-

Mortgage industry hiring and new job appointments for the week ending May 19.

May 19 -

State regulators felt they were strung along by the mortgage servicing giant Ocwen Financial after years of promises that were never fulfilled, resulting in successive enforcement actions against the company.

May 17 -

Reverse mortgage lender Financial Freedom has agreed to pay $89 million to settle False Claims Act allegations involving unearned interest payments it received from the Federal Housing Administration.

May 17 -

Foreclosure activity continued to sink in Southwest Florida last month, tracking the statewide and national trends.

May 17 -

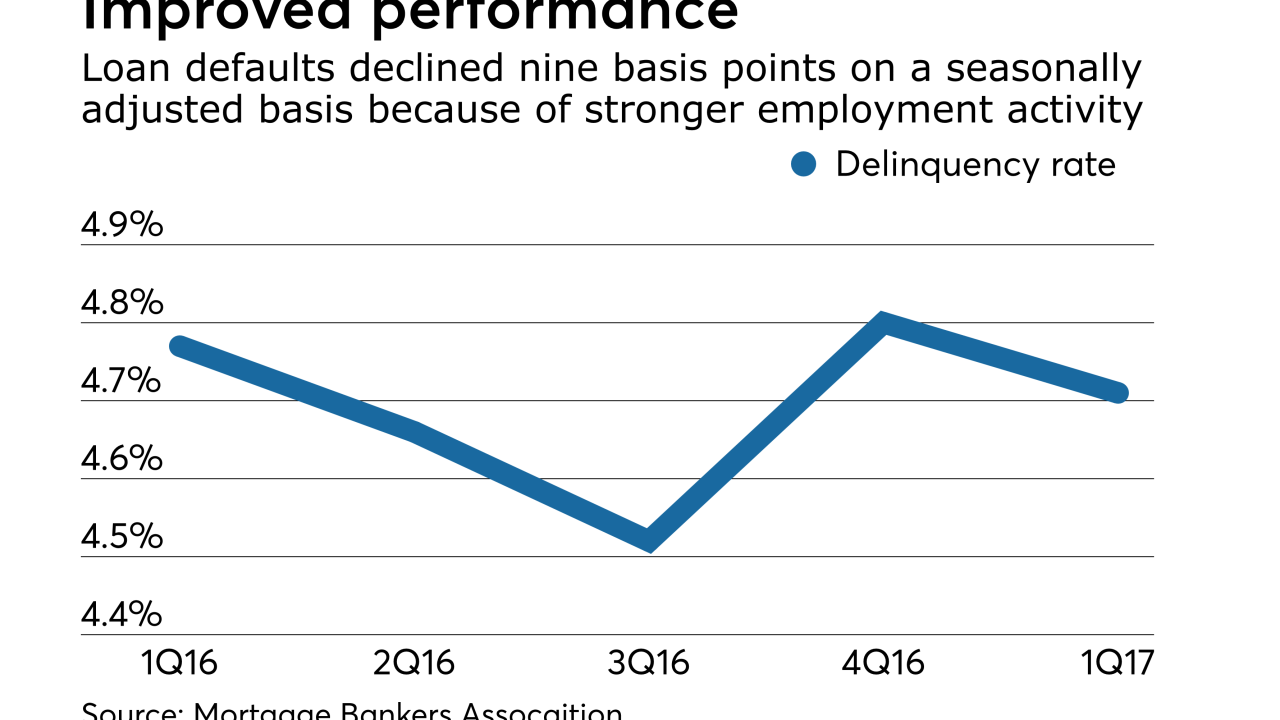

Lower defaults among government-guaranteed mortgage borrowers drove the overall delinquency rate down, the Mortgage Bankers Association said.

May 16 -

An El Paso real estate investment trust, run by some of city's most successful business people, faces new allegations of fraud in a failed housing venture just as another lawsuit against the trust has been dismissed by a federal judge.

May 16 -

Across the nation, the once-pernicious foreclosure crisis nearly has abated, but in Lucas County, Ohio, foreclosure activity is stronger than it was a year ago.

May 16 -

Daytona Beach has a message for the hundreds of property owners who collectively have stiffed the city on $4.46 million in code violation fine payments: Pay up soon, or the city's coming after your land and buildings with foreclosure actions.

May 15 -

Mortgage industry hiring and new job appointments for the week ending May 12.

May 12 -

Foreclosure filings in April were at their lowest level since November 2005 at 77,049 properties, down 7% from March's 83,145 and 23% from April 2016.

May 11