-

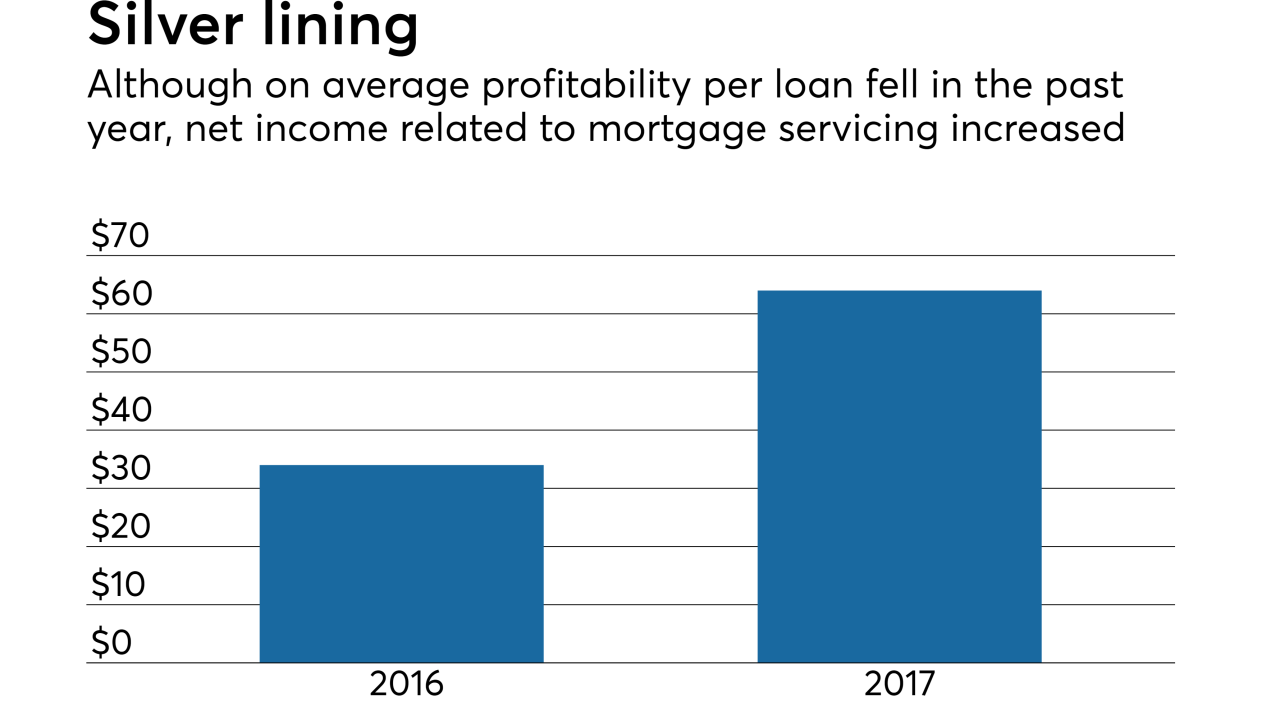

Mortgage servicers growing due to acquisitions or the increased value of servicing in the market could remain under pressure if these strategies don't outweigh other rising costs they face.

May 7 -

Freddie Mac has quietly started extending credit to nonbanks that issue mortgages, a move it says will help the companies maintain access to a crucial stockpile of cash if their home loans go sour.

May 7 -

Nationstar Mortgage Holdings reported first-quarter net income nearly four times higher compared to the fourth quarter of 2017.

May 4 -

Ocwen Financial Corp. got back in the black during the first quarter after selling New Residential Investment Corp. $110 million in economic rights to mortgage servicing.

May 2 -

From tech that ensures foreclosures are processed correctly to implementing robotic process automation, here's a look at seven strategies that servicers can use to stay compliant and on budget.

April 30 -

New Residential Investment Corp. reported a 400% year-over-year increase in net income as its servicing revenue improved dramatically over the previous year.

April 27 -

Flagstar Bancorp returned to profitability in the first quarter after tax reform caused a loss in fourth quarter, but its mortgage revenues dropped 15% due to margin compression and lower volume.

April 24 -

The real estate investment trust is issuing $450 million of five-year notes backed by rights to excess servicing strips of Fannie Mae loans.

April 23 -

However, mortgage growth and servicing income weren't the only reasons profits rose by double digits at the Dallas bank.

April 18 -

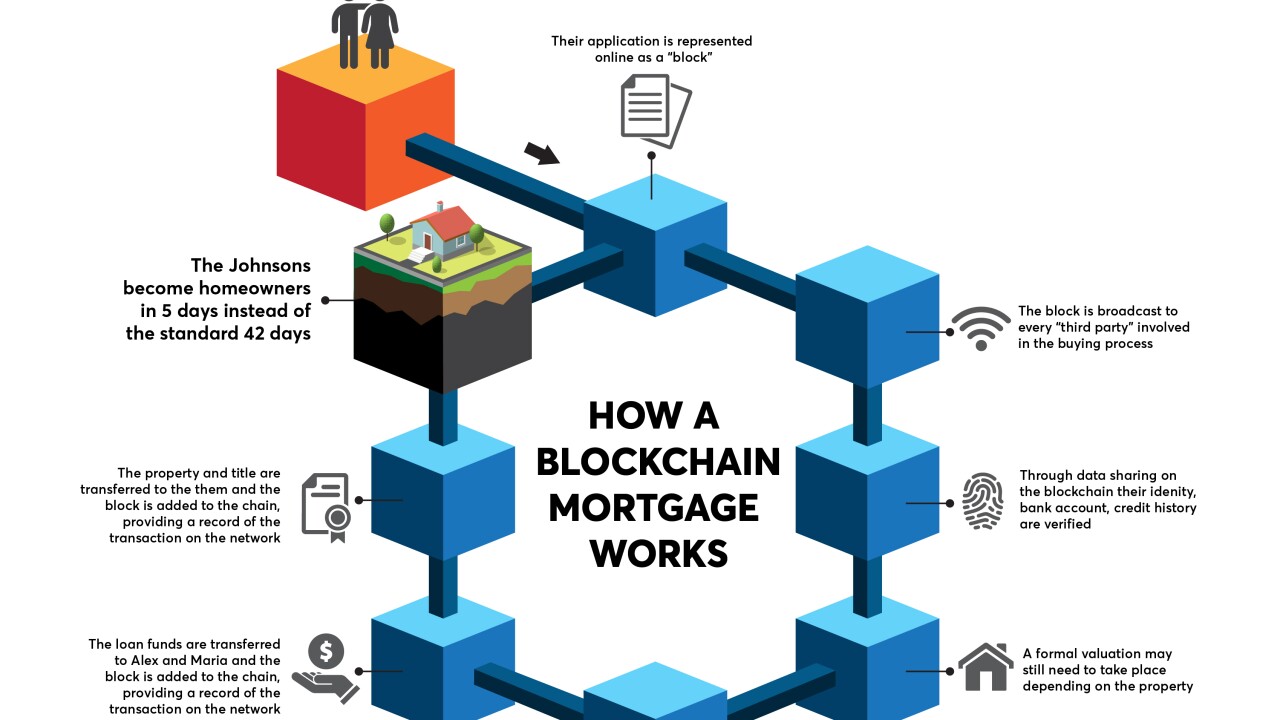

Blockchain technology can support a number of core technology issues plaguing the mortgage industry, including data integrity, security, distribution and compliance.

April 16