-

The real estate investment trust is issuing $450 million of five-year notes backed by rights to excess servicing strips of Fannie Mae loans.

April 23 -

Mortgage industry hiring and new job appointments for the week ending April 20.

April 20 -

March's increase in foreclosure starts was a direct result of the end of the moratorium for borrowers affected by Hurricanes Harvey and Irma, Black Knight said.

April 19 -

However, mortgage growth and servicing income weren't the only reasons profits rose by double digits at the Dallas bank.

April 18 -

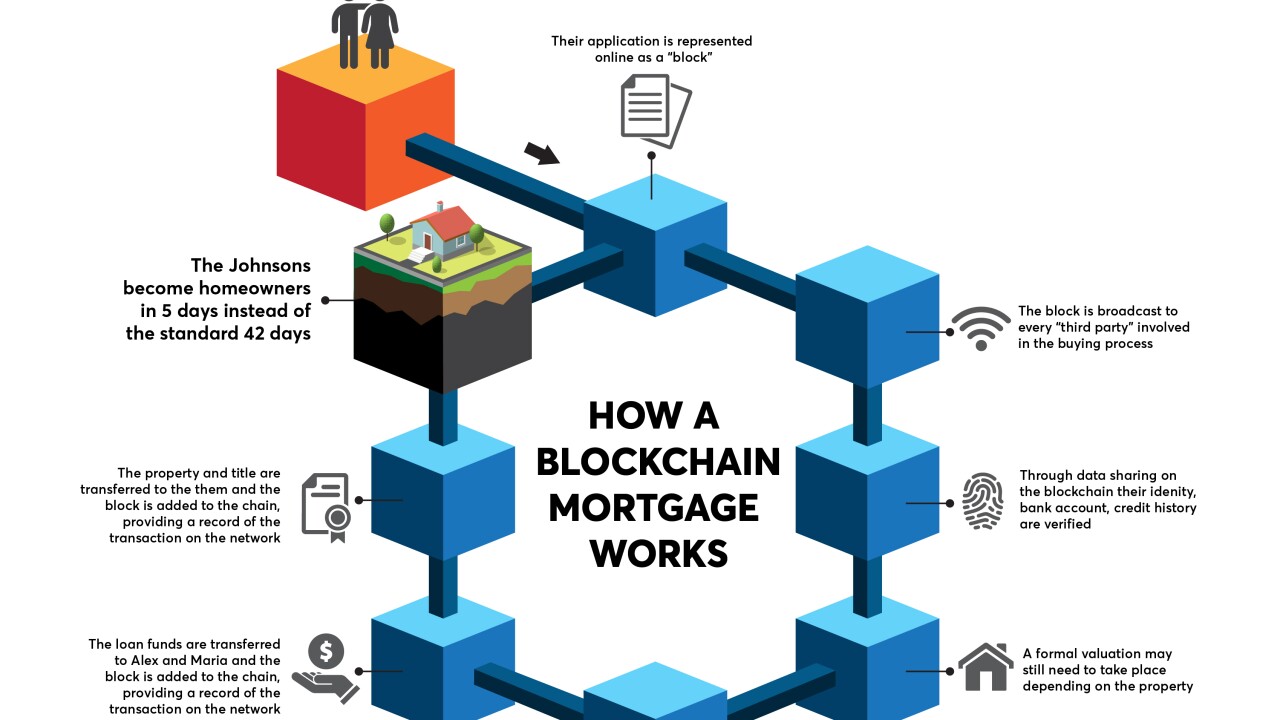

Blockchain technology promises to streamline how mortgages are managed at every point in their life cycle. But it will take an industrywide embrace for blockchains to reach their full potential.

April 18 -

MGIC Investment Corp.'s first-quarter net income beat analysts' estimates due to favorable loss development and that should be seen with the other private mortgage insurers.

April 18 -

Ditech Holding Corp. lost $426.9 million in 2017, with almost half of that recorded during the fourth quarter, when the company filed for bankruptcy.

April 17 -

Blockchain technology can support a number of core technology issues plaguing the mortgage industry, including data integrity, security, distribution and compliance.

April 16 -

First-quarter mortgage banking results at Wells Fargo and JPMorgan Chase were weaker than Keefe, Bruyette & Woods forecast due to lower-than-expected gain-on-sale margins.

April 13 -

Mortgage industry hiring and new job appointments for the week ending April 13.

April 13