-

Mortgage industry hiring and new job appointments for the week ending Dec. 2.

December 2 -

Steven Mnuchin's confirmation hearing is likely to be dogged by stories of homeowners who claim his bank, OneWest, illegally foreclosed on them. While the stories are unlikely to prevent President-elect Donald Trump's pick from being confirmed, it could weaken Mnuchin politically and rehash grievances from the financial crisis.

December 1 -

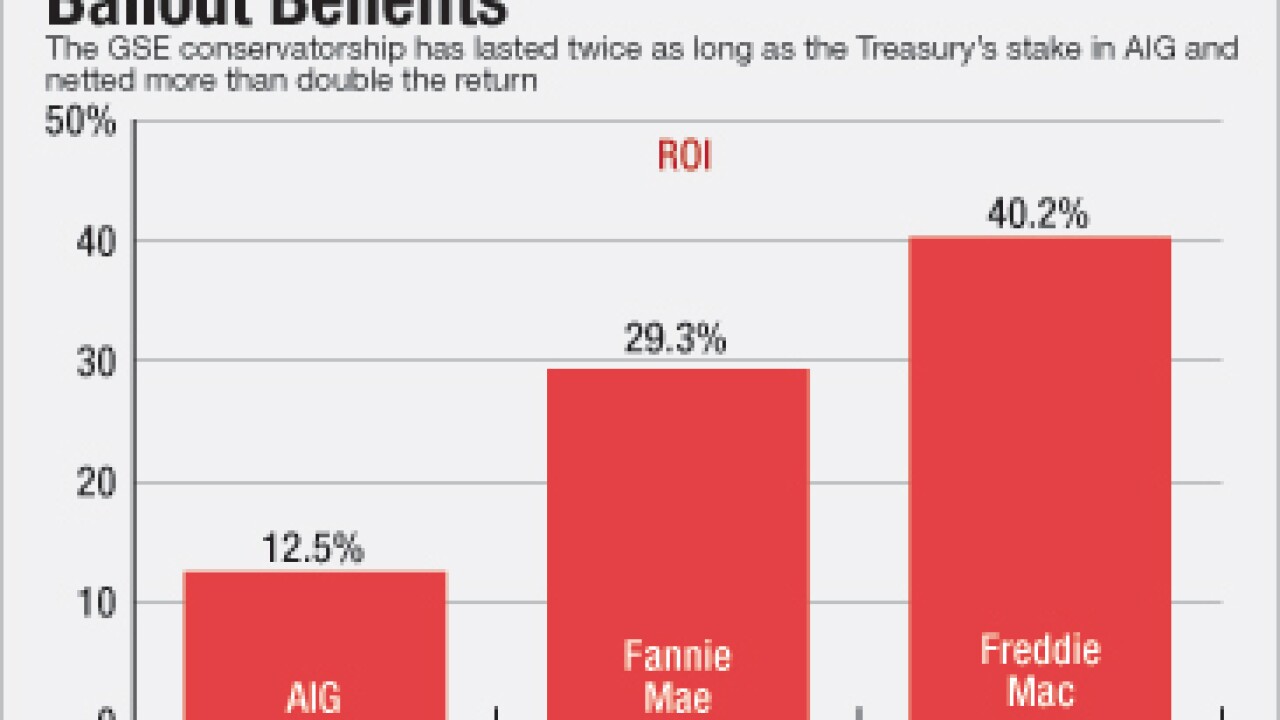

Privatizing the government-sponsored enterprises is a priority for Treasury Secretary-designate Steven Mnuchin. Here's a look at what it will take to pull off and the potential implications for the mortgage industry of unwinding the conservatorship.

December 1 -

Bank of America has conditionally completed 97% of the $7 billion in consumer relief it agreed to provide as part of its 2014 settlement with the Department of Justice and six states.

December 1 -

Some banks are set to get a fourth-quarter earnings boost from their MSR portfolios, thanks to a sudden spike in yields on Treasury bonds. Add to that the prospect of further rate hikes and the potential dismantling of Basel III, and more banks could be encouraged to re-enter the servicing business.

November 30 -

Treasury Secretary-designate Steven Mnuchin wasted no time Wednesday wading into one of the thorniest debates in the financial services arena, saying the Trump administration would seek to end government control of Fannie Mae and Freddie Mac.

November 30 -

Much like President-elect Donald Trump himself, expected Treasury Secretary-designate Steven Mnuchin represents something of a question mark for bankers when it comes to his agenda.

November 29 -

Foreclosure starts dropped to the lowest level recorded since January 2005, according to Black Knight Financial Services.

November 29 -

Mortgage bankers are anxiously waiting to see who President-elect Donald Trump will pick as the next Treasury secretary. Several prominent names have been floated for the job, though with every passing day, a new possible choice seems to pop up. Following is a look at the current crop of candidates and their chances.

November 29 -

FirstKey Mortgage is marketing its fifth portfolio consisting primarily of formerly troubled first-lien residential mortgages that have rebounded to reperforming status.

November 28