-

The actions taken by the Federal Reserve to calm the financial markets was key to the drop in mortgage rates this week, according to Freddie Mac.

March 26 -

The $16 trillion U.S. mortgage market — epicenter of the last global financial crisis — is suddenly experiencing its worst turmoil in more than a decade, setting off alarms across the financial industry and prompting the Federal Reserve to intervene.

March 24 -

Mortgage rates rose sharply this week as originators looked to manage the overwhelming demand from consumers, according to Freddie Mac.

March 19 -

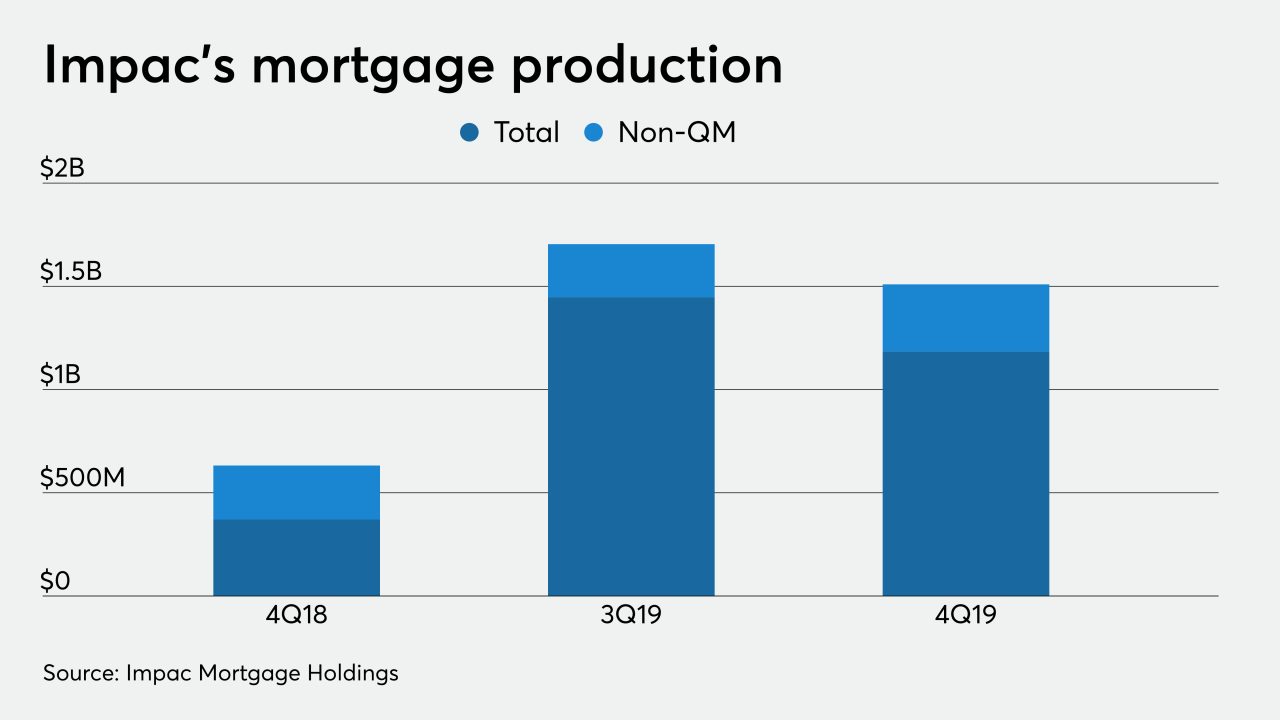

Impac Mortgage Holdings decided a year ago to emphasize its non-qualified mortgage lending operations and placed the company in position to succeed when the housing market returns to normal.

March 13 -

Increased refinancing volume led Fannie Mae to raise its 2020 estimate by $300 billion and 2021 projection by $280 billion.

March 12 -

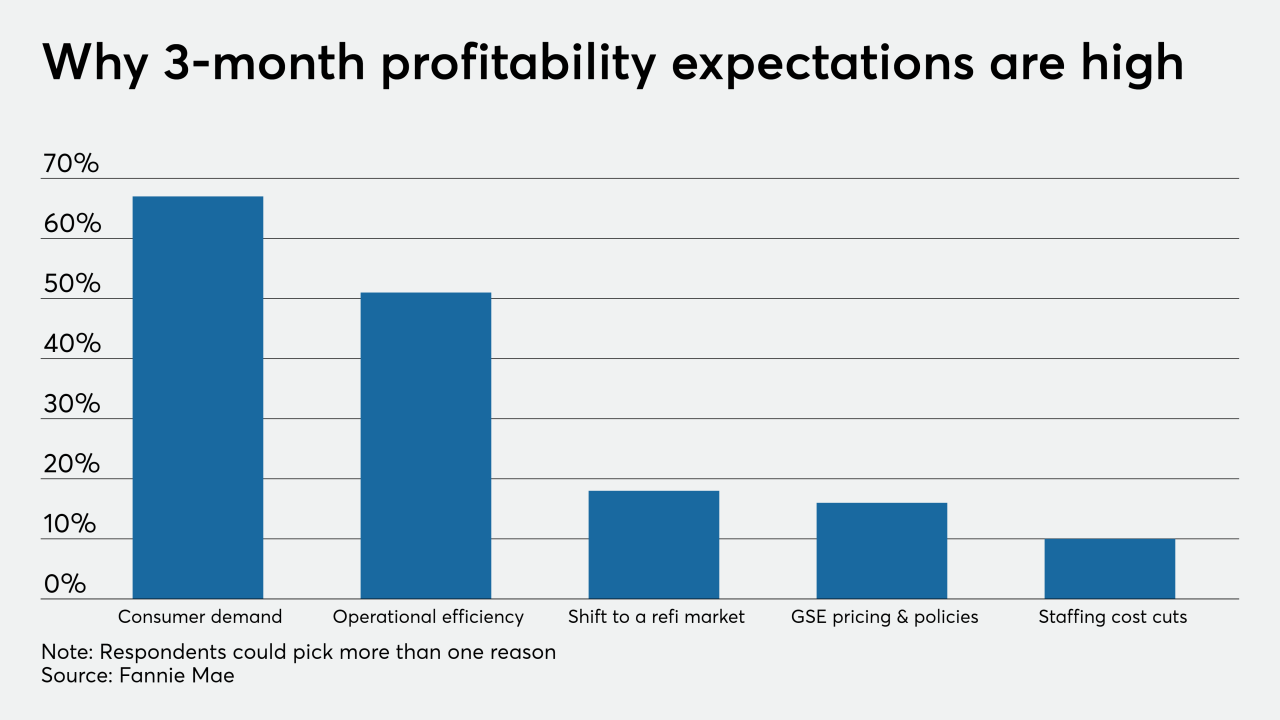

Companies in the mortgage business were already focused on processing a lot of loans and generating efficiencies before the latest uptick in business hit.

March 12 -

Paradoxically, mortgage rates actually increased this past week, even as the 10-year Treasury yield plumbed new depths, likely because lenders are too busy to handle the influx of applications.

March 12 -

Mortgage lenders could benefit from the surge in refinancing due to widening market spreads, and that could help offset damage to servicing rights portfolio valuations, according to Keefe, Bruyette & Woods.

March 9 -

The 10-year Treasury yield fell below 0.5% and the 30-year yield dropped under 0.9%, taking the whole U.S. yield curve below 1% for the first time in history.

March 9 -

It's hard to overstate just how wild bond markets have gotten amid the coronavirus scare, forcing traders to rethink what's possible.

March 6 -

Capacity constraints among mortgage lenders are leading to wider spreads between mortgages and the 10-year Treasury yield even after it remained below 1% for an extended period this week.

March 5 -

Mortgage rates hit their lowest point since Freddie Mac began tracking this data in 1971, as the 10-year Treasury yield fell below 1% after the Federal Open Market Committee's surprise short-term rate cut.

March 5 -

A drop in interest rates in response to the coronavirus outbreak is adding urgency to a hiring spree across the mortgage industry.

March 4 -

Investors' purchases of 10-year Treasurys after the Fed's 50 basis point short-term rate cut drove the yield below 1% for a period of time.

March 3 -

Fears stemming from the coronavirus have resulted in lower mortgage rates and more business for now, but if the situation deteriorates further, consumers could decide to put off buying a home.

March 2 -

Mortgage rates slipped this week, as the stock market sell-off resulted in investors moving into bonds which drove the 10-year Treasury yield down, according to Freddie Mac.

February 27 -

A rally in Treasuries that's driven 10-year yields toward record lows could have more room to run, a Goldman Sachs report said.

February 24 -

Investors snapped up U.S. Treasuries, sending the yield on 10-year securities plunging by as much as 11 basis points Monday to within 5 basis points of its all-time low.

February 24 -

Even with the small increase in mortgage rates this past week, the home purchase market stayed active and should remain so for the peak buying season.

February 20 -

For the first time since the start of the housing crisis, mortgage origination volume could top $2 trillion for three consecutive years, according to Fannie Mae.

February 18