-

The onslaught of regulatory actions against Ocwen may open the door for Nationstar to pick up a massive subservicing portfolio from the beleaguered servicer.

April 27 -

Radian Group earned $76.5 million for the first quarter, up 16% from $66.2 million one year prior, helped by a 25% year-over-year rise in new insurance written.

April 27 -

Housing prices in the Near West Side, Logan Square and a handful of other popular areas north of downtown are now well above their pre-crash peaks, but most of the city and the suburbs are still clawing their way back from the depths of the devastating crash.

April 27 -

A bipartisan coalition in Pennsylvania created more than a decade ago to fight neighborhood blight is setting its sights on new legislative goals after a string of successes.

April 26 -

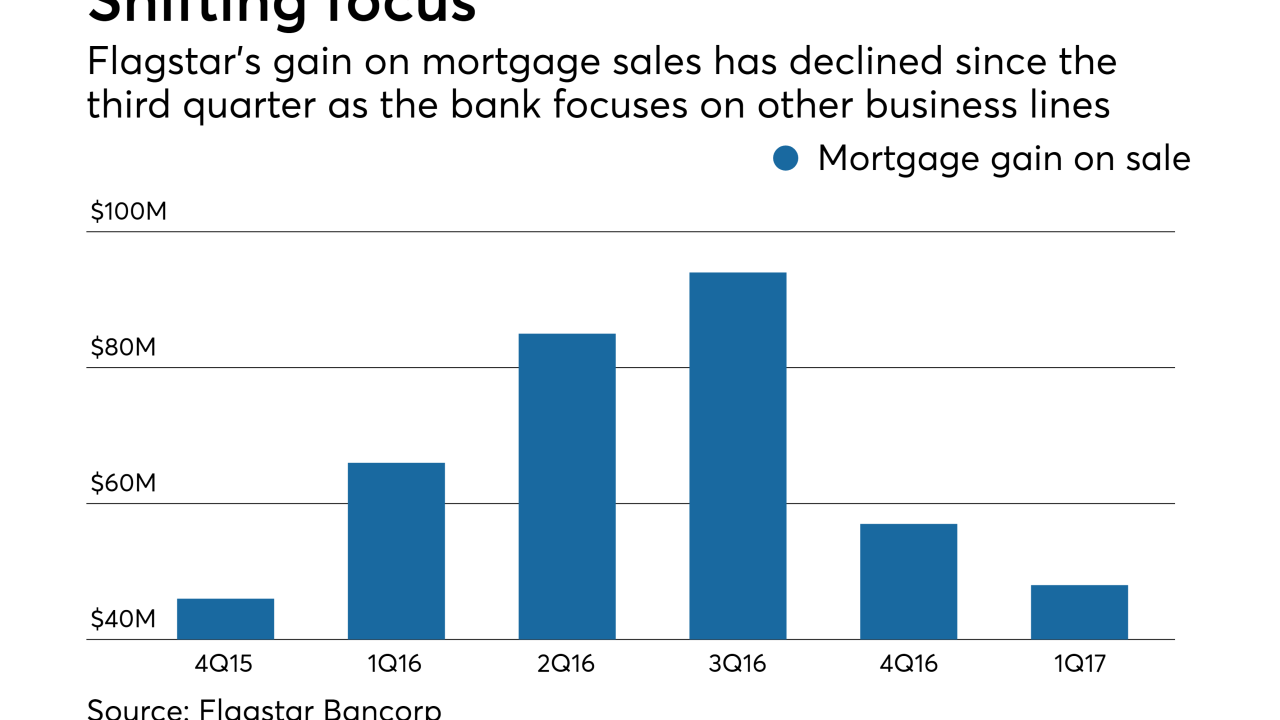

Growth outside of its residential mortgage business contributed to Flagstar Bank beating first-quarter earnings estimates, company executives said.

April 25 -

The current struggles of the oil-based economy of the Houma-Thibodaux, La., area has led to an increase in foreclosures, a new report says.

April 25 -

The struggling Pittsburgh Athletic Association in Oakland has paid $55,000 towards taxes it owes the county for the 7% drink tax, preventing a scheduled sheriff's sale Tuesday morning at the iconic Fifth Avenue social club.

April 25 -

With its mortgage in default and no refinancing on the horizon, The Plaza at PPL Center in Allentown, Pa.,appears headed for foreclosure.

April 24 -

Incenter Mortgage Advisors is brokering an $898 million alt-A bulk servicing rights portfolio for an undisclosed bank.

April 21 -

Mortgage industry hiring and new job appointments for the week ending April 21.

April 21