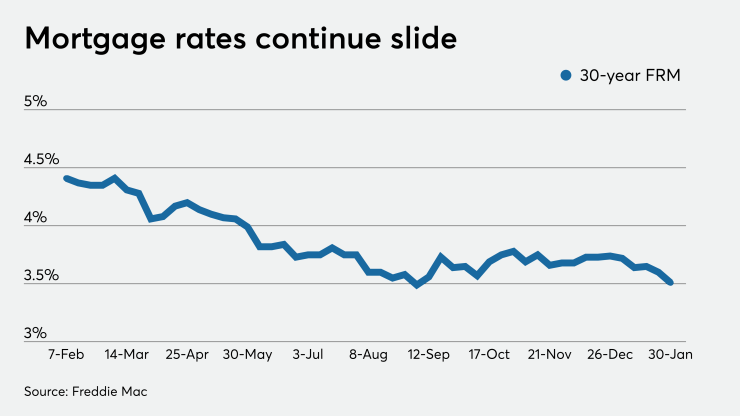

Mortgage rates continued sliding this week as investors put money into safer assets like bonds, contributing to the 30-year fixed-rate mortgage dropping 9 basis points, according to Freddie Mac.

"This week's mortgage rates were the second lowest in three years, supporting homebuyer demand and leading to

Concerns over the spread of the coronavirus continued for a second week, with investors stepping up their purchases of 10-year Treasury notes, driving the yields — which are a benchmark for the 30-year FRM — lower.

"While the epidemic's impact on global commerce remains unclear, markets appear to be erring on the side of pessimism, preparing for slowdowns in growth and, potentially, another cut to the Federal Reserve's benchmark interest rate. Investors sought out safer assets en masse this week, particularly on Thursday and Friday, snapping up Treasurys and pushing yields — and mortgage rates — down as a result," Zillow economist Matthew Speakman said when that company released its rate tracker.

At its Jan. 29 meeting, the Fed took no action regarding short-term interest rates, but Chairman Jerome Powell left open the possibility of further easing of monetary policy.

The 30-year fixed-rate mortgage averaged 3.51% for the week ending Jan. 30,

The 15-year fixed-rate mortgage averaged 3%, down from last week when it averaged 3.04%. A year ago at this time, the 15-year fixed-rate mortgage averaged 3.89%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.24% with an average 0.3 point, down from last week when it averaged 3.28%. A year ago at this time, the five-year adjustable-rate mortgage averaged 3.96%.

Fears over the coronavirus will be the primary driver of mortgage rates in the near future, Speakman said.

"Mortgage rates remain near multiyear lows, and there's a chance they could move even lower, should conditions pertaining to the outbreak continue to worsen," said Speakman. "On the other hand, should there be a marked improvement in the situation, a swift move to higher rates would likely follow."