-

While seasonal factors were attributed to the monthly rise in mortgage delinquencies for June, the jump was still much higher than last year's fairly steady increase, according to Black Knight.

July 23 -

New York Attorney General Letitia James is monitoring how the bankrupt Ditech Holding Corp. handles borrower-sensitive issues like foreclosure proceedings, and is backing the involvement of a consumer creditors' committee.

July 23 -

MGIC reported higher-than-expected earnings, seen as a positive for the other mortgage insurers, plus Flagstar and KeyCorp had strong quarters for their mortgage businesses.

July 23 -

Black Knight created a pair of tools for its MSP servicing system in order to help mortgage services identify loans in their portfolio tied to areas affected by natural disasters.

July 22 -

Mortgage industry hiring and new job appointments for the week ending July 19.

July 19 -

Former Lend America executive Michael Ashley was sentenced to three years in prison for his actions that led to the implosion of the once-high-flying Melville, N.Y.-based mortgage lender.

July 18 -

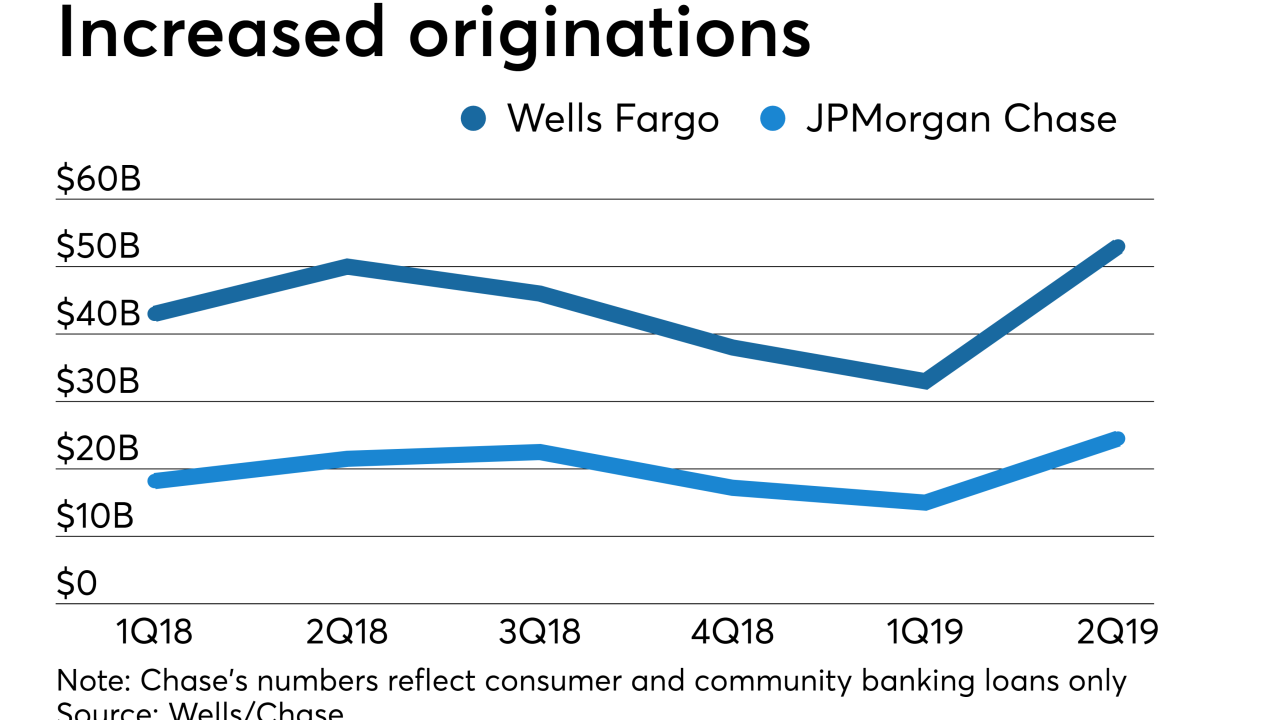

The second quarter continues to shape up as a good one for bank mortgage lenders — and one ancillary service provider — that are benefiting from a spike in volume.

July 17 -

Wells Fargo and JPMorgan Chase recorded stronger mortgage originations in the second quarter as rates fell, but profits from single-family loans were lower than a year ago due to decreased servicing revenue.

July 16 -

A builder based near the Lake of the Ozarks swindled six families that sought new homes in Kirkwood, Mo., out of $356,000, the builder's federal plea agreement says.

July 16 -

Damage related to flash flooding from Tropical Storm Barry has the potential to affect about 340,000 homes, according to CoreLogic. Reports estimate a worst-case total of $10 billion in reconstruction cost value.

July 15