Although Bank of America bucked market expectations by originating more mortgages on a quarter-to-quarter basis in the fourth quarter, the bank saw a significant drop-off in volume on a year-over-year basis.

The Charlotte, N.C.-based bank reported fourth-quarter volume of $13.7 billion, compared with $13.4 billion in the third quarter, but down from $22.1 billion for the fourth quarter of 2019.

For the industry as a whole, Fannie Mae expected fourth-quarter production to be down nearly 7% from the third quarter, to $1.24 trillion from $1.32 trillion.

Among its

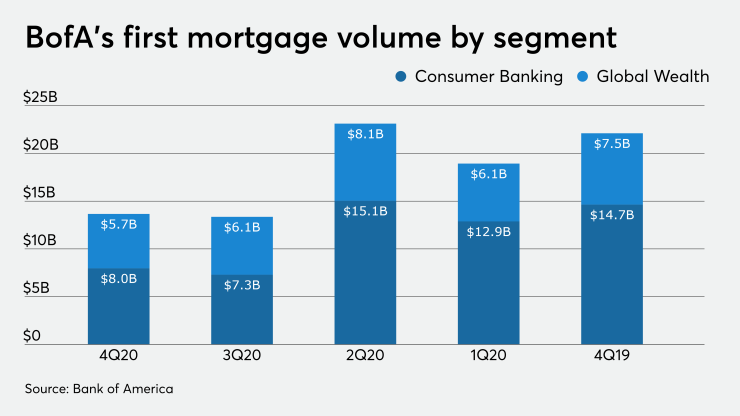

Bank of America reports mortgage volume from two divisions. In the consumer banking division alone, fourth-quarter volume was just under $8 billion, compared with $7.3 billion in the third quarter and $14.6 billion in the fourth quarter of 2019. The remaining volume comes from the global wealth and investment management segment, which works with BofA’s affluent and high-net-worth clients.

Total first mortgage volume for 2020 at the bank was $69.1 billion, down from $72.5 billion in 2019. When production from consumer banking only is measured, BofA did $43.2 billion, down from $49.2 billion in 2019.

The decline in annual volume is noteworthy given that

Home equity originations for the year fell to $8.2 billion in 2020 from $11.1 billion for the prior year. For consumer banking alone, home equity production fell to $6.9 billion from $9.8 billion.

Nonperforming residential mortgage loans increased to $2 billion in the fourth quarter, versus $1.7 billion in the third quarter and $1.4 billion in the fourth quarter of 2019.

At the same time, nonperforming home equity loans grew to $649 million, up from $640 million from the prior quarter and $536 million the previous year.

Commercial real estate loans in nonperforming status declined to $404 million in the fourth quarter from $414 million in the third quarter, but up from $280 million in the fourth quarter of 2019.

BofA does not break out mortgage banking income separately, but the company reported $51 million on the “all other” line for noninterest income from consumer lending in its consumer banking segment for the fourth quarter, compared with $8 million in the third quarter and $65 million in the fourth quarter of 2019.

For the full year, the company reported $164 million of noninterest income on this line, down from $294 million in 2019.