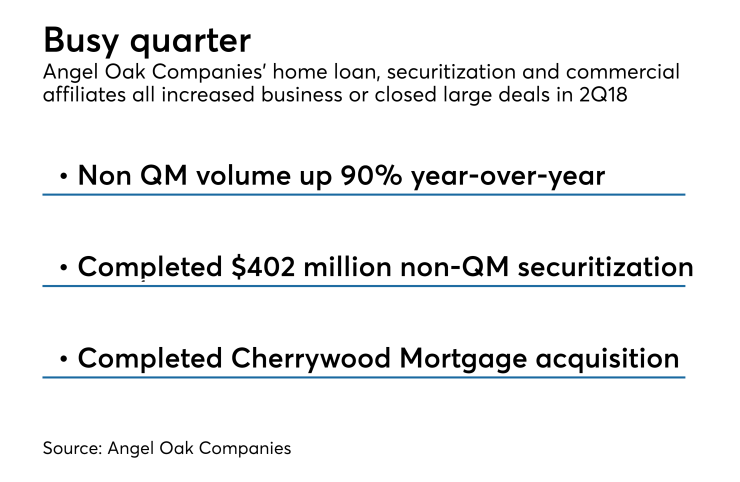

Angel Oak Companies' affiliates increased their production of loans made outside the boundaries of the Qualified Mortgage definition by 90% year-over-year during the second quarter, when most lenders' volume fell.

Non-QM production by Angel Oak Mortgage Solutions, Angel Oak Home Loans and Angel Oak Prime Bridge totaled more than $512 million in the second quarter. This represents a 52% increase from the first quarter and puts the company on track to meet its goal of producing

Higher year-to-year interest rates have led to a decline in many lenders' mainstream home mortgage volumes compared to 12 months ago, but seasonal activity has increased most companies' production levels relative to the previous quarter.

Besides generating higher volumes, Angel Oak Companies added 104 new employees during the quarter. Due to the increase in hiring, Angel Oak Mortgage Solutions has filled a new operations center in Dallas and is searching for additional space.

Also during the second quarter, Angel Oak Capital Advisors completed a $402 million non-QM securitization collateralized by

"We are growing every aspect of our business," Mike Fierman, co-CEO of Angel Oak Companies, said in a press release. "We don't see that slowing any time soon."

Loans made outside the QM definition can be riskier for lenders, but Angel Oak has taken pains to ensure that the loans will meet ability to repay requirements without the safe harbor from liability, Sean Marr, Angel Oak Mortgage's director of correspondent lending, said in an interview.