-

The number of loans going into coronavirus-related forbearance ground down to a growth rate of 2 basis points between June 1 and June 7, according to the Mortgage Bankers Association.

June 15 -

The company could be seeking a cash infusion to handle market difficulties ahead, but representatives are keeping mum on the matter.

June 12 -

The expected rise in refinance volume overrides pessimism about purchase activity for their businesses.

June 11 -

The coronavirus market disruption actually caused the company's execs to speed up its return.

June 10 -

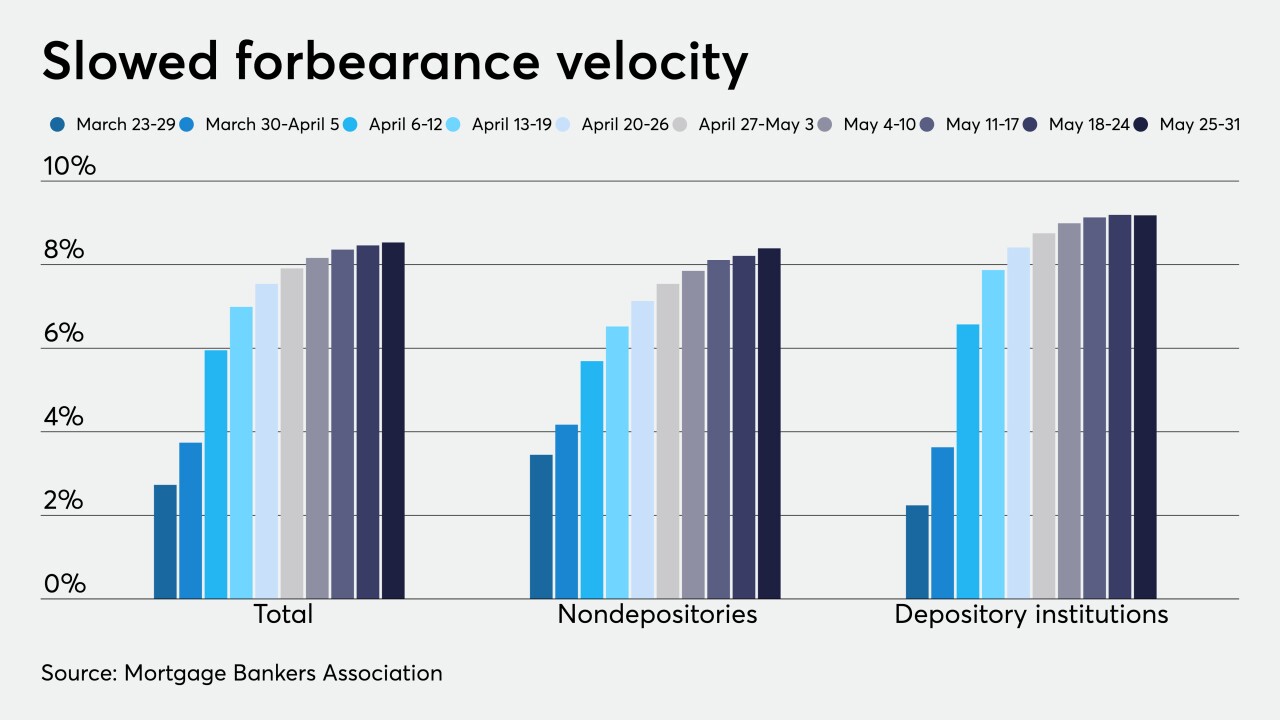

The number of loans going into coronavirus-related forbearance slowed to a rate of 7 basis points between May 25 and May 31, according to the Mortgage Bankers Association.

June 8 -

Independent mortgage banks started 2020 strong after three quarters of high profits, according to the Mortgage Bankers Association.

June 4 -

The company's planned two-week halt on originations turned into more than two months on hiatus because of coronavirus-related market disruptions.

June 4 -

Coronavirus-related mortgages in forbearance grew 10 basis points between May 18 and May 24, according to the Mortgage Bankers Association.

June 1 -

In addition to the potential wave of mortgage defaults resulting from coronavirus-driven forbearances, hurricane season could put nearly 7.4 million homes worth $1.8 trillion at risk.

May 28 -

Coronavirus-related mortgages in forbearance grew 20 basis points between May 11 and May 17, according to the Mortgage Bankers Association.

May 26 -

As the growth rate in forbearance requests downshifts, a vast stockpile of loans await modifications.

May 22 -

The lenders also are receiving warrants to purchase New Residential stock.

May 20 -

Total forbearance driven by the coronavirus rose by 25 basis points, which suggests it is still growing but at a slowing pace, according to the Mortgage Bankers Association.

May 18 -

Now is the time for mortgage servicers to prioritize customer care for the homeowners they serve.

May 15 Sagent Lending Technologies

Sagent Lending Technologies -

But in the worst-case scenario, the number of forbearances could grow by 3 percentage points through the end of June.

May 15 -

The number of mortgages in coronavirus-related forbearance rose by 37 basis points as the unemployment rate soared, according to the Mortgage Bankers Association.

May 11 -

After ending 2019 on a high note, Ocwen Financial posted an income loss in the first quarter due to the unexpected costs and volatility created by COVID-19.

May 8 -

But Black Knight and Arch Capital's mortgage insurance business aren't as affected, at least so far.

May 5 -

The total coronavirus-related mortgages in forbearance grew by 55 basis points, in lockstep with rising unemployment claims, according to the Mortgage Bankers Association.

May 4 -

Jay Bray speaks about the company's experience in working with distressed borrowers going back to the Great Recession.

May 1