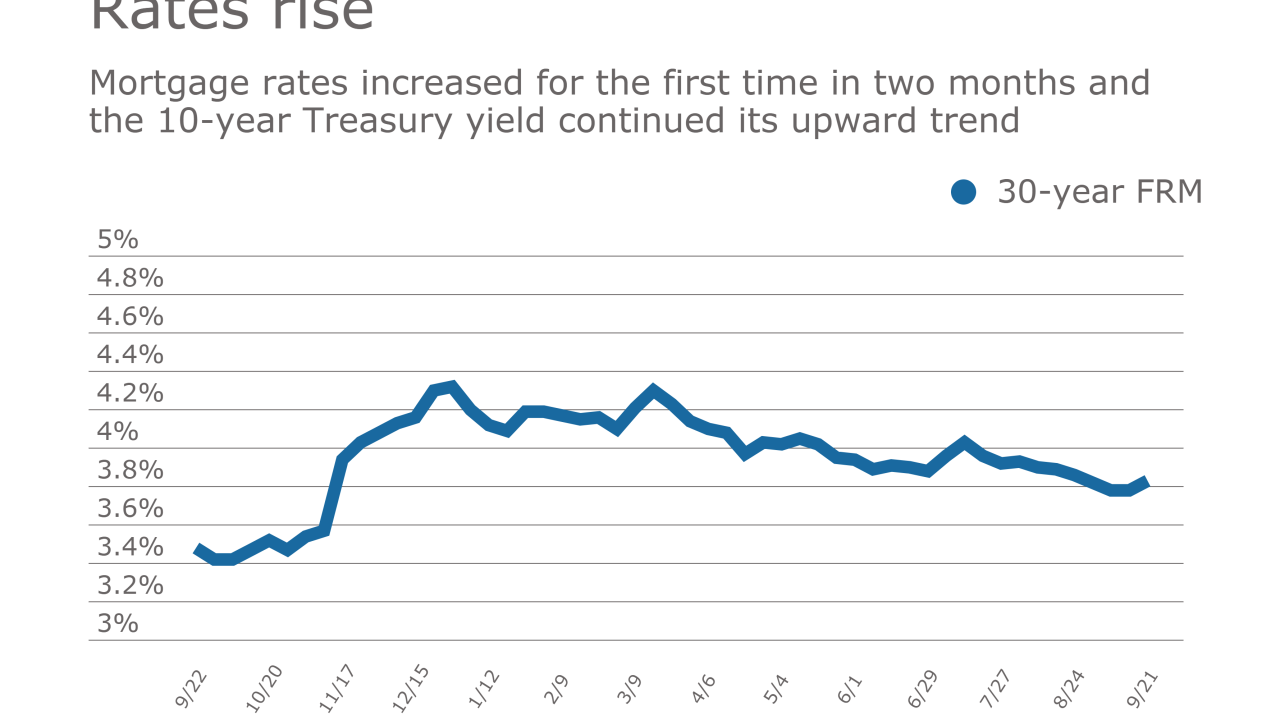

Mortgage rates increased for the first time in seven weeks, while the 10-year Treasury yield continued its upward trend, according to Freddie Mac.

September 21 -

Mortgage application activity decreased from one week earlier due to normal seasonal trends, according to the Mortgage Bankers Association.

September 20 -

Along with the temperature, the housing market in the Twin Cities is beginning to cool.t

September 19