-

Measures designed to give banks and credit unions more flexibility to help customers weather the coronavirus pandemic are set to expire Dec. 31 unless Congress renews them.

September 18 -

Lenders and vendors are starting to realize that there are both areas in which artificial intelligence can be used more broadly, and areas in which technology’s role should be limited.

September 16 -

The only rational strategy for holding MSRs is to be very aggressive on protecting the servicing assets via loan recapture. This is one of the chief reasons that banks have been willing to give up their share in lending and servicing as they collapse back to retail-only lending strategies.

September 16 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The government-sponsored enterprise’s seller/servicer guide is now integrated into the online portal. Freddie also improved the readability of loan-level reporting it provides, and has further changes in the works.

September 15 -

After flattening over the three prior weeks, the number of loans going into coronavirus-related forbearance dove at a rate not seen since early August, according to the Mortgage Bankers Association.

September 15 -

Only 18% of refinance borrowers returned to the same lender in the second quarter, the second lowest rate since 2005.

September 14 -

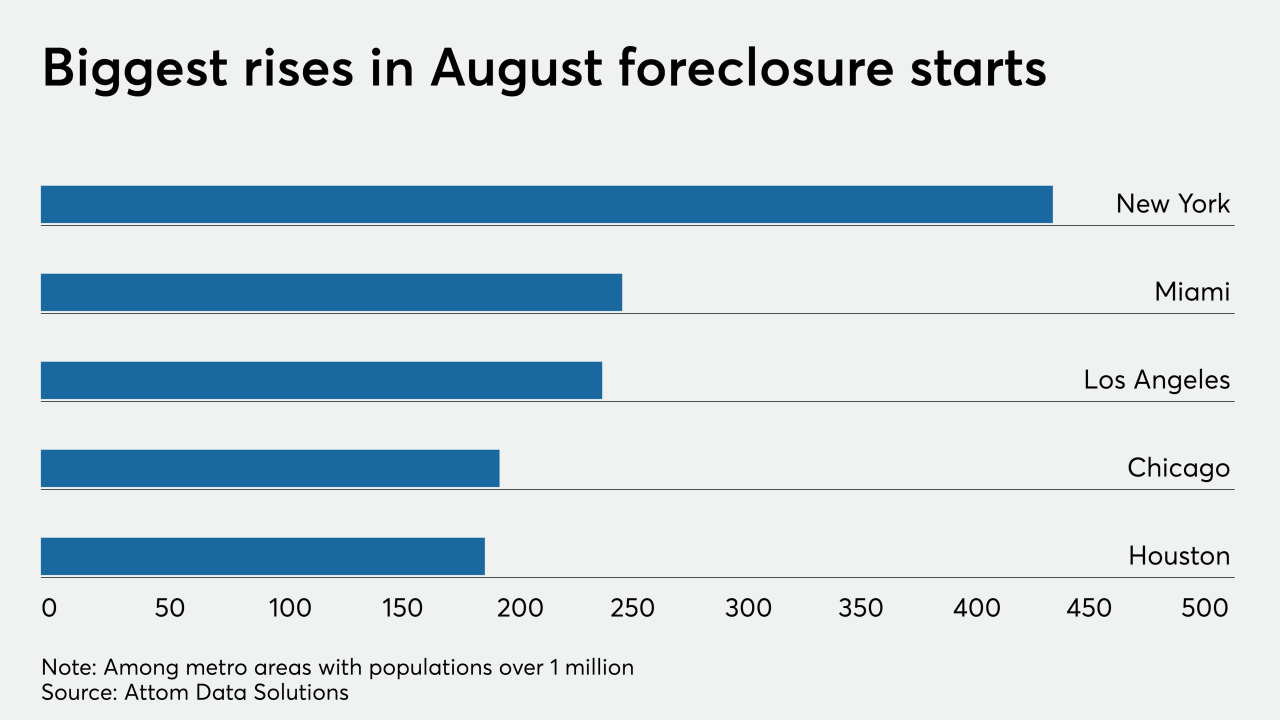

While still greatly trailing year-ago numbers, mortgage foreclosure activity jumped in August from July as moratorium restrictions started lifting and courthouses reopened, according to Attom Data Solutions.

September 11 -

The financial industry has praised the measured approach taken in a pending regulation on permitted communications with consumers. But two recent complaints by the bureau against debt collectors reflect a potentially aggressive enforcement stance.

September 11 -

Mortgage industry hiring and new job appointments for the week ending Sept. 11.

September 11 -

The post was vacant since Kristy Fercho left to run Wells Fargo Home Loans in July.

September 10