-

Both Zillow and Black Knight Optimal Blue recorded significant increases, but the Freddie Mac survey only reported a 3-basis-point rise.

February 9 -

More than half of borrowers paid 0.5 points or more to cut their interest rate for the life of the loan, while just 3% chose the short-term option, Black Knight said.

February 6 -

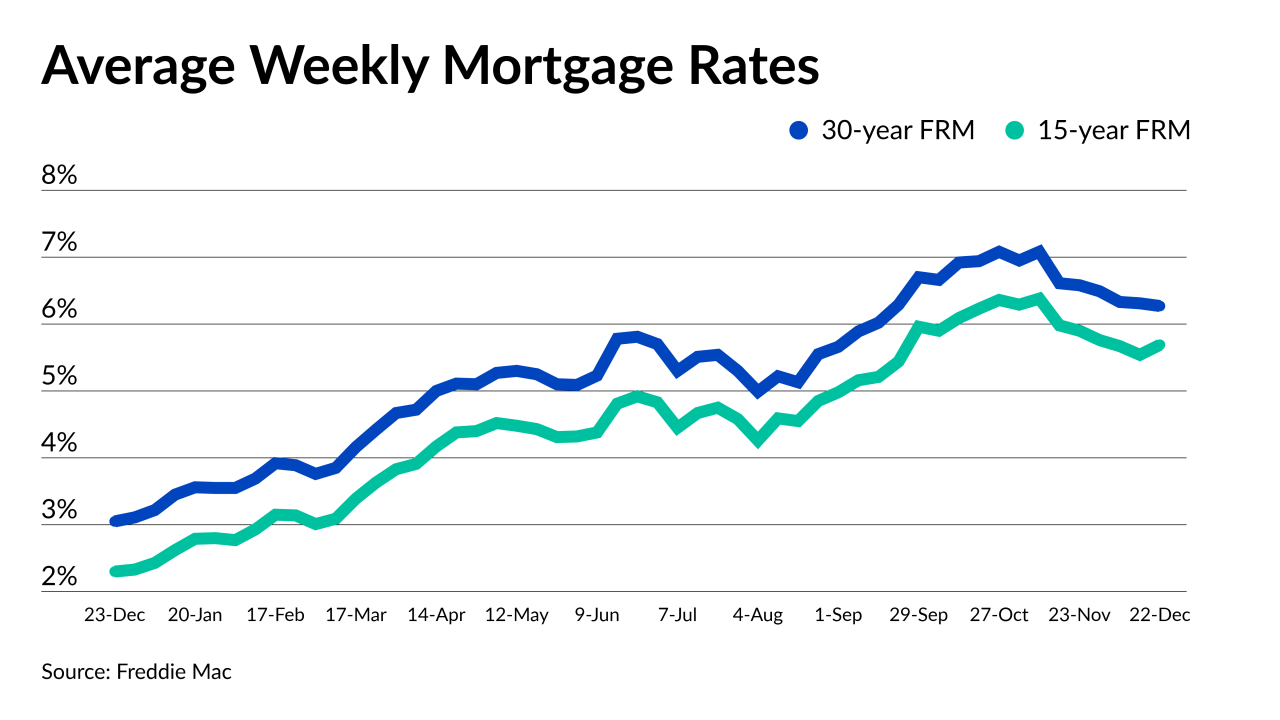

Since breaking above 7% in November, the 30-year fixed is now down nearly a full percentage point, Freddie Mac said.

February 2 -

The Federal Reserve slowed its drive to rein in inflation and said further interest-rate hikes are in store as officials debate when to end their most aggressive tightening of credit in four decades.

February 1 -

Despite 2022's slew of interest-rate hikes from Chair Powell and colleagues, financial conditions are the loosest since last February as investors bet fading inflation will allow the central bank to soon cease raising borrowing costs and then cut them later this year.

January 30 -

But several recent news developments are creating the perception that the risk of a recession is on the wane and that could end the downward pressure on rates.

January 26 -

The U.S. economy expanded at a healthy pace in the fourth quarter, though an extended salvo of Federal Reserve interest-rate hikes is seen jeopardizing growth prospects this year.

January 26 -

The market is signaling that a Federal Reserve policy rate peak short of 5% will be enough to cause a recession, requiring rate cuts totaling half a point during the second half of the year.

January 22 -

Federal Reserve Bank of New York President John Williams said officials have not completed their aggressive tightening campaign to reduce stubborn price pressures.

January 20 -

Generally positive news about the U.S. economy helped push rates lower, but worries about Congressional infighting over the debt ceiling could reverse the trend, Freddie Mac and Zillow said.

January 19 -

Single-family property values during the year's final three months rose 9.2% year-over-year, but that bump fell below the 13.1% annual rise in the prior quarter.

January 17 -

The 30-year fixed loan rate dropped 15 basis points compared with last week as bond market investors acted in advance of this morning's Consumer Price Index report.

January 12 -

With Control Your Price loan officers can lower the interest rate by up to 40 basis points on a loan and by 1.25 percentage points across their pipeline.

January 12 -

However, trackers from Optimal Blue and Zillow found that rates moved in line with the drop in the 10-year Treasury yield.

January 5 -

Federal Reserve Bank of Kansas City President Esther George said the central bank should raise its benchmark interest rate above 5% and hold it there well into 2024 to bring inflation down.

January 5 -

The 30-year fixed rate surged 15 basis points from a week earlier but ends 2022 at more than twice its mark from a year ago.

December 29 -

The National Association of Realtors index of contract signings to purchase previously owned homes decreased 4% last month to 73.9, the lowest outside of the pandemic in data back to 2001, according to a release Wednesday.

December 28 -

The sharpest run-up in rates seen in over three decades slashed mortgage origination volumes, and contributed to a volatile market environment, but had some cyclical benefits for servicing.

December 23 -

But the 15-year interest rate rose last week, in line with 10-year Treasury yields, as bond investors used a quiet week to reflect on broader trends.

December 22 -

This was the fifth week in a row the Freddie Mac Primary Mortgage Market Survey reported a decline in the 30-year rate after peaking at 7.08%.

December 15