-

Rocket Cos. profits were over 35 times greater than what it disclosed for the first quarter.

July 17 -

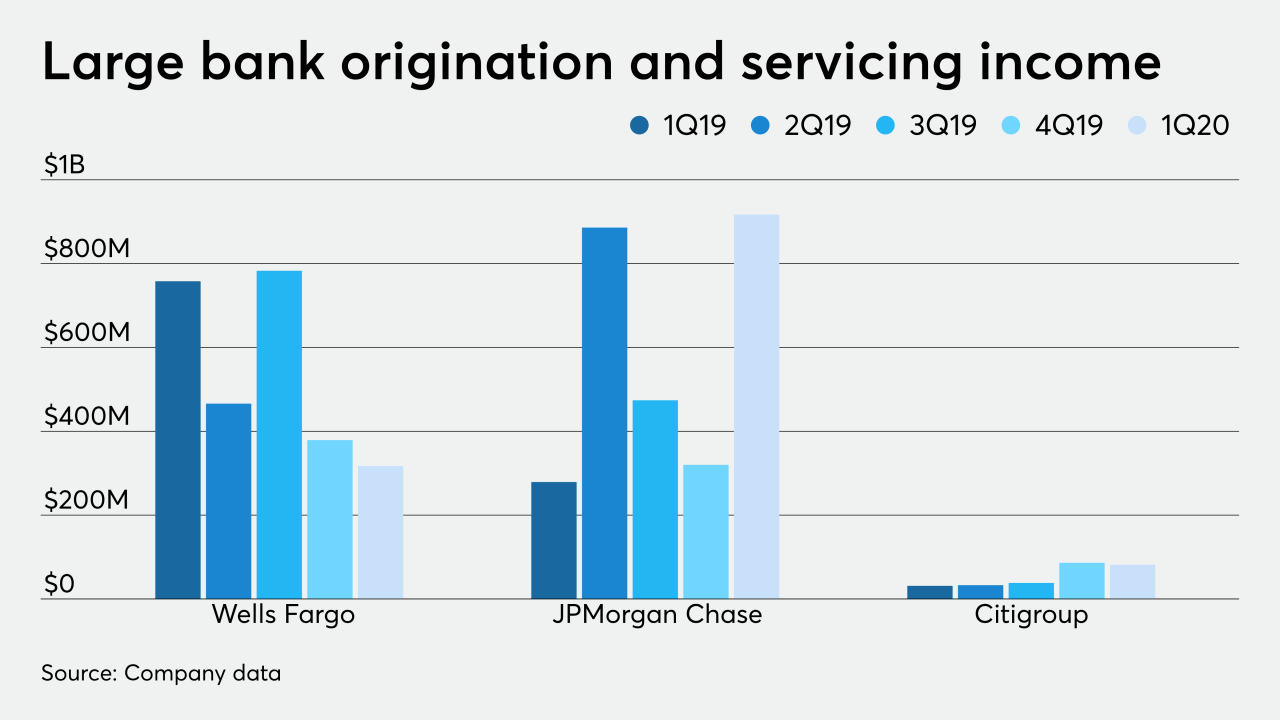

The banks logged strong year-over-year growth in gain-on-sale margins for mortgage loans.

July 14 -

The number of loans going into coronavirus-related forbearance fell for the fourth consecutive week, as the growth rate plummeted 21 basis points between June 29 and July 5, according to the Mortgage Bankers Association.

July 13 -

A more than $5 billion offering going up for bid is one of the first large transactions seen since the coronavirus complicated trading.

July 10 -

The number of loans going into coronavirus-related forbearance dropped for the third consecutive week, as the growth rate fell 8 basis points between June 22 and June 28, according to the Mortgage Bankers Association.

July 7 -

Mortgage insurers had been operating under the belief that rules pertaining to natural disaster delinquencies apply with COVID-19, but now it's in writing.

July 1 -

The number of loans going into coronavirus-related forbearance edged down slightly, with the growth rate dipping 1 basis point between June 15 and June 21, according to the Mortgage Bankers Association.

June 29 -

The company formally reported a nearly $65 million loss in the first quarter as the coronavirus affected its operations in March.

June 26 -

The number of loans going into coronavirus-related forbearance dropped, with the growth rate falling 7 basis points between June 8 and June 14, according to the Mortgage Bankers Association.

June 22 -

New Residential Investment Corp., fresh off a substantial first-quarter reduction of its asset holdings, is now planning to securitize the receivables on its $200 billion servicing portfolio of Fannie Mae-owned mortgages.

June 17 -

The number of loans going into coronavirus-related forbearance ground down to a growth rate of 2 basis points between June 1 and June 7, according to the Mortgage Bankers Association.

June 15 -

The company could be seeking a cash infusion to handle market difficulties ahead, but representatives are keeping mum on the matter.

June 12 -

The expected rise in refinance volume overrides pessimism about purchase activity for their businesses.

June 11 -

The coronavirus market disruption actually caused the company's execs to speed up its return.

June 10 -

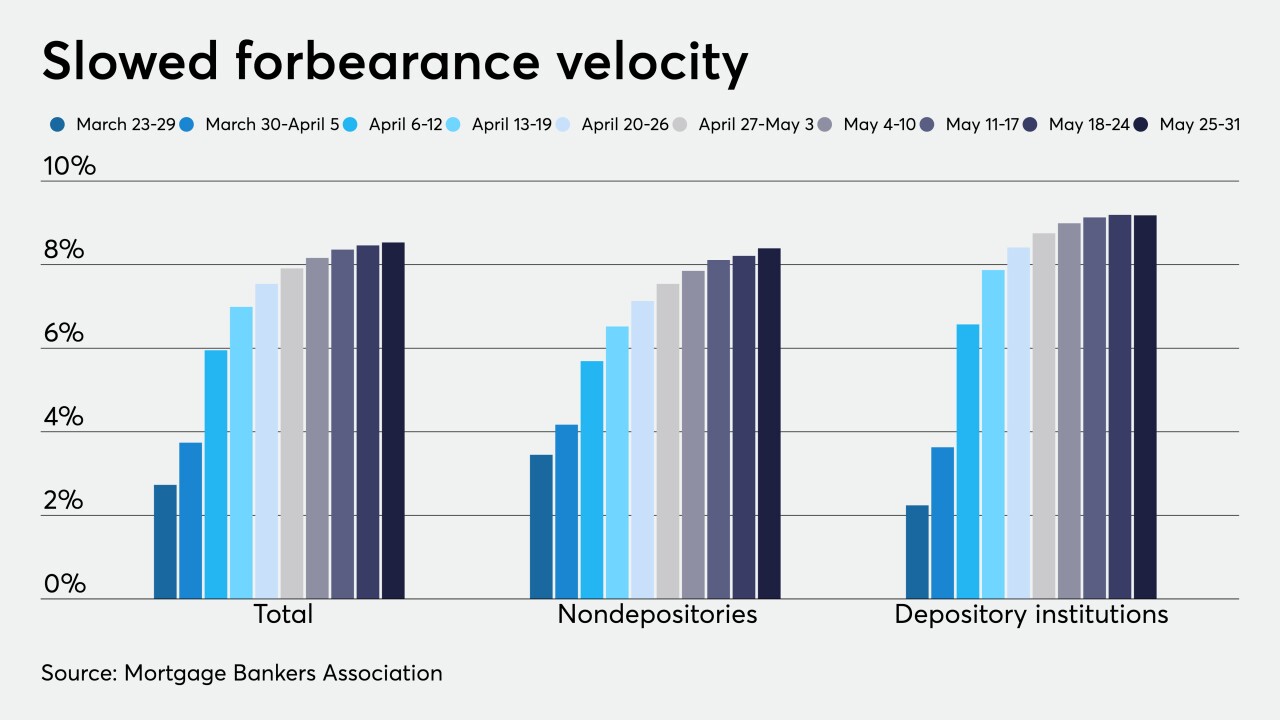

The number of loans going into coronavirus-related forbearance slowed to a rate of 7 basis points between May 25 and May 31, according to the Mortgage Bankers Association.

June 8 -

Independent mortgage banks started 2020 strong after three quarters of high profits, according to the Mortgage Bankers Association.

June 4 -

The company's planned two-week halt on originations turned into more than two months on hiatus because of coronavirus-related market disruptions.

June 4 -

Coronavirus-related mortgages in forbearance grew 10 basis points between May 18 and May 24, according to the Mortgage Bankers Association.

June 1 -

In addition to the potential wave of mortgage defaults resulting from coronavirus-driven forbearances, hurricane season could put nearly 7.4 million homes worth $1.8 trillion at risk.

May 28 -

Coronavirus-related mortgages in forbearance grew 20 basis points between May 11 and May 17, according to the Mortgage Bankers Association.

May 26