As lenders look to the year ahead, a number of question marks make gazing into the crystal ball even more of a challenge than usual. As the pandemic worsens in hot spots across the country, disputed election results are creating even more uncertainty about the road ahead. Taking these variables into account, NMN checked in with leaders in the origination to make their predictions for the year ahead.

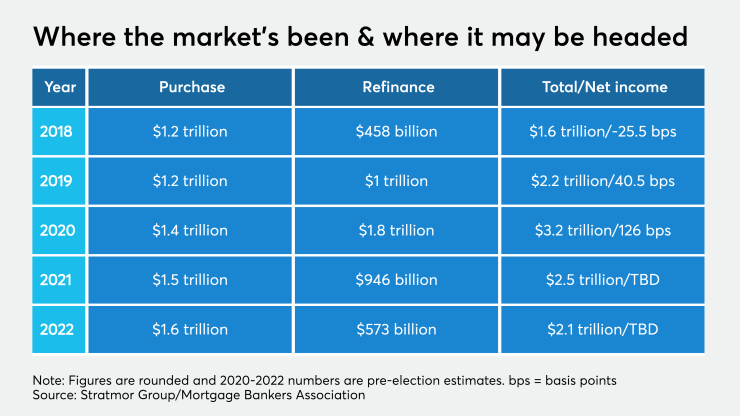

With 2021 in line to become one of the best years ever for purchase origination volume, there are a few potholes in the road ahead that lenders need to be aware of.

In particular they should be watchful of how pandemic-related pain points will continue to evolve, Jim Cameron, a senior partner at Stratmor Group, pointed out.

At the start of 2021, the industry will be considering what reentry from

Interest rate movements will determine where the struggles will lie in 2021. If rates go up next year, rate and term refinancings are likely to drop off significantly, more than the expected rise in purchases.

This would trigger massive margin compression as too many lenders chase too few loans, Cameron said.

The margin compression will also likely lead to a wave of industry consolidation, he said.

But if rates remain low, the primary pain points will be recruiting and retaining staff; managing capacity; and looking for ways to automate the process to decrease cycle times and increase throughput.

Meanwhile, a recent uptick in

Through July, the number of EPDs reviewed by lenders through the Aces software was 75% higher than the average monthly rate of these reviews for 2019, the company noted in a September report. That continued to grow through the third quarter, he added.

Typically, lenders have to repurchase any loans sold into the secondary market if the borrower defaults in the first few months after closing.

But borrowers who were granted

“What percentage of those people that are currently on forbearance plans are actually able to start making the payment that is larger than their original payment?” he asked.

“And what percentage of those end up in

Unemployment is one of the drivers of early payment defaults, but the growth in cash-out refinancings might be masking some of the problems that borrowers are having, he said. When those forbearance plans end, and the borrowers are still jobless and the equity removed runs out, there could be that

Meanwhile, because it is going to be a purchase dominant market, mortgage loan defects are likely to increase, Gauthier added.

“Purchase is that much more complex [than refi] and in addition to that, you’ve got a number of things from an operational perspective that are new to the process, whether that be COVID-related or agency and state requirements, which have been changing regularly,” he said.

“You’ve got reverification turnarounds that are superfast, and you’ve got a lot of potential for human error,” Gauthier added. “Not to mention the different processes to handle these purchases because they are at home, with your processor, underwriter and closer handling different bits of that process.”