Bank-led efforts to shield loans held on balance sheet from new mortgage rules are drawing heavy fire from consumer activists and independent mortgage lenders.

What began as an attempt by community bankers to get a free pass from the qualified-mortgage rules imposed by the Dodd-Frank Act has expanded to include the biggest banks. Opponents say they are concerned about the potential loss of consumer protections and the possibility of opening the door to risky lending by large banks.

"There is nothing inherent about a portfolio loan that makes it safer," said Mitria Wilson, a vice president of government affairs at the Center for Responsible Lending. "It doesn't make sense."

Yet with possible Senate Banking Committee action approaching fast, the idea has gained enough momentum that damage control could be the best hope from opponents' perspective.

The

Senate Banking

At least one proposal up for debate would give QM status to all loans held in a bank's portfolios regardless of the loan's underwriting characteristics or of a bank's asset size.

That means loans strictly curtailed by the CFPB — including interest-only and balloon loans, loans tied to so-called "teaser" interest rates and high-cost loans with excessive points and fees — would be given the ultrasafe "QM" imprimatur. The QM stamp of approval would last for life as long as the loan was held in a bank's own portfolio but not necessarily if a loan gets sold.

James Ballentine, the head lobbyist with the American Bankers Association, said there should be far fewer worries about loans held in bank's own portfolios because the loans are "properly underwritten" and bank examiners provide a backstop.

Consumer groups are outraged at rolling back consumer protections particularly for large banks. "Most of the legislation pushing for portfolio loans to get safe harbor status [from litigation] don't have any requirements on the loans themselves, which is highly problematic," Wilson said.

Even the Mortgage Bankers Association is against the lender-specific waivers.

David Stevens, the MBA's president and CEO, said he is against slicing and dicing business models that favor some special interest groups such as big banks and community banks over others, such as nonbank mortgage lenders, which make up a large part of the MBA's membership. Rules should consistent for all industry players, he said.

"Let's not create confusion by having a dialogue about business models," Stevens said. "There's no hall pass for any business models on mistakes made during the financial crisis."

Attempts to chip away at the CFPB's ability-to-repay and qualified- mortgage rules have been going on for years. But critics of the CFPB might now have their best shot at changes, with Republicans controlling both chambers of Congress, even if a final agreement

Senate Banking

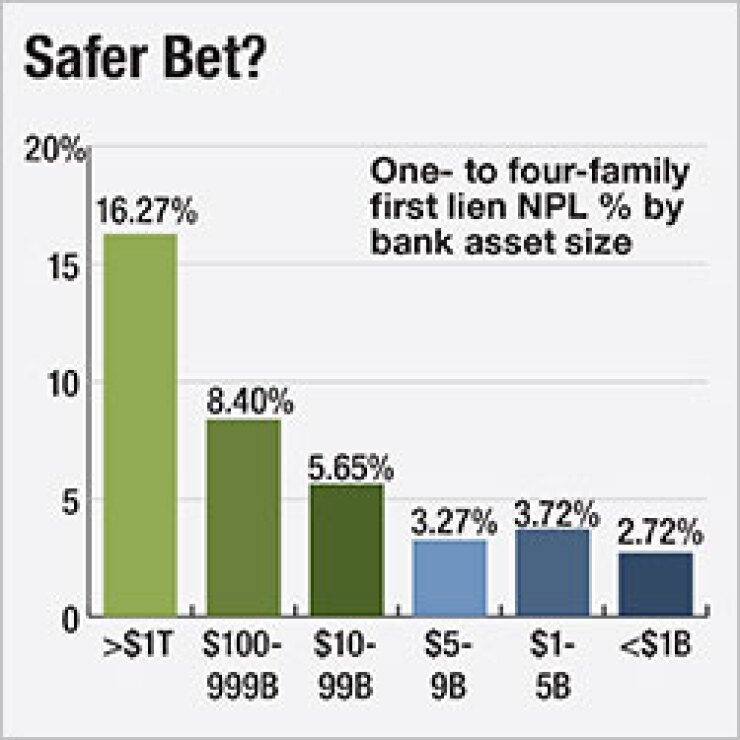

Easing the regulatory burden on community banks has been less controversial than for big banks precisely because smaller institutions did not originate the bulk of loans that defaulted during the crisis.

Banks with fewer than $10 billion in assets had nonperforming loans of 3.27% at the peak of the crisis in 2011. Nonperforming loans at the four largest banks with assets of $1 trillion or more Bank of America, Citigroup, JPMorgan Chase and Wells Fargo hit 16.27% during the same period, according to Bankregdata, which culls call reports.

Some mortgage experts have argued that community banks had lower nonperforming loans during the crisis because of the strong relationships with their customers, and the loans held on their balance sheets performed better.

"There is no big bank pushing for this," just community banks, Ballentine said, referring to the most far-reaching legislation, the Portfolio Lending and Mortgage Access Act, introduced last year by Rep. Andy Barr, R-Ky., that seeks QM relief for all loans held by banks.

"This is not somehow going to turn the clock back to 2006 or 2007," Ballentine said. "The examiners are in banks all the time. If they saw risky loans whether they were held in portfolio or not, there's no way that banks would be able to operate in that environment."

Despite the mortgage rules, community banks have posted surprisingly strong lending profits in the past year, which was caustically pointed out

Community bankers have been seeking exceptions especially for balloon loans, which exist now but will expire in April 2016 unless renewed. Many community banks rely on balloon mortgages for the bulk of their profits, earning interest by holding the loans on their balance sheets.

Still, balloon loans are inherently risky since they do not amortize, leaving a large balloon payment when the loan comes due. They also earned a bad reputation during the financial crisis when unscrupulous lenders pushed such loans on some unwitting borrowers who were unable to refinance and ended in foreclosure.

Ron Haynie, vice president of mortgage finance policy at the Independent Community Bankers of America, said if a bank is willing put up private capital and hold a loan in portfolio, then it has a vested interest in making sure a borrower can repay.

"These loans are safe, sound and have no tricks," he said. "They are QM by virtue of the way the bank underwrites the loan."

But Stevens at the MBA cautioned that while balloon loans work well in a low interest rate environment, they may backfire going forward.

There is no need "to let an unsophisticated institution [do such lending] with no credit modeling," Stevens said.

One of the main points of contention for lenders is abiding by the extensive underwriting requirements of the ability-to-repay rule's Appendix Q. Lenders have to verify and document whether a borrower's monthly income and debt satisfy the current 43% debt-to-income ratio limit that determines if a loan is ultrasafe and therefore a qualified mortgage.

But documenting the requirements is costly and eats into lenders' profits. Some lenders attribute the estimated

Jeffrey Naimon, an attorney at BuckleySandler, said banks are punished enough if a loan defaults because the ability-to-repay rule allows borrowers to sue a lender for alleged underwriting mistakes. The minimum cost of litigation is $50,000 a loan, he said.

"The point of QM was to identify risky loans not to make loans riskier," Naimon said. "The only thing that makes these loans held in portfolio risky is the government's rule."