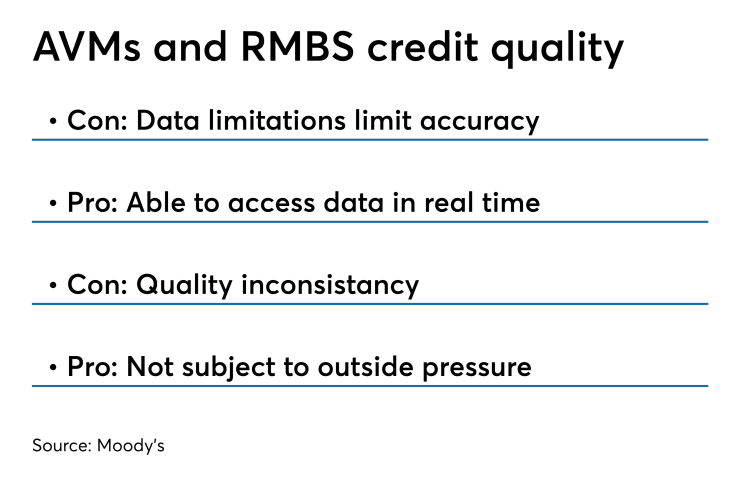

Because automated valuation models have not been subjected to a stressed housing market, their increased use holds negatives and positives for residential mortgage-backed securities credit quality, a

"While errors were found in the use of

An AVM's systemic errors "have far-reaching effects, undermining the valuations of all loans calculated using that model, while an underperforming appraiser would skew only a small share of loans in a securitization," Moody's said.

Fannie Mae and Freddie Mac looked at alternative forms of property valuation, such as

AVM use is likely to grow as the mortgage process becomes more digitized and the pool of appraisers shrinks. Technology limitations constrain the full replacement of human processes by a machine though.

Areas restricting the public availability of home price transaction data challenge AVM accuracy.

"Texas and North Dakota, for example, do not require parties to submit sales prices to county offices, while New Mexico bars the public distribution of this information. Data for some rural areas are not published," Ekram said. "In those cases, AVMs seek to use alternative data and estimations to bridge the gap."

In those circumstances, some models estimate the sale price based on the buyer's first mortgage or the property taxes.

On the other hand, appraisers are able to bridge the data gap using their local market knowledge of transactions, neighborhood trends and property improvements, the report said.

"By omitting a property visit, AVMs miss important inputs, such as the quality of materials in a home, the extent of a property's disrepair and its aesthetics. AVMs perform best in areas with fairly homogeneous groups of properties such as tract housing and perform worse in areas with unique properties or scarce data," Moody's said.

But for AVMs using data from a multiple listing service and/or similar source, they will have more information about local market conditions — such as changes in the labor market — than other AVMs and may be able to identify new trends earlier, the report continued.

Consistency between AVM models is another problem, Ekram said. "In contrast with traditional appraisers, AVM models and data access differ among providers, an inconsistency that would lead to valuation variability for RMBS that rely on multiple AVMs."

Each AVM has its own proprietary approach for calculating a value, which leads to output differences.

Investors are unable to pinpoint differences between models because providers keep details private," the report said. "This privacy also makes it difficult to compare the accuracy of one AVM model against another."

This risk is somewhat mitigated by federal banking regulations such as a Federal Deposit Insurance Corp. requirement to "establish policies and procedures that outline the appropriate and acceptable use of AVMs. Also, depository institutions must validate AVM results and performance on an ongoing basis. Given this guidance, bank lenders that also hold loans in their portfolio are likely to demand greater AVM accuracy and transparency than non-bank lenders who may have less stringent AVM governance policies," the report said.

A positive for

"AVMs use regression and appraisal-emulation models that are able to access vast amounts of data in real time. Critics of traditional valuations say views on market trends vary among appraisers, introducing bias that can affect valuations," said Ekram. "In addition, appraisers may be subject to business pressures from borrowers, real estate brokers and lenders to support a particular value given that a major deviation could derail a mortgage approval or property sale.

"Finally, AVMs' statistical estimates of their valuations' reliability and accuracy can benefit lenders. If an AVM confidence score is low because of an absence of suitable comparables or data, in certain cases lenders can interpret that result as a red flag, and undertake more diligence," according to Moody's.