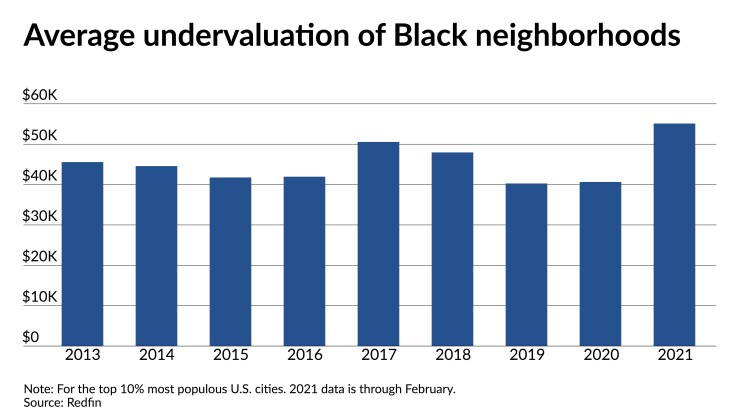

The racial imbalance in home values have shown few signs of progress over the past eight years.

Homes in Black neighborhoods — those comprised of 50% or more Black residents — are worth $45,382 less on average compared to equivalent properties in white neighborhoods, according to Redfin. While the average disparity fell to $40,652 in 2020 from $45,573 in 2013, the data didn’t follow a steady trajectory of improvement over that time frame. Additionally, 2021’s small sample average of $55,126 undervaluation through February isn’t an encouraging start to the year.

The real estate brokerage and data provider based its study on over 7.3 million home sales from 2013 to 2021 in the top 10% most populous U.S. cities.

At the metro level, Buffalo, N.Y., had the worst undervaluation at 86% followed by 72% in both Memphis, Tenn., and Indianapolis, and 67% in Rochester, N.Y. Conversely, Nashville, Tenn., and Oklahoma City accounted for 1% undervaluations, with Tallahassee, Fla., and Durham, N.C. behind at 3% and 4%, respectively.

“In many instances, the policies in the marketplace today have a discriminatory effect and operate to entrench racial wealth and equity, limiting communities of color and other underserved communities from accessing credit and home equity,” Morgan Williams, general counsel at the National Fair Housing Alliance, said in an interview. “Those practices abuse the market in so many varied ways that addressing the problem will take dismantling the discrimination and bias in those various facets.”

Passed down from now-illegal redlining practices, those undervaluations

Across the board, Black borrowers face the

Recently,

“There isn’t a policy that would make people less prejudiced. We would need to see a broad cultural shift in the way homebuyers view neighborhoods that are predominantly Black,” Redfin chief economist Daryl Fairweather said in the report. “There still appears to be a stigma against primarily Black neighborhoods and the longer Black Americans have lower home values than their white counterparts, the longer they are missing out on wealth that could be used for other investments and to pass along to their children.”