-

For the second consecutive week, the 30-year fixed rate mortgage increased as investors were still sorting through the lack of information due to the shutdown.

November 13 -

Yields were higher by as much as three basis points, led by tenors more sensitive to changes in Fed policy.

November 13 -

The government shutdown added an additional dose of pessimism about the U.S. economy to panelists' outlooks, Wolters Kluwer said in its latest survey.

November 12 -

The number of highly qualified refinance candidates rose to 1.7 million, the most in three and a half years, as mortgage rates ease.

November 10 -

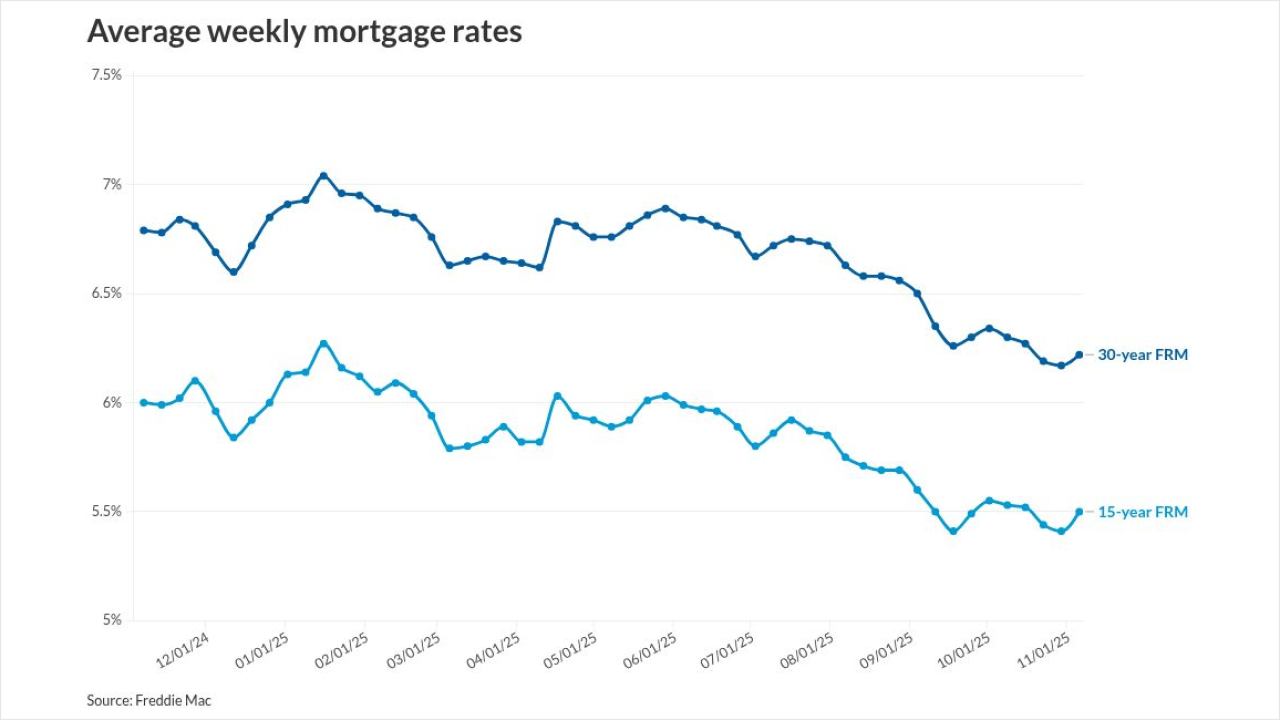

The 30-year fixed-rate mortgage rose five basis points from last week to 6.22%, while the 15-year rate increased nine basis points to 5.50%

November 6 -

Treasuries fell after the US government signaled that larger auction sizes are on the horizon, while signs of economic resilience hurt the odds a Federal Reserve interest-rate cut in December.

November 5 -

Now that quantitative tightening is ending, the debate on who should be the MBS buyer of last resort, Fannie Mae and Freddie Mac, or the Fed, is taking hold

November 3 -

Wall Street dealers expect Bessent to signal as soon as Wednesday, when his department releases a quarterly statement on debt sales, that issuance in the $30 trillion Treasury market will keep shifting in that direction.

November 3 -

Three Federal Reserve officials said they did not support the US central bank's decision to cut interest rates this week, citing inflation that remains too high.

October 31 -

The 30-year rate dropped just 0.2 percentage points, as Federal Reserve Chair Jerome Powell's recent comments caused Treasury yields to rise.

October 30 -

An index of contract signings held at 74.8 after climbing a revised 4.2% a month earlier to the highest level since March, according to National Association of Realtors data released Wednesday.

October 29 -

Mortgage loan application volume jumped 7.1% on a seasonally-adjusted basis last week, the Mortgage Bankers Association said.

October 29 -

Fannie Mae revised its economic and housing outlook for 2025 and 2026, projecting mortgage rates to hit 6.3% and 5.9%, respectively.

October 27 -

The industry analyst also described the significant refinance opportunity should rates decline slightly, and the threshold where home prices soften or firm up.

October 27 -

While expectations that another federal rate cut is on the way next week, other economic trends may be having a larger influence on mortgage lending.

October 23 -

While the Federal Open Market Committee has yet to meet this month, investor pricing of longer-term bonds helped mortgages by 11 basis points, Wallethub said.

October 22 -

While purchase volume is up 20% from last year, it was 5% lower than one week ago, although a 4% increase in refinance activity helped pick up the slack.

October 22 -

Mortgage Bankers Association economist Marina Walsh said lenders could be failing to close more loans as more consumers apply with multiple originators.

October 20 -

LendingTree found that during 2024, May's median price for a 1,500 square foot home was $194.20 versus January's $178.60, a difference of $23,400.

October 17 -

Observers believe the government shutdown and lack of data is keeping mortgage rates in the same narrow range, as investors have issues reading the tea leaves.

October 16