-

The real estate investment trust is issuing $450 million of five-year notes backed by rights to excess servicing strips of Fannie Mae loans.

April 23 -

However, mortgage growth and servicing income weren't the only reasons profits rose by double digits at the Dallas bank.

April 18 -

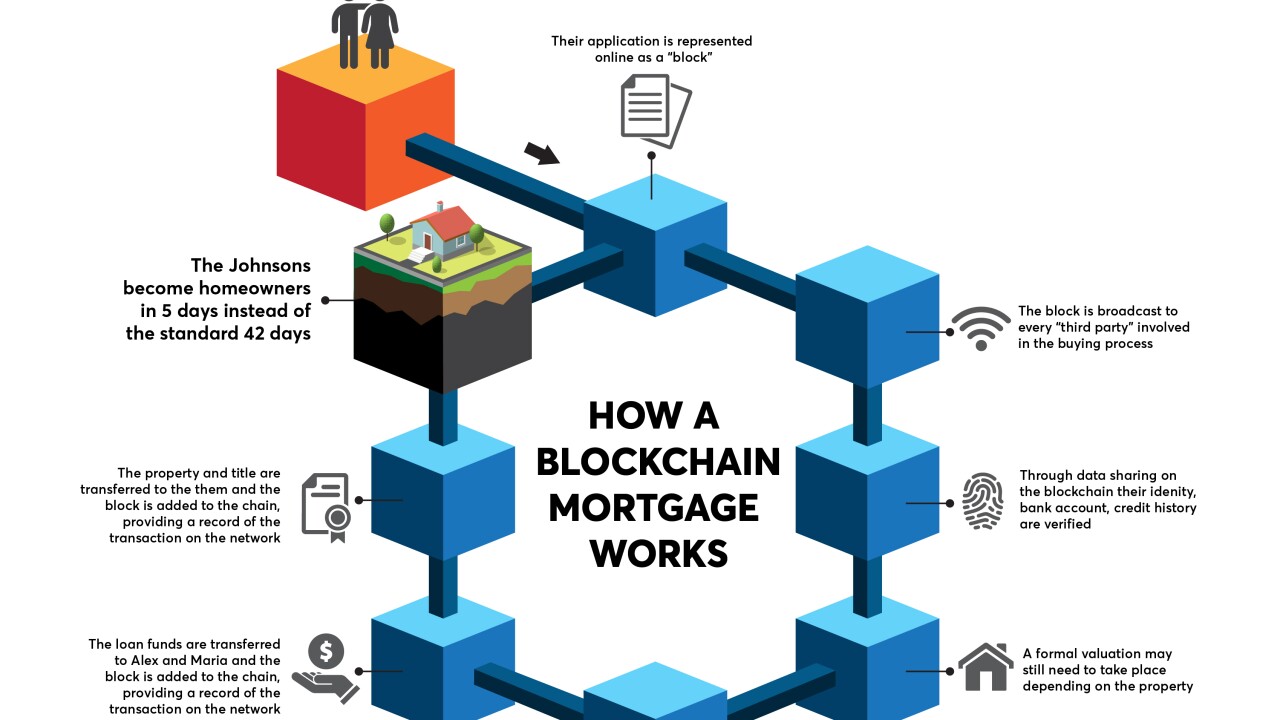

Blockchain technology can support a number of core technology issues plaguing the mortgage industry, including data integrity, security, distribution and compliance.

April 16 -

First-quarter mortgage banking results at Wells Fargo and JPMorgan Chase were weaker than Keefe, Bruyette & Woods forecast due to lower-than-expected gain-on-sale margins.

April 13 -

Situs subsidiary MountainView Financial Solutions is brokering a $6.1 billion package of government-sponsored enterprise and Ginnie Mae servicing rights.

April 11 -

A pair of the nation's largest banks, Citigroup and Wells Fargo, made changes to their mortgage banking executive teams.

April 2 -

There is an oncoming liquidity crisis that will force consolidation in the mortgage industry as margins tighten and funding sources dry up.

March 28 -

Servicers are still trying to figure out how they can best take advantage of the growing use of electronic notes and other digital mortgage tools by lenders and the secondary market.

March 27 -

Banks would welcome a proposal to loosen Basel III capital restrictions because it would make holding mortgage servicing rights easier and stem the recent exodus of depositories from the servicing business, executives said.

March 26 -

A new settlement with Massachusetts resolves all outstanding administrative actions against Ocwen Financial Corp. by a group of 30 states, but two states' legal actions against the servicer remain outstanding.

March 23 -

Joseph Tomkinson, who first pared down and then rebuilt Impac Mortgage Holdings in the aftermath of the housing crisis, is stepping down as the company's chairman and CEO.

March 21 -

Incenter Mortgage Advisors is putting up for bid a $712.8 million package of government-sponsored enterprise and Ginnie Mae mortgage servicing rights concentrated in the Southeast.

March 2 -

The servicing business drove Nationstar Mortgage Holdings' fourth-quarter profitability and will be a major factor going forward after the company is acquired by WMIH.

March 1 -

From accelerating its subservicing transformation to overcoming regulatory obstacles, here's a look at three reasons behind Ocwen Financial Corp.'s $360 million acquisition of PHH Corp.

February 27 -

From origination to payoff, blockchain technology makes data more reliable and secure to enhance and improve mortgage lending.

February 23 Fiserv

Fiserv -

Ocwen Financial Corp. fired Otto Kumbar, executive vice president of lending, as the company significantly reduces its origination business.

February 13 -

A new due diligence firm created by a trio of former Clayton Holdings executives wants to shake up a static business model.

February 12 -

Warburg Pincus has agreed to buy a majority stake in a mortgage and consumer loan origination and servicing platform owned by Fiserv.

February 7 -

Mortgage servicers should approach efforts to overhaul their compensated structure with caution, as changes to the status quo "could have ripple effects across the entire real estate finance industry," warned Mortgage Bankers Association Chairman David Motley.

February 7 -

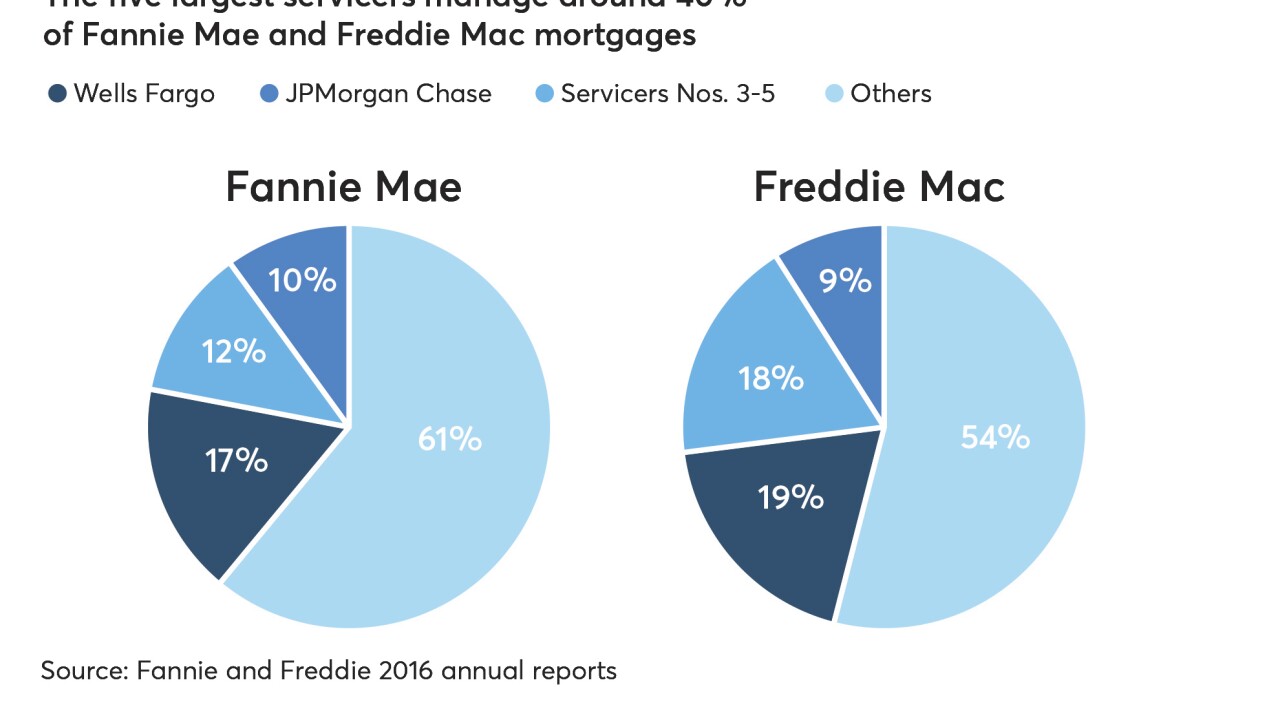

Wary of concentration risk, secondary market participants are backing initiatives to give more players a piece of the action.

February 6