-

Mortgage application fraud risk came in hot at the start of the year, but two housing market conditions worked against each other to bring growth to a halt, according to First American Financial Corp.

May 3 -

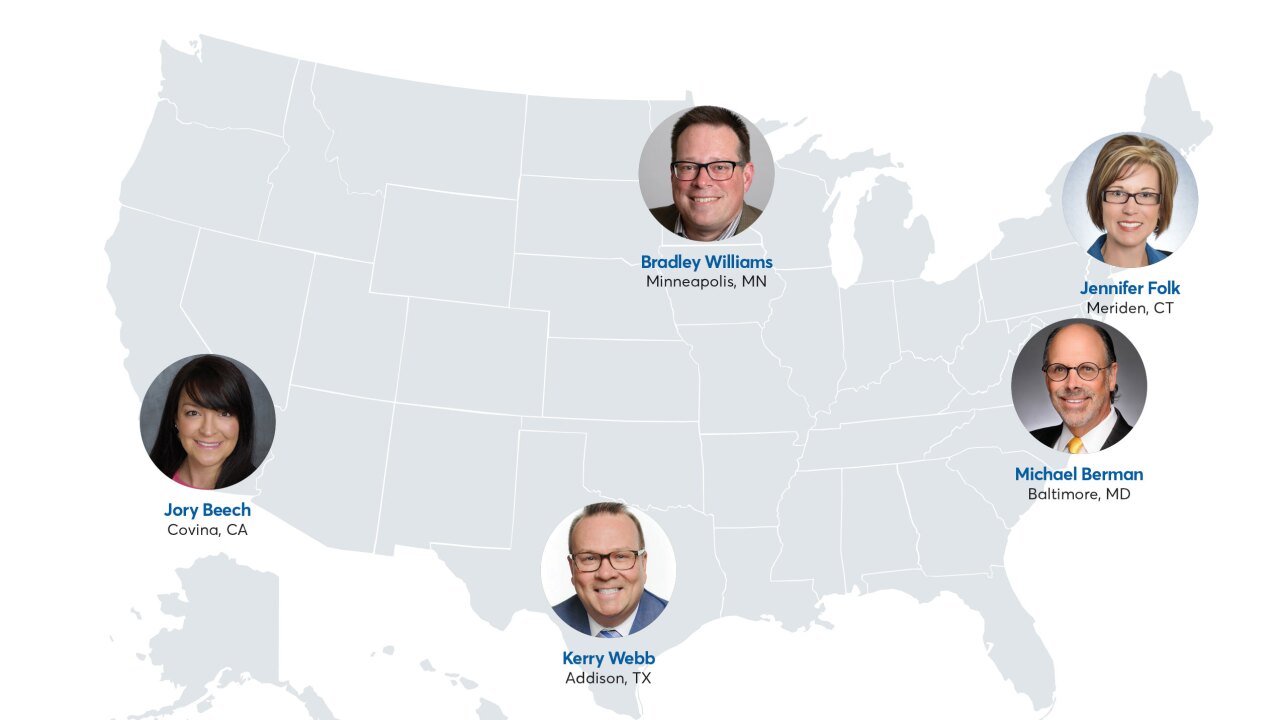

Mortgage industry hiring and new job appointments for the week ending May 3.

May 3 -

With nearly $90 million added in the past two months, Goldman Sachs marched closer to its $1.8 billion consumer-relief mortgage settlement with the U.S. Department of Justice.

May 2 -

As the CFPB moves closer to updating its debt collection regulations, revising restrictions on phone calls and other communications with consumers must be a priority.

May 1

-

First-quarter year-over-year results declined at a pair of mortgage bankers active in the acquisitions market as well as at the provider of the most used servicing technology.

May 1 -

In a long-term attempt to stabilize its earnings from the cyclical nature of home loans, HomeStreet took a loss in the opening quarter of 2019.

April 30 -

New licensing rules for mortgage professionals servicing loans secured by New Jersey properties will go into effect this summer, adding to a trend toward tighter state regulation of standalone servicers.

April 30 -

The debt collection proposal is expected to address how debt collectors can use text messages and emails to track down debtors.

April 29 -

Commercial mortgages placed into special servicing grew last year, but default and foreclosure dollar volume fell as legacy loan resolutions outpaced newly distressed loans, according to Fitch Ratings.

April 29 -

Two Sacramento, Calif., defendants were found guilty of wire fraud stemming from a fraudulent real estate company that targeted members of Sacramento's Latino community, according to the U.S. Attorney's Office.

April 26