-

Property losses piled up in Mid-Atlantic and New England states as the tropical storm devastated the East Coast, according to CoreLogic.

September 9 -

But distressed loans released from backlogs by discontinued foreclosure bans could drive numbers higher eventually, depending on the strength of the housing market

September 8 -

About 400,000 plans are scheduled to drop out in September based on the limits afforded by the CARES Act.

September 3 -

Roughly $8 billion to $12 billion of the residential losses in the Louisiana area could be insured, according to CoreLogic. The storm’s more recent Northeast impact has not yet been calculated.

September 2 -

From 2016 to 2019, the Long Island man stole from Home Point Financial, LoanDepot and United Wholesale Mortgage, and faces 30 years in prison.

September 2 -

The extension in the number of days investors are locked out of the process comes amid a broader push by the Biden administration to boost access to affordable housing.

September 1 -

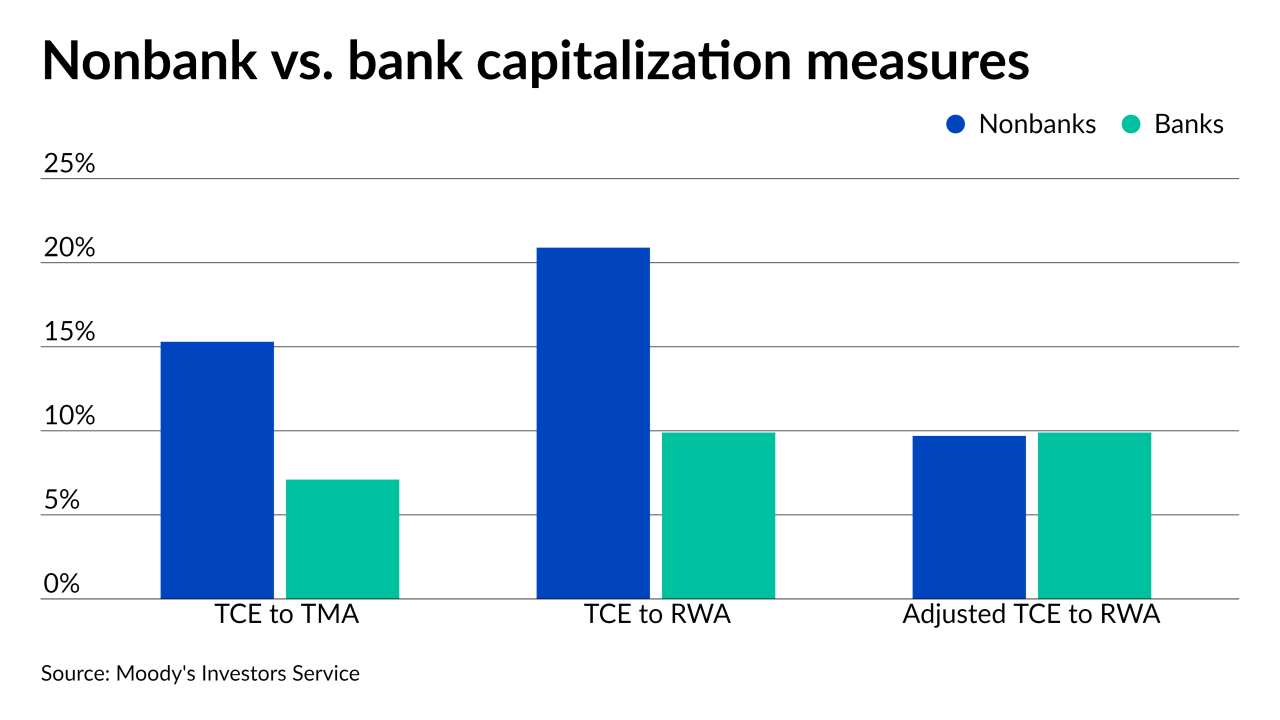

By some current measures, nonbank capitalization looks strong compared to banks, but the way a Ginnie Mae proposal aims to assess the value of mortgage servicing rights would change that, Moody’s Investors Service reported Tuesday.

August 31 -

More than 500,000 houses were potentially affected by this type of damage from the more recent storm, which was the second-most intense storm in Louisiana’s history.

August 31 -

Distressed homeowners who first took advantage of deferrals in March of last year will either start repayment or look for new solutions in September.

August 30 -

The end of many COVID relief plans in September have the industry holding its breath, with outcomes potentially foreshadowing the months to come.

August 27