-

After declining for two straight weeks, mortgage rates reversed direction this week and rose to their second highest level this year, according to Freddie Mac.

June 14 -

Continued optimism in the sell side of the real estate market outweighed the growing negative perception on the buy side, as consumer sentiment about purchasing a home reached a new high, according to Fannie Mae.

June 7 -

Mortgage rates dipped for the second consecutive week although 10-year Treasury yields started to rise again, according to Freddie Mac.

June 7 -

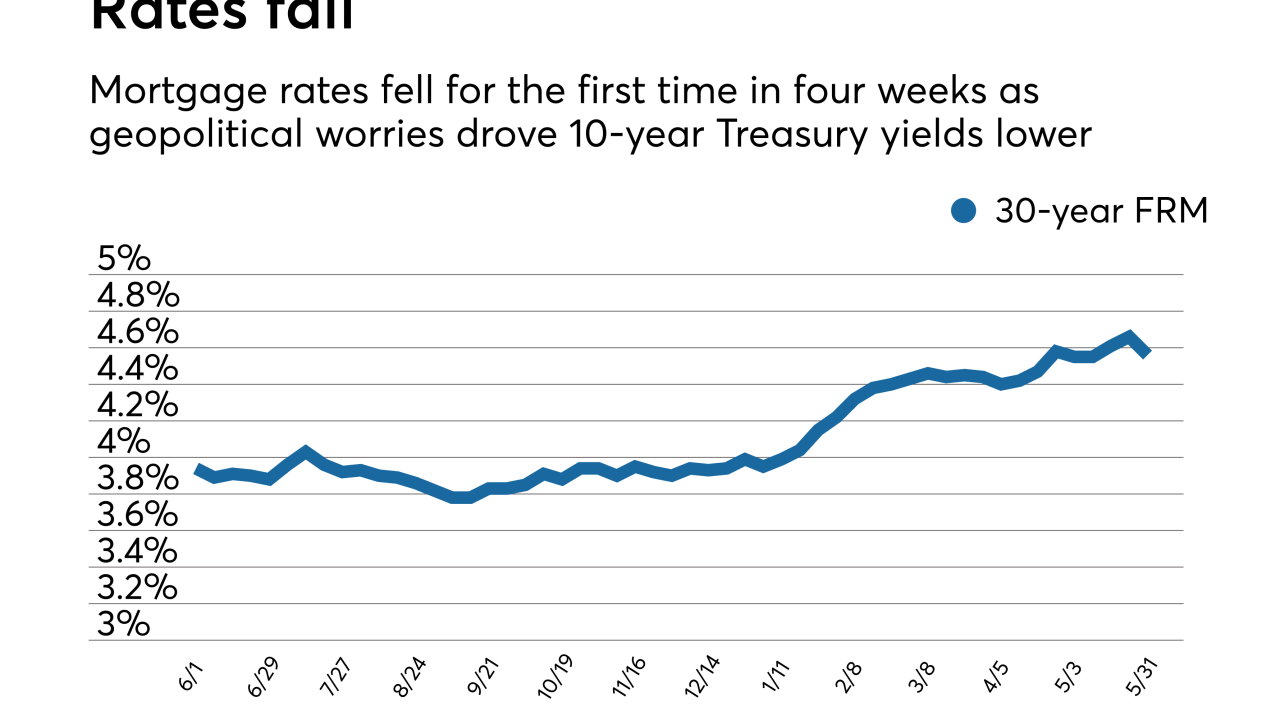

Mortgage rates fell for the first time in four weeks, dropping 10 basis points as investors' concerns over a government crisis in Italy drove bond yields lower.

May 31 -

Freddie Mac's economists took a more bullish outlook than others on the 2018 mortgage market, raising its forecast by $30 billion citing higher-than-projected refinance activity.

May 25 -

Mortgage rates continued their climb this week, jumping 5 basis points to their highest level since May 2011, according to Freddie Mac.

May 24 -

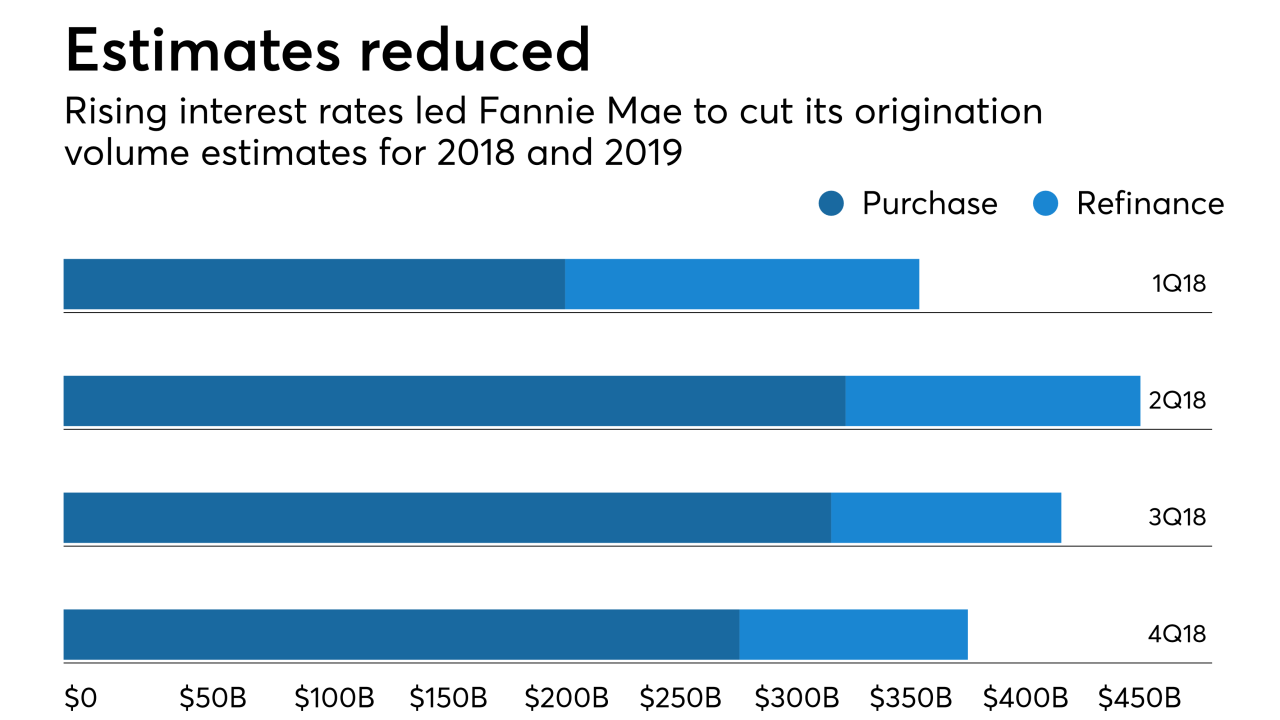

Fannie Mae reduced its mortgage origination volume forecast for 2018 and 2019 as rising interest rates are affecting refinancings now, and will curtail purchase activity going forward.

May 17 -

Mortgage rates have reversed course and reached a new high last seen seven years ago as the yield on the 10-year Treasury crossed the 3% threshold this week, according to Freddie Mac.

May 17 -

The 10-year U.S. Treasury yield rose to its highest level since 2011, extending a selloff in the world’s biggest bond market and raising fresh questions about how high America's borrowing costs will climb.

May 15 -

Mortgage rates were unchanged over the past week, but appear to be headed higher with a robust summer home sales season expected, according to Freddie Mac.

May 10