-

Despite an especially strong hurricane season last year, the national mortgage delinquency rate fell on an annual basis, signaling a healthier economy, according to CoreLogic.

May 8 -

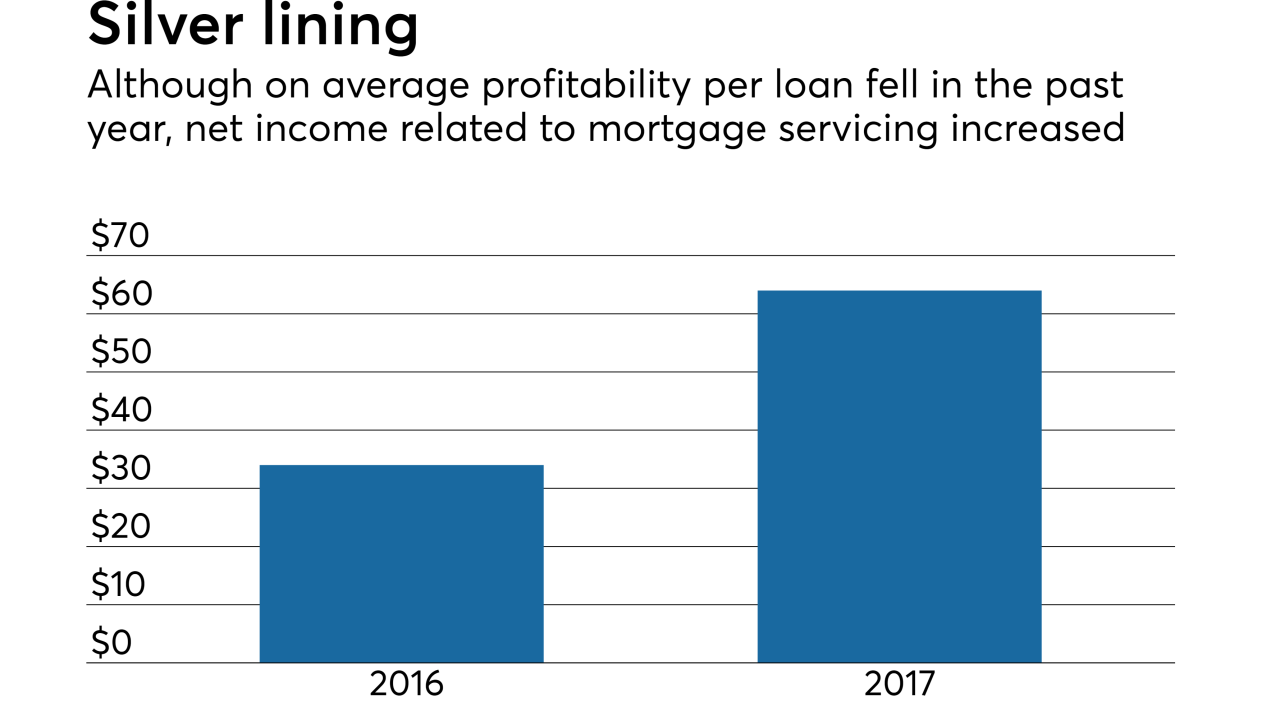

Mortgage servicers growing due to acquisitions or the increased value of servicing in the market could remain under pressure if these strategies don't outweigh other rising costs they face.

May 7 -

Freddie Mac has quietly started extending credit to nonbanks that issue mortgages, a move it says will help the companies maintain access to a crucial stockpile of cash if their home loans go sour.

May 7 -

Nationstar Mortgage Holdings reported first-quarter net income nearly four times higher compared to the fourth quarter of 2017.

May 4 -

Robert Klein, the son of Holocaust survivors who went on to build an empire in the property preservation industry, died on May 3. He was 65.

May 4 -

Mortgage industry hiring and new job appointments for the week ending May 4.

May 4 -

As the number of equity rich properties falls from its peak, the volume of seriously underwater properties saw its smallest annual decline, according to Attom Data Solutions.

May 3 -

Ocwen Financial Corp. got back in the black during the first quarter after selling New Residential Investment Corp. $110 million in economic rights to mortgage servicing.

May 2 -

Arch Capital Group's mortgage insurance subsidiary slipped to No. 2 in market share just five quarters after completing the acquisition of former No. 1 United Guaranty Corp.

May 2 -

A Texas lawyer pleaded guilty to his role in an elaborate $5 million mortgage fraud scheme involving pricey beach homes, according to the U.S. Attorney's Office in Houston.

May 1