-

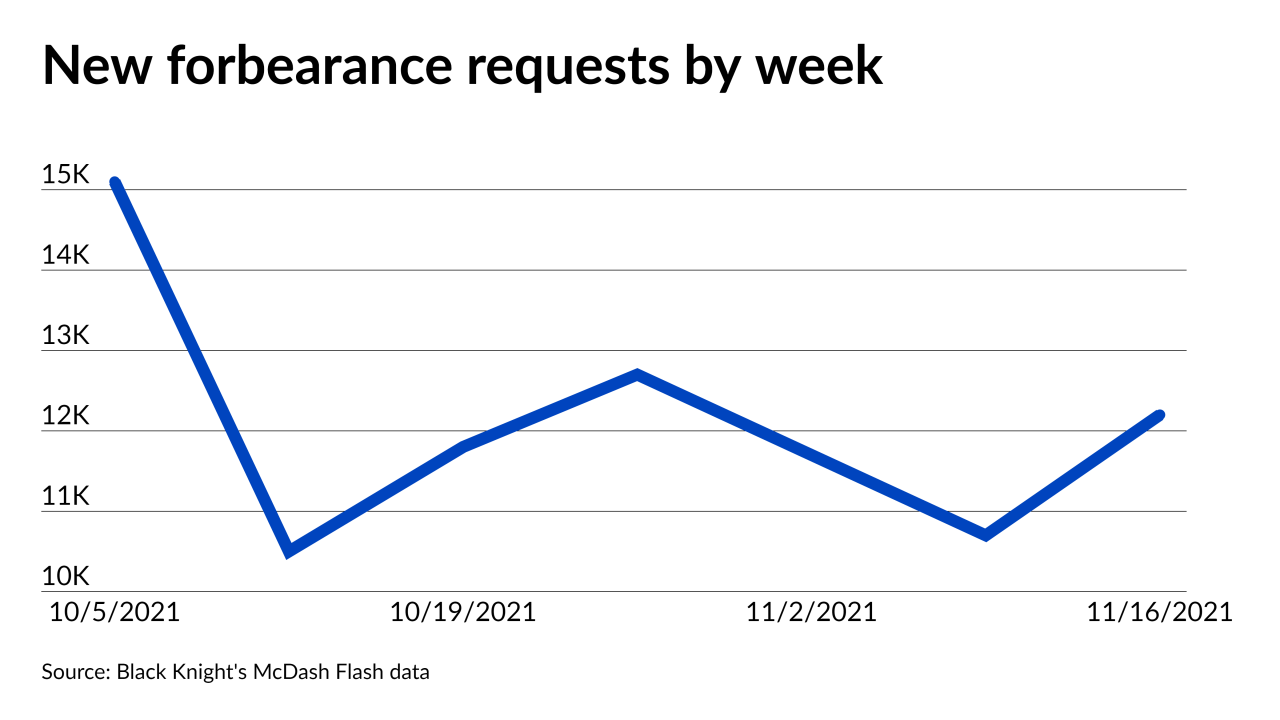

Activity in loans insured by the Federal Housing Administration and guaranteed by the Department of Veterans Affairs drove the increase in new requests, according to Black Knight.

November 19 -

The bulk package from an unnamed seller is associated with retail loans generally originated a little over a year ago and purchased by government-sponsored enterprises Fannie Mae and Freddie Mac.

November 18 -

Electronic signatures and remote online notarization can now be used for mortgages that previously were signed in person, subject to certain restrictions.

November 16 -

Bargain-hunting buyers are willing to make a purchase on the courthouse steps or via online sale, according to ServiceLink.

November 16 -

Unpaid balances among distressed loans also dropped by over 10% to under $200 billion.

November 12 -

The company’s servicing operations also reported a quarterly profit, with its portfolio increasing by 20% annually.

November 11 -

The decline in late payments recorded in a trade group survey raise hope that many servicers will bear up under a wave of tighter enforcement coming from regulators.

November 10 -

Mortgage defaults, bank repossessions and auctions rose for the third month in a row, according to Attom Data Solutions.

November 10 -

The number of plans is less than one-fourth of what it was at its pandemic peak, and many are expiring, so the group will replace the weekly measure with a monthly one.

November 8 -

The company’s gains, which far exceeded analysts’ expectations, were partially offset by thinner production margins.

November 8