-

Walter Investment Management Corp. pushed back the date it would emerge from bankruptcy to no earlier than Feb. 2 from the originally planned Jan. 31.

January 31 -

The mortgage industry should expect significant volatility that could result in a wave of lender consolidation in 2018, warns an analyst at risk management technology vendor LoanLogics.

January 31 -

Flagstar Bancorp swung to a fourth-quarter loss as the company took an $80 million noncash charge to earnings because of the tax reform bill.

January 23 -

Ocwen Financial is receiving a lump-sum payment of $280 million from New Residential under the latest restructuring of the mortgage servicing rights sale.

January 19 -

Bank of America's mortgage banking business reported a loss for the fourth quarter driven largely by representations and warrants provisions.

January 17 -

Citigroup's fourth-quarter residential mortgage banking revenue was 22% lower from the previous year because the company sold the vast majority of its servicing rights.

January 16 -

JPMorgan Chase reported lower mortgage banking revenue in the fourth quarter as the returns from its servicing business declined from the previous year.

January 12 -

Situs agreed Friday to buy mortgage servicing rights valuation and brokerage firm MountainView Financial Solutions in a deal set to close this month.

January 5 -

MountainView is brokering a nonrecourse $3.5 billion package of Fannie Mae and Freddie Mac mortgage servicing rights on behalf of an unnamed seller.

January 5 -

The largest residential mortgage servicers will get even larger in 2018, benefiting from consolidation and the outsourcing of servicing rights acquired by companies without their own platforms.

December 26 -

New Residential Investment Corp. is planning to purchase Shellpoint Partners in the first half of next year for $190 million with an additional earn-out over the next three years.

November 29 -

The Senate tax reform proposal could force servicers to pay tax upfront on income that is currently tax deferred, according to the Mortgage Bankers Association and the Consumer Mortgage Coalition.

November 28 -

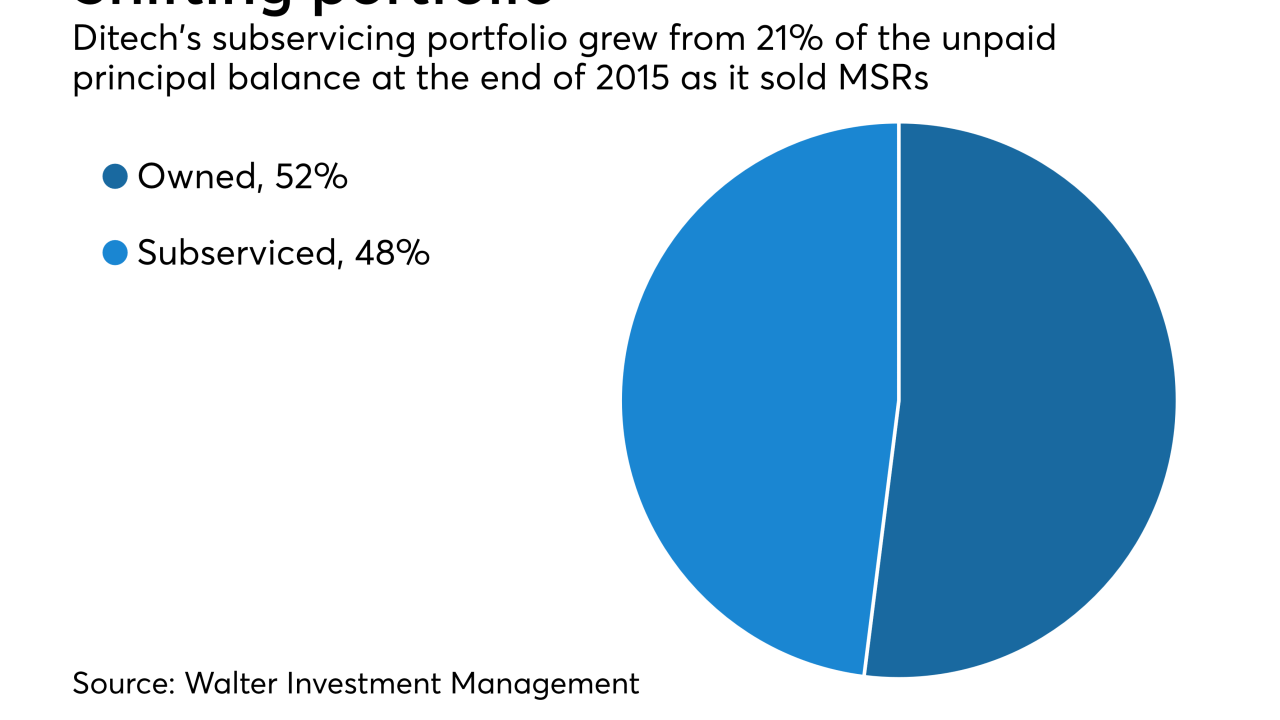

The impending bankruptcy of Walter Investment Management Corp. should not affect its subsidiary Ditech Financial's capability to service securitized mortgages, Fitch Ratings said.

November 20 -

Walter Investment Management Corp. is looking to file for bankruptcy protection by Nov. 30, after lining up $1.9 billion of debtor-in-possession warehouse financing.

November 10 -

Impac Mortgage Holdings' nonqualified mortgage origination volume increased 248% year-over-year in the third quarter as the company accumulates loans for a planned securitization next year.

November 9 -

PHH Corp.'s net loss grew in the third quarter as the company took a hit from the costs of its transformation to being a subservicer and portfolio retention originator.

November 8 -

Nationstar Mortgage Holdings posted net income of $7 million for the third quarter, its first under the new Mr. Cooper consumer-facing brand.

November 2 -

Ocwen Financial Corp. lost $6.1 million in the third quarter, as pretax losses from its origination business outweighed any profits generated from the servicing side.

November 2 -

New Residential Investment Corp. may seek to accelerate the process of transferring more than $100 billion in mortgage servicing rights it agreed to buy from Ocwen for $400 million.

October 31 -

The Michigan company's third-quarter results were down slightly from a year earlier despite increased commercial lending and a wider net interest margin.

October 24