-

Even as lenders increased purchase share, higher expenses and margin compression related to pricing competition led to smaller quarterly net gains.

August 24 -

Approximately 65% of all current forbearance plans will expire by year-end and many of those borrowers won't be able to resume paying their contractually mandated amounts.

August 24 -

The overall pace of both entries and exits slowed, even as the private-label securities and portfolio loan segment saw a spike in its numbers.

August 23 -

Rep. Val Demings introduced legislation in Congress that automatically triggers a stop on evictions and foreclosures for homeowners with federally-backed mortgages when a disaster is declared.

August 20 -

The rate at which borrowers went past due on their home loans showed near-term improvement in July, according to Black Knight, but servicers fear those who still have forborne payments won’t recover.

August 20 -

Marked declines in loans that have had relatively higher levels of pandemic-related distress reinforced other indicators suggesting the market could normalize if infection rates remain contained.

August 19 -

But 45% of the top 100 counties still have an above-average likelihood that borrowers won’t make their payments on these business-purpose loans, RealtyTrac said.

August 18 -

The move adds to signs that the broader restart of foreclosures won’t get fully underway until 2022.

August 17 -

Forborne mortgages stemming from the coronavirus outbreak reached their lowest level since late March 2020, according to the Mortgage Bankers Association.

August 16 -

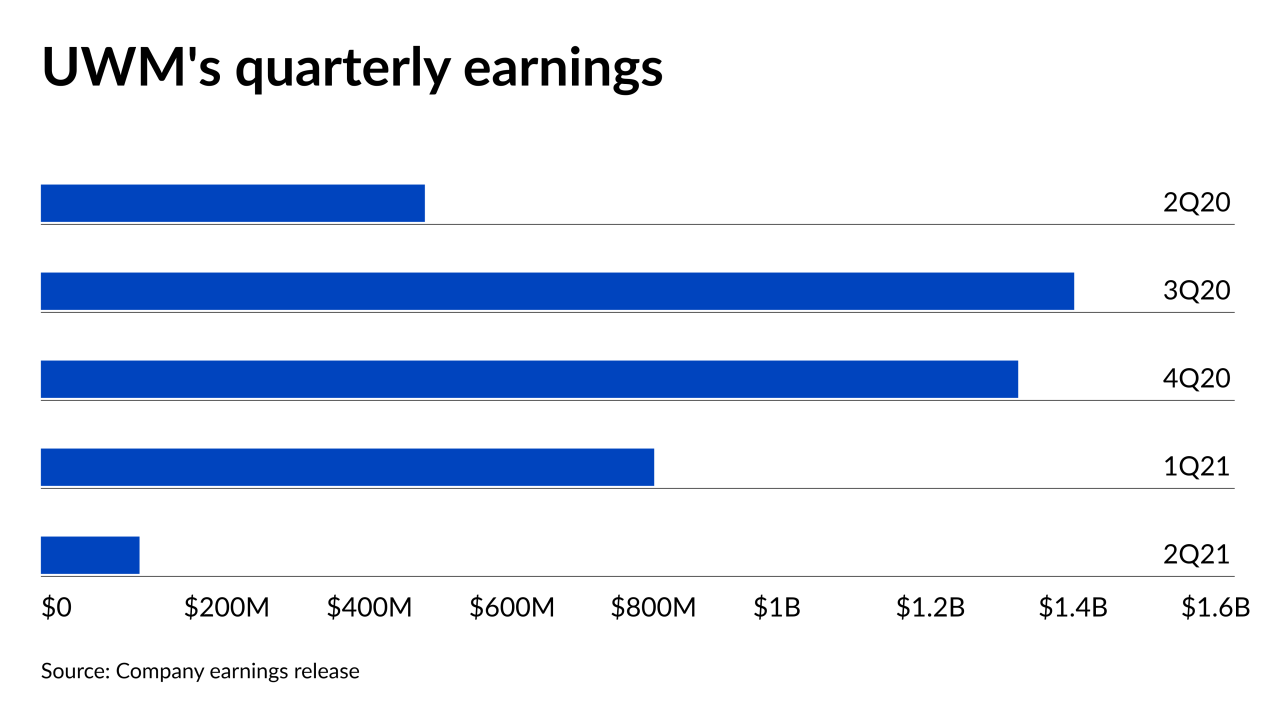

Depressed margins and a $219 million hit to its servicing rights fair value translated to a lower bottom line at the wholesaler.

August 16