Andrew Bon Salle, executive vice president of Fannie Mae's single-family business, oversees the policies of the largest buyer of residential mortgages in the U.S.; but there are limits to his power.

Bon Salle is focused on overseeing policies designed to help mortgage lenders sell loans to Fannie so it can fulfill its affordable housing mission. And as a career executive at Fannie, Bon Salle knows a lot about what lenders want; but he admits there are practical limits to what he can, or will, do for them.

For example, he can't do too much about

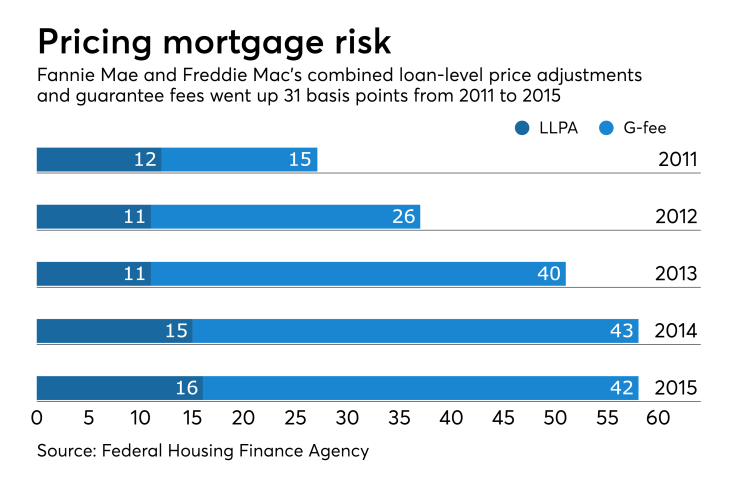

"FHFA holds the pen on that," he acknowledged in an interview in New York earlier this year.

That's not to say there no hope that lenders will ever get more a little more relief from the credit adjustments that are added on top of fees they already pay for Fannie to guarantee the credit risk on their loans.

Fannie has, for example, waived some LLPAs for

But even if Bon Salle could get rid of LLPAs, he doesn't think it would make sense to get rid of them entirely.

"I think LLPAs kind of get an undeserving rap because it's this fee that's on top of a g-fee," he said. "But this is really about how you charge for credit in the industry, and I'm a believer in risk-based pricing. It's a commercial, reasonable way to extend pricing in the market."

Even if Fannie did want to shift to make a change, it would be time-consuming and costly, said Bon Salle.

"If we said 'no more LLPAs,' that would be really hard," he said. "It would take the industry five to 10 years to adopt a change in how we extend pricing in the marketplace."

It's not that getting rid of LLPAs and converting to g-fees is a complex undertaking, "it's just that the industry's not wired that way."

And even if Fannie Mae was willing to do the rewiring, it may not even result in any improvement in pricing for lenders.

"I can eliminate LLPAs all day long, but what we're not going to do is change risk-based pricing," said Bon Salle.

There are some limited exceptions, though, in the cross-subsidies Fannie offers to support affordable housing.

While Fannie's not going to completely eliminate the extra fees it charges for loans with higher credit risk, it will eliminate them in some circumstances, and there are many other ways the agency is willing to adjust the policies in its selling guide to make lenders' lives easier.

"There are a whole bunch of things we're looking at, and they all relate to how lenders underwrite borrowers," he said. "Our modus operandi is to get customer feedback and where we can streamline or tweak the guide, that's what we'll do."

Among other things, Fannie has plans to build on its recent efforts to remove home buying hurdles faced by

There are limits to how far Fannie Mae can open up its underwriting, but doing something like accommodating cash-out refinances for borrowers with student loans makes sense because it manages risk by decreasing the consumer's debt burden, Bon Salle said.

Making improvements to the underwriting process can take time, he noted. Doing more to improve condominium lending, for example, won't be something Fannie can do overnight.

"That's a longer-term data-set kind of challenge that we're going to have to work with the industry on," said Bon Salle. "That's not a quick fix. There isn't a lot of structured data in that space and there are so many condos that it's hard just to get our arms around everything."

Digitizing and standardizing data from hundreds of thousands of homeowners associations that run condos, often on a volunteer basis, can be challenging to collect. But Fannie is looking at ways it could be done.

"We're talking to vendors in the industry who may spend time helping the HOAs or other sorts of things, and there may be opportunity there to work through that," Bon Salle said.

Another lender-friendly change Fannie Mae would consider is an expansion of the relief from representations and warranties it is now able to offer lenders on loan data elements that were tied to a lot of loan repurchases in the past.

"I think LLPAs kind of get an undeserving rap because it's this fee that's on top of a g-fee. But this is really about how you charge for credit in the industry."

— Andrew Bon Salle, EVP, Fannie Mae

When asked if there could be more pieces types of data the GSE could apply the relief to, Bon Salle said, "I’m sure there are, but I'm not sure we have all the answers yet.

"We have already hit the big three," he added. "When you look at the reasons why loans got repurchased, those are income, assets and collateral value. We've covered that."

Finding a way to use data to validate certain conditions lenders must rep and warrant to in underwriting condos, such as the owner-occupancy rate, could be an example of this.

Fannie also continues to look at the possibility of expanding the financing available to borrowers looking to buy manufactured housing as part of the FHFA's

"There are no silver bullets there, but just like HomeReady and the student loan program that we have in the marketplace now, it's going to be the same process. We're looking at what are the challenges for serving those underserved markets and what can we do in terms of product design and policy changes to try to help create more affordable options while attaining sustainable homeownership and risk?"