-

As the government shutdown enters its third week, mortgage servicers are activating the response plans they normally use during hurricanes and wildfires to assist federal workers who may have trouble paying their mortgages.

January 4 -

Mortgage industry hiring and new job appointments for the week ending Jan. 4.

January 4 -

Mr. Cooper Group is buying servicing rights on $24 billion in mortgages, a subservicing contract for an additional $24 billion in home loans and the Seterus platform from IBM.

January 3 -

New York Gov. Andrew Cuomo has signed into law a bill that provides a property tax break for Syracuse property owners who buy flood insurance.

January 3 -

New Fed Mortgage's pending acquisition of Commonwealth Mortgage LLC will allow it to expand its geographic footprint outside of New England.

January 2 -

Nonbank lenders are gearing up for new secondary market requirements and must make some difficult choices about whether to buy, sell or hold mortgage servicing rights, says Ruth Lee, the executive vice president of MorVest Capital.

December 28 -

Mortgage industry hiring and new job appointments for the week ending Dec. 28.

December 28 -

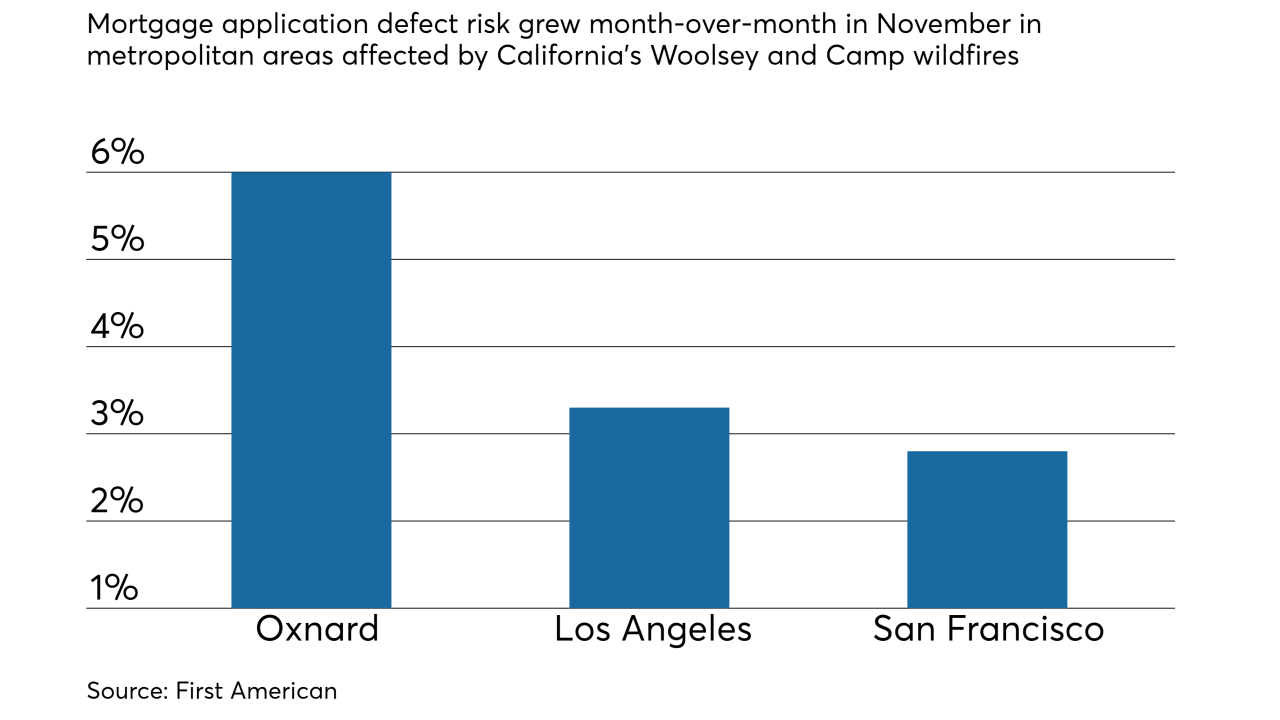

Mortgage application fraud risk continued growing for the fifth consecutive month, and the recent California wildfires are partly to blame, according to First American Financial Corp.

December 27 -

The biggest question is whether new CFPB Director Kathy Kraninger will deviate from the pro-industry policies of her predecessor, or bring continuity.

December 25 -

Mortgage servicing assets are poised for gains in 2019. But as higher average mortgage rates spur lenders to sell servicing rights and diversify their loan offerings, servicers' work will also get more complicated and costly.

December 24