-

Single-family property values during the year's final three months rose 9.2% year-over-year, but that bump fell below the 13.1% annual rise in the prior quarter.

January 17 -

The 30-year fixed loan rate dropped 15 basis points compared with last week as bond market investors acted in advance of this morning's Consumer Price Index report.

January 12 -

With Control Your Price loan officers can lower the interest rate by up to 40 basis points on a loan and by 1.25 percentage points across their pipeline.

January 12 -

However, trackers from Optimal Blue and Zillow found that rates moved in line with the drop in the 10-year Treasury yield.

January 5 -

Federal Reserve Bank of Kansas City President Esther George said the central bank should raise its benchmark interest rate above 5% and hold it there well into 2024 to bring inflation down.

January 5 -

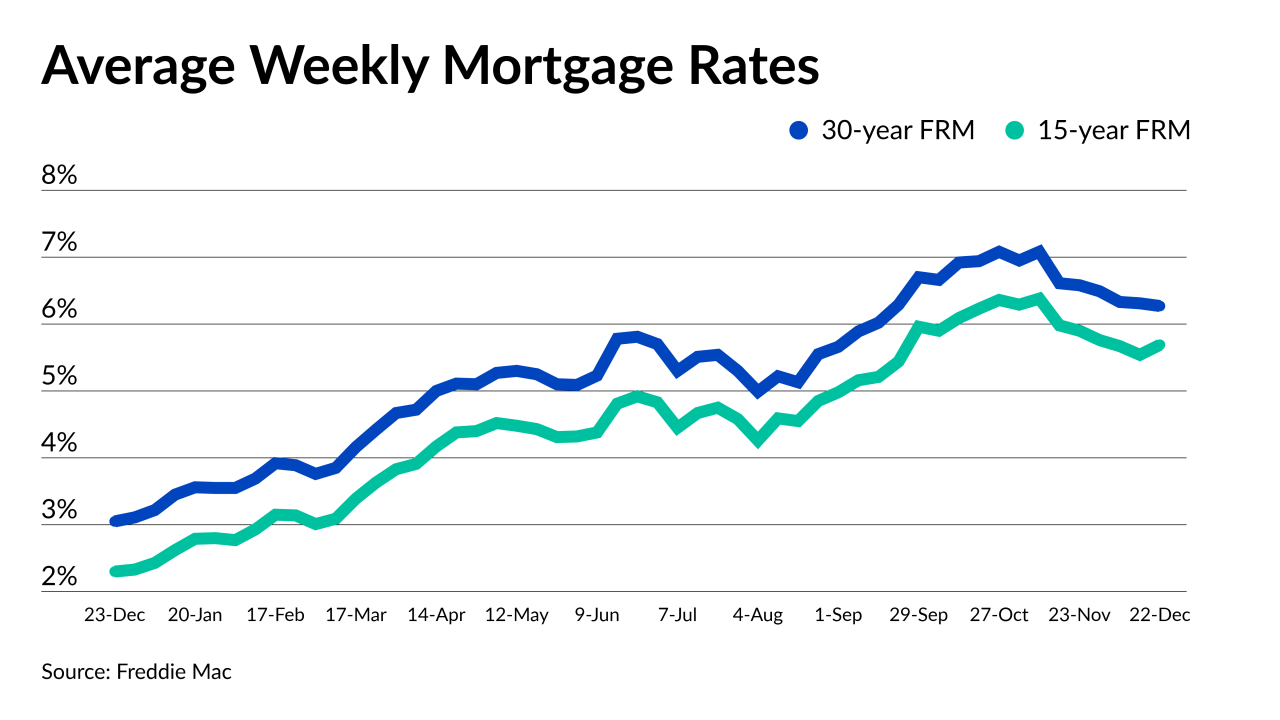

The 30-year fixed rate surged 15 basis points from a week earlier but ends 2022 at more than twice its mark from a year ago.

December 29 -

The National Association of Realtors index of contract signings to purchase previously owned homes decreased 4% last month to 73.9, the lowest outside of the pandemic in data back to 2001, according to a release Wednesday.

December 28 -

The sharpest run-up in rates seen in over three decades slashed mortgage origination volumes, and contributed to a volatile market environment, but had some cyclical benefits for servicing.

December 23 -

But the 15-year interest rate rose last week, in line with 10-year Treasury yields, as bond investors used a quiet week to reflect on broader trends.

December 22 -

This was the fifth week in a row the Freddie Mac Primary Mortgage Market Survey reported a decline in the 30-year rate after peaking at 7.08%.

December 15 -

And having a paperless process was an important reason for many in picking their originator, the National Survey of Mortgage Originations found.

December 14 -

Borrowers' affordability concerns drove activity lower than normal seasonality in November would indicate, Black Knight said.

December 12 -

Following peaking at 7.08% on Nov. 10, the 30-year fixed has come down three-quarters of a percentage point, Freddie Mac said.

December 8 -

Home prices, sales volumes, interest rates are expected to drop next year, researchers at the company forecasted.

December 6 -

The benchmark 10-year Treasury in particular tumbled 11 basis points between Wednesday's close and Thursday's open.

December 1 -

But the rapid drop could be enhancing the volatility that is keeping buyers out of the market, Freddie Mac said.

November 23 -

Rising mortgage rates also led to the highest level of listing price reductions as well as the largest annual drop in pending home sales, Redfin found.

November 22 -

A Fannie Mae survey says 36% get only one quote, while a separate Zillow study found 72% don't plan to look for options.

November 18 -

Contract closings decreased 5.9% to an annualized pace of 4.43 million last month, according to the National Association of Realtors

November 18 -

One week following the Consumer Price Index data release, the 30-year fixed rate loan is 47 basis points lower, while the 15-year is down 40 basis points, Freddie Mac said.

November 17