-

The company sees an opportunity as its competitors have to sell to make up for lost income due to tighter origination margins.

October 28 -

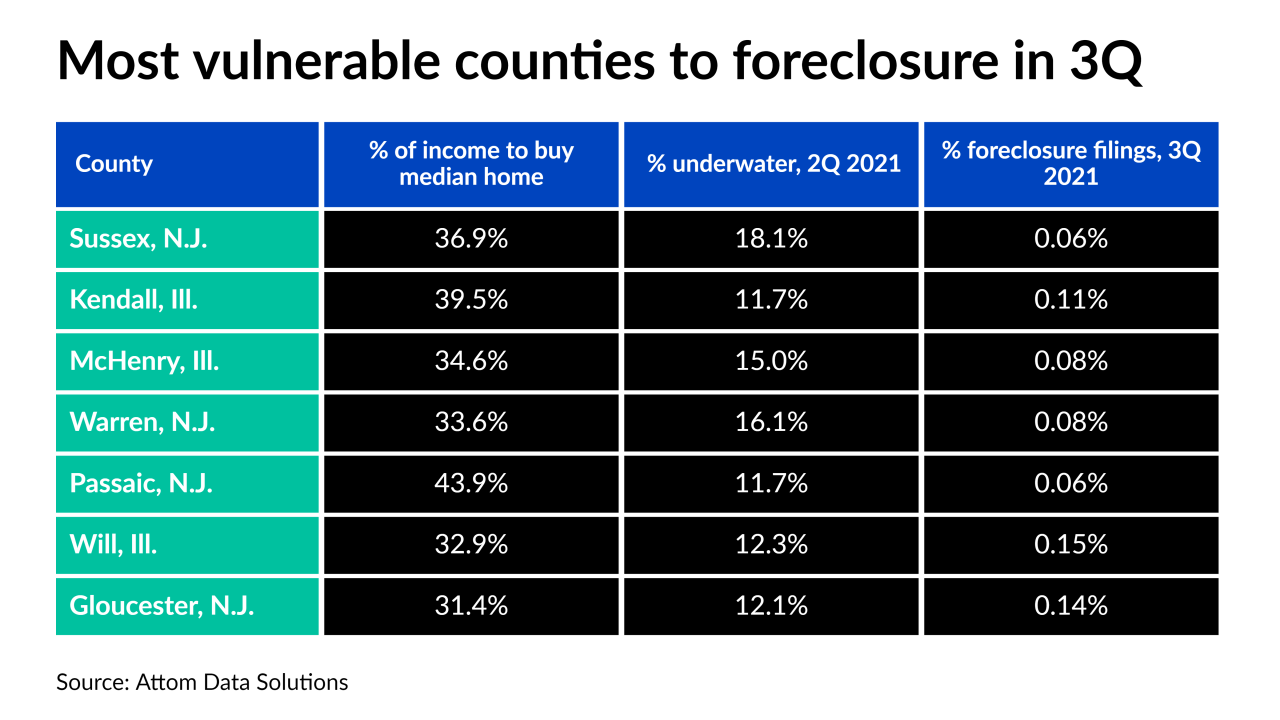

Numbers have fallen on a consecutive quarter and 12-month basis in half of all states but are likely to increase following the gradual end to the federal foreclosure ban, according to Attom Data Solutions.

October 28 -

The increased complexity of loss mitigation in the wake of the pandemic has increasingly prompted a growing number of mid-sized players to outsource, so constraints on one player could affect others.

October 27 -

The agency said the risk management program for Cenlar FSB, which performs servicing functions for financial institution clients, was inadequate for the bank's size.

October 26 -

To avoid a crisis similar to in 2008, protection needs to be in place for the mortgage industry. Soon, flood insurance will need to be standard for almost all coastal areas, which will be a considerable cost, writes the CEO of Repair Pricer.

October 26 Repair Pricer

Repair Pricer -

Around 432,000 homeowners exited their pandemic-related payment suspensions in the first 19 days of October and more than 280,000 plans have month-end review dates, but the number of private-loan plans increased.

October 22 -

This increases the opportunity for the company to keep in touch with its HomeSafe and EquityAvail customers between the loan closing and when it becomes due.

October 21 -

Counties in the West faced the least risk from pandemic distress in the third quarter, according to Attom Data Solutions.

October 21 -

One winning bidder, who bought two of the four pools in the government-sponsored enterprise’s nonperforming loan offering, is a repeat buyer affiliated with a minority- and women-owned business.

October 20 -

Taking a consistent, equitable and borrower-friendly approach could go a long way toward compliance, but mortgage companies and attorneys expect the devil will be in the details.

October 19