With each state using its own discretion in the distribution of the $150 billion Coronavirus Relief Fund, some of the money is still available for mortgage and rental payments. Since those CARES Act funds must be used before year’s end, many states are scrambling to ensure the money gets used in time.

“That puts a lot of pressure on these programs,” said Stockton Williams, executive director of the National Council of State Housing Agencies. “The demand in most states is far in excess of what is available and going to be available.”

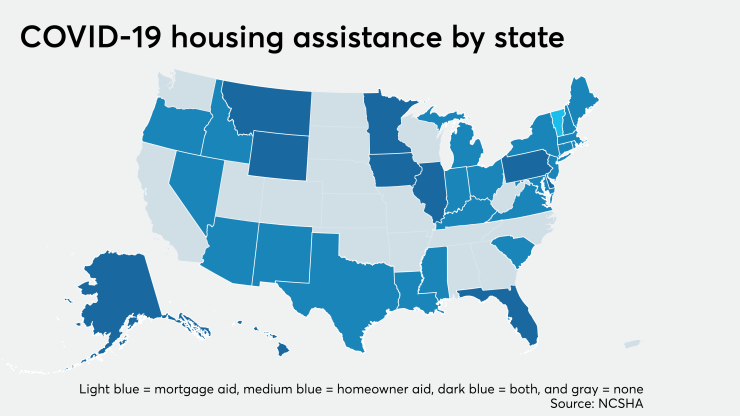

A total of 34 states have put a total of $1.5 billion toward housing assistance, an estimated $1 billion of which comes from the fund, according to the NCSHA. One state, Vermont, allocated the funds solely for mortgage assistance and 23 states allocated the money solely to rental assistance. Ten states and Washington, D.C., used the funds for both.

While states like

“So far the most serious housing hardship has been by lower income renters but there are certainly places where homeowners are also experiencing difficulty even with the forbearance options,” Williams said. “With forbearance, sooner or later the bill will be due. Some people will be able to pay it back, but many won’t. That’s what has motivated the creation of these programs.”

Vermont, for example, may have chosen to focus on mortgage assistance because 71% of the homes in the state are owned. In contrast, in a state like New York, nearly half the homes are rented.

State housing assistance programs could be extended through use of other funding, or if federal officials were to come to an agreement in negotiations over a second stimulus bill, but the latter is considered unlikely to occur before the federal election in November.

In the meantime, the states are working to use the existing funds available.

The Pennsylvania Housing Finance Agency, for example, is offering consumers with certain coronavirus-related hardships six months of mortgage or rental assistance to cover payments since March. The agency recently extended its deadline to Nov. 4 and relaxed some of its requirements for lenders and landlords.

Single-family mortgage lenders and rental landlords in Pennsylvania must still participate in

When asked how similar Pennsylvania’s use of the money is to other states’ programs, Williams said, “If you squint and look closely no state is exactly alike, but there are a lot of commonalities.”

Other states also have made adjustments to their deadlines and programs based on the responses they received over time, said Williams. The Vermont Housing Finance Agency, for example, has extended its deadline for

“You can’t overstate the challenges involved in creating brand new housing programs during a pandemic and a severe economic recession,” he said. “To their credit, agencies have been flexible and responsive as circumstances change and have seen how their programs could be revised to work better.”

The average size for the state housing assistance programs is $44.2 million and the median size is $21.1 million, according to the NCSHA.