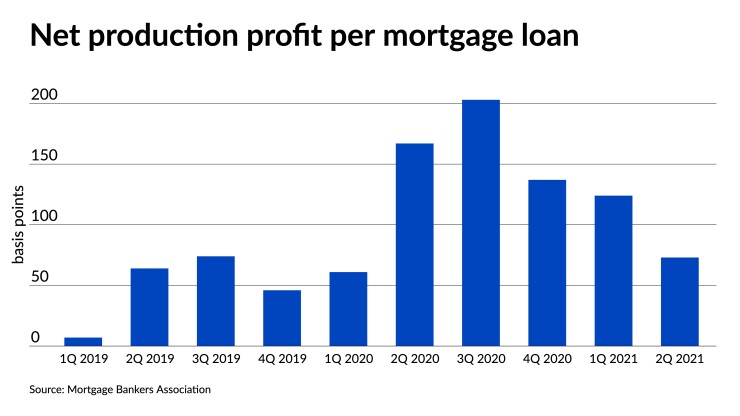

Profits at independent mortgage banks and bank subsidiaries tumbled in the second quarter to a two-year low, reflecting both margin compression and slowing production, according to the Mortgage Bankers Association.

The Quarterly Mortgage Bankers Performance Report reported a net gain of $2,023 per origination, or 73 basis points, for the IMBs in the quarter, dropping from $3,361 and 124 bps in

“Production revenues have declined for three straight quarters, and per-loan production expenses have increased for four straight quarters. This is a strong indication that the industry is moving away from the record-high profits of 2020,” Marina Walsh, the MBA’s vice president of industry analysis, said in a press statement.

But Walsh noted that even with declining profits, the per-loan gains

“Competition stiffened, production volume declined, and the market began to shift towards more purchase activity and less refinances," Walsh said. "The result for mortgage lenders was a combination of lower revenues and higher expenses.”

Average production volume amounted to $1.35 billion per company, versus $1.44 billion in the first quarter, with total originations per lender averaging 4,615 units in the second quarter, down from 4,879 loans in the previous quarter.

Among the expenses that ate into profit margins as a result of the increased

The IMBs' purchase share by dollar volume came out to 57% for the quarter, up from 39% in the first quarter, while for the industry as a whole, purchases accounted for 44% of volume, up from 29%, respectively.

Although demand has cooled off due to rising home prices and a smaller pool of homeowners looking to refinance, Freddie Mac last month raised its

Contributing to the lower IMB numbers was that the net gains from servicing dropped off as well, primarily due to fair value markdowns of mortgage servicing rights and increased operating expenses. Servicing net financial income for the second quarter was $7 per loan, down from $154 in the first three months of 2021. But the segment’s operating income, which excludes amortization, any gains or losses in the valuation of servicing rights net of hedging and gains or losses on MSR bulk sales, was $71 per loan in the second quarter, up from $65 per loan in the first quarter.

The MBA’s data is compiled from surveys of 361 independent mortgage banks or home-lending subsidiaries of chartered banks. Accounting for both their loan production and servicing segments, 85% of firms reported net profits in the second quarter, down from 97% in the first quarter.