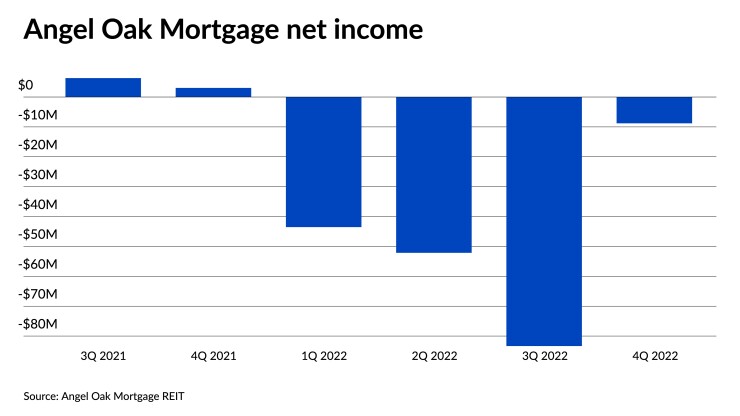

Angel Oak Mortgage reduced losses in the fourth quarter but ended up in the red after attempting to address elevated liquidity risk toward the end of 2022.

The Atlanta-based real estate investment trust posted a net loss of $8.8 million, or 36 cents per share, in the final three months of last year compared to $83.3 million over

For the full year, the REIT saw a loss of $187.8 million, unprofitable in each quarter as new mortgage

"We commenced a strategic plan in the fourth quarter to reduce warehouse financing risk and increase liquidity. Over the last several months, we have made tremendous progress," said

Among the moves Angel Oak made was a selloff of residential loans in November to reduce financing risk.

"This was a calculated decision and we found that the price that we received was commensurate with the lack of liquidity in the securitization markets at that time," Prabhu said. At the end of December, it still held residential mortgage whole loans with a fair value of $771.0 million.

The REIT also converted approximately $286 million of mark-to-market from nonmark-to-market financing for continually performing loans in December and January, and followed it up with a

Since the end of the third quarter, Angel Oak Mortgage has reduced its whole loan warehouse debt by 51%, its leaders said. The past several months have seen other lenders making

Angel Oak's leaders said its late 2022 strategy would continue as it attempts to build its balance sheet and eventually restart purchases of newly originated loans.

"We expect to get another securitization out, much like we did in January," said Chief Financial Officer Brandon Filson.

"As we build that balance sheet, the loan balance will come up some. We won't go as high as we did like in Q1 of '22," he added.

Recent market conditions may favor new securitizations as well, according to Prabhu. "We're not in a situation of August, September, October, November of last year when there was absolute illiquidity in the system."

"Also, remember that not a lot of new originations have been done, so if buy-side guys want to buy bonds off non-QM shelves, they've got to buy now," Prabhu said.

Angel Oak finished 2022 with loan financing capacity of $573 million, compared to $695 million at the end of the third quarter. The figure has grown to $767 million so far this year, largely due to its January securitization.

Operating expenses during the fourth quarter totaled $4.3 million, decreasing by $2 million from the previous three months, excluding securitization and severance costs.

Investors appeared to react positively to the news coming from Angel Oak on Thursday, despite the loss. After opening at $6.70, its stock climbed higher by 9.1% to a closing price of $7.31 at closing bell.

Earlier this month, the company also said it would undergo a rebranding from Angel Oak Mortgage to Angel Oak Mortgage REIT, with both its website address and stock ticker symbol remaining the same. Some of the other affiliated businesses belonging to its parent include Angel Oak Mortgage Solutions,