-

Lenders are feeling some relief on the regulatory front, but they still expect their compliance expenses to rise, according to a recent Lenders One survey.

June 7 -

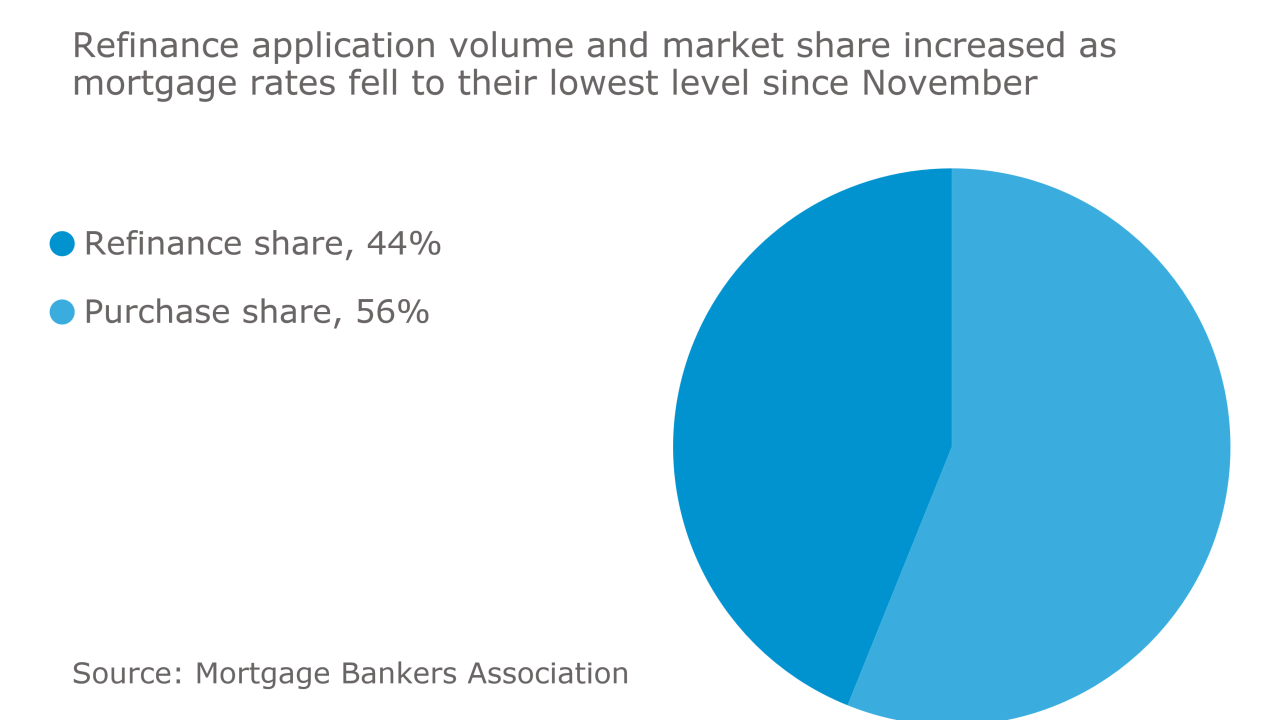

Lower rates led to an increase in both purchase and refinance applications compared with the previous week. according to the Mortgage Bankers Association.

June 7 -

For the first time since before the recession, the entire central Puget Sound region — from Pierce to Snohomish and Kitsap counties — has set records for median home prices.

June 7 -

The Fannie Mae Home Price Sentiment Index fell 0.5 percentage points in May to 86.2 as the continued price increase had more stating it was a better time to sell than buy.

June 7 -

Home prices were up 6.9% in April over the prior year, as lower mortgage rates during the month stimulated consumer demand to purchase a property, according to CoreLogic.

June 6 -

Mortgage rates inched lower for the third consecutive week and set a new low for the year, according to Freddie Mac.

June 1 -

Application volume decreased 3.4% from one week earlier, according to the Mortgage Bankers Association.

May 31 -

Housing demand unexpectedly weakened for a second month across most regions as lean inventory took a toll on affordability, putting a damper on the typically busier spring selling season.

May 31 -

A larger-than-forecast increase in home prices in 20 U.S. cities in March underscores both steady demand and lean inventory, according to S&P CoreLogic Case-Shiller.

May 30 -

Rising prices are holding back some potential sellers from listing their properties because they fear they won't find an affordable replacement, according to First American Financial Corp.

May 26 -

A drop in home sales in Porter County in April led to a year-over-year decline in Northwest Indiana, with total existing home sales of 898 in the seven-county area.

May 25 -

Mortgage rates hit their lowest mark of the year, as they were affected by the stock market sell-off on May 17, according to Freddie Mac.

May 25 -

Sales of homes in the Chicago area dropped in April as potential homebuyers looked at houses but then turned away after finding disappointing choices, the Illinois Realtors reported.

May 25 -

Refinance mortgage volume hit a 10-year low during the first quarter, while a tepid market for purchase lending put total origination activity at its lowest level since 2014.

May 25 -

A larger-than-projected decline in April sales of previously owned homes from a 10-year high indicates the residential real estate market remains constrained by a lack of inventory.

May 24 -

Application volume increased 4.4% from one week earlier as rates hit their lowest level in seven months, according to the Mortgage Bankers Association.

May 24 -

While mortgage rates dropped just three basis points this past week, Wednesday's stock market sell-off could drive them even lower going forward, according to Freddie Mac.

May 18 -

Mixed economic news kept mortgage rates just above 4% for the third consecutive week, according to Freddie Mac.

May 11 -

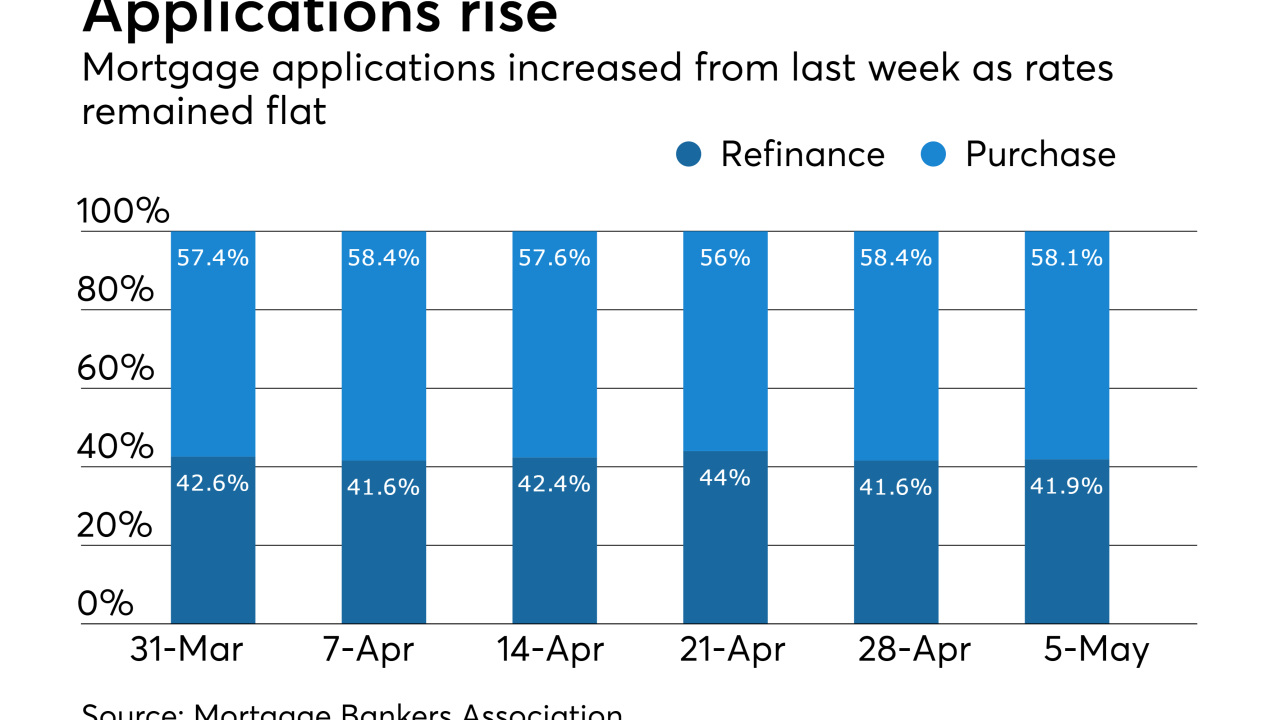

Mortgage applications increased 2.4% from one week earlier as there was little movement in interest rates, according to the Mortgage Bankers Association.

May 10 -

Here's a look at the 12 markets where rising home prices, along with shifts in wages and interest rates, have combined to put the most downward pressure on consumers' purchasing power.

May 9