The Market Composite Index, an overall measure of mortgage applications, dipped from 1117.1 to 1114.9 on a seasonally adjusted basis during the week ended March 19, according to the Mortgage Bankers Association's Weekly Mortgage Applications Survey.On an unadjusted basis, applications fell 0.3% on the week and were down 25.6% from the level of a year earlier. The Purchase Index declined from 452.4 to 448.9 on a seasonally adjusted basis, while the Refinance Index rose from 4983.7 to 4988.7. Refinancings represented 63.1% of total applications, up from 62.8% the previous week, while adjustable-rate mortgages accounted for 28.1%. The average contract interest rate for 30-year fixed-rate mortgages rose from 5.37% to 5.38%, and points (including the origination fee) fell from 1.26 to 1.24 for loans with 80% loan-to-value ratios, the MBA reported. The MBA can be found online at http://www.mortgagebankers.org.

-

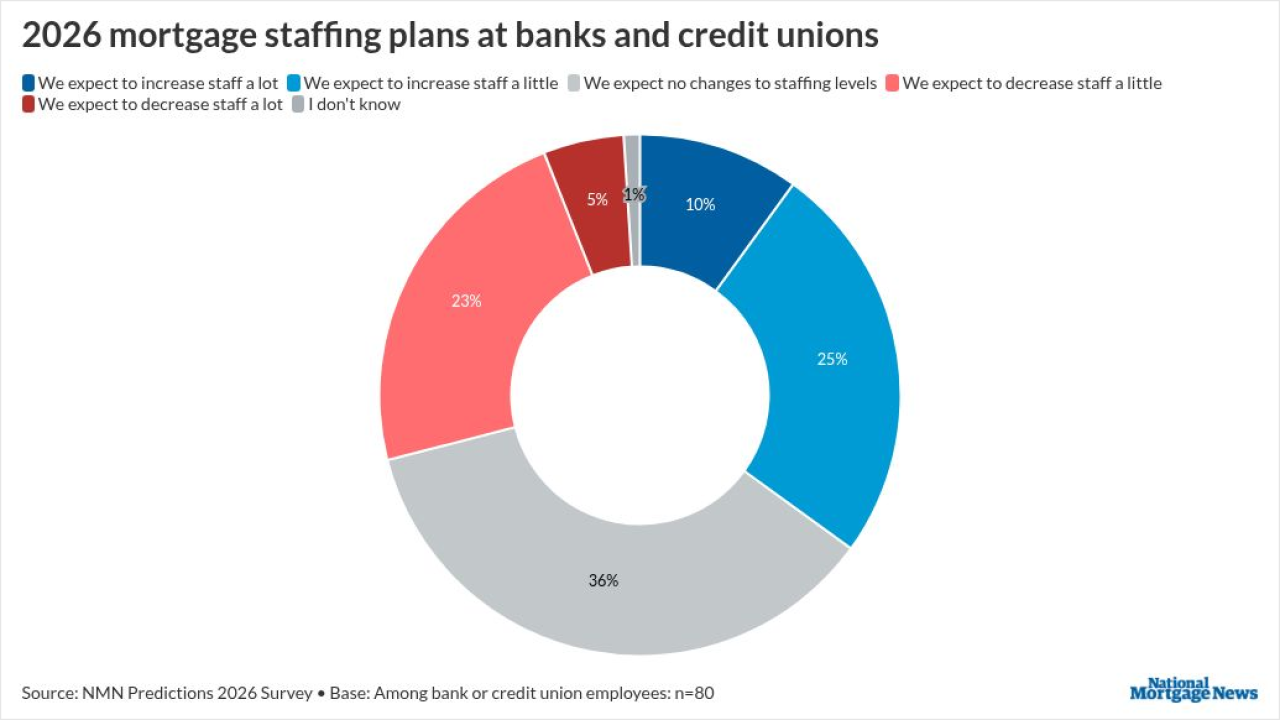

Banks and credit unions are pairing AI-driven efficiency with stable staffing and cross-training to scale mortgage production as originations rebound and technology expands capacity.

4h ago -

The agencies' representatives weighed in on the insurance fund's capital ratio and evolving policies at the Mortgage Bankers Association's servicing conference.

February 17 -

Some observers say changes to MSR risk-weighting would have limited near-term impact and are unlikely to prompt banks to rush back.

February 17 -

In a speech Tuesday, Federal Reserve Gov. Michael Barr said it was possible that artificial intelligence will boost productivity in an undisruptive way. But he said policymakers should also be wary of a financial crash if those gains are not realized or a rapid adoption that could lead to labor displacement.

February 17 -

The two organizations announced the Certified Home Equity Advisor credential, which will help financial professionals integrate home equity in retirement plans.

February 17 -

Large and mega investors accounted for 5.8% of all single family-home purchases in December, up from 4.8% at the same time last year, according to Cotality.

February 17