WASHINGTON — Several times last year, Robert Cauldwell urged his colleagues at the Consumer Financial Protection Bureau to play it cool.

Every time his fellow employees, incensed by alleged discrimination and retaliation by management, discussed the issue on conference calls, Cauldwell advised them to stop "airing their dirty laundry" to the media. Give management "honey, not fire," he told them.

More than a year later, however, Cauldwell has reached his breaking point — and has decided to go public with his own complaints about management. Although the CFPB made several changes to its employee rating system last year in the wake of

"I don't think the CFPB is scared of Congress. They weathered the storm and feel more empowered," said Cauldwell, who is seeking a civil suit after the CFPB denied his claim of being discriminated against for his sexual orientation. "Until we figure out who we are — and the agency realizes that the most important aspect to helping consumers are the people who work for them — it will not get better. You have to get your house in order before you can clean someone else's."

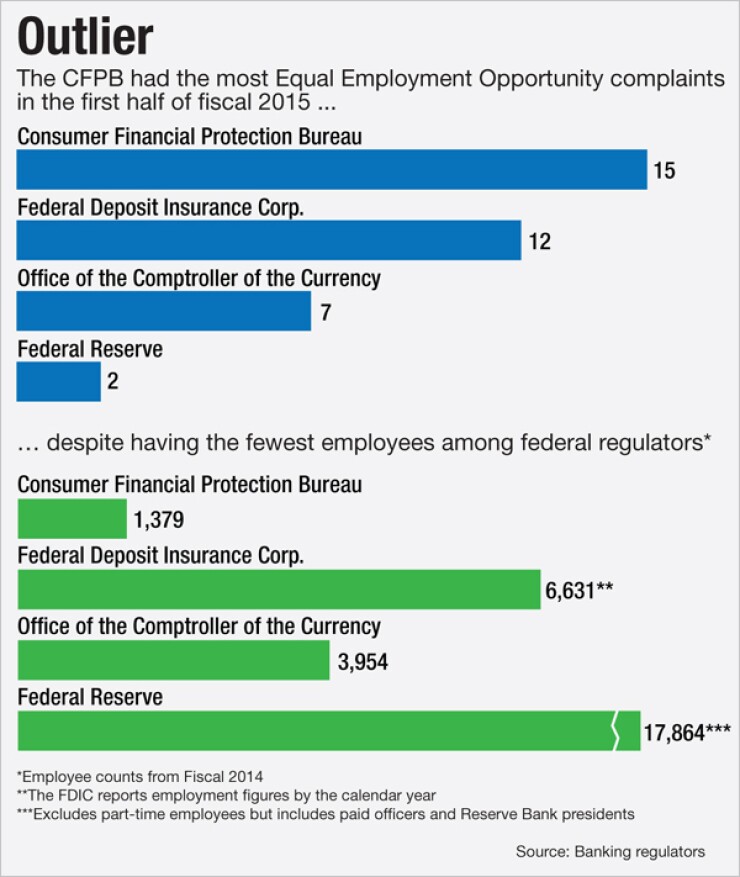

Cauldwell is one of a growing number of employees who have filed dozens of equal employment opportunity complaints against the agency, largely on the grounds of discrimination by race and gender, including charges of retaliation by management for piping up. Among the four federal banking regulators, the CFPB holds the dubious distinction of most EEO complaints so far this year, despite having the fewest employees.

Some of the complaints are different from those aired last year, which focused primarily on internal employee evaluations. NMN sister publication American Banker reported in March 2014 that CFPB documents found African-Americans and other minority employees were more likely to have a lower score on their reviews, which were used to establish pay, than white employees.

The stories led to a Congressional investigation into all federal financial regulators and the CFPB soon afterward

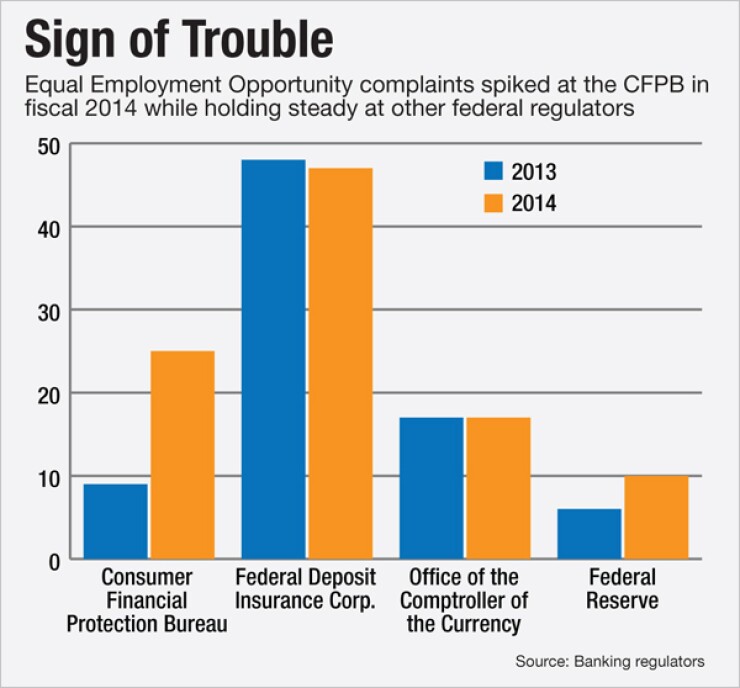

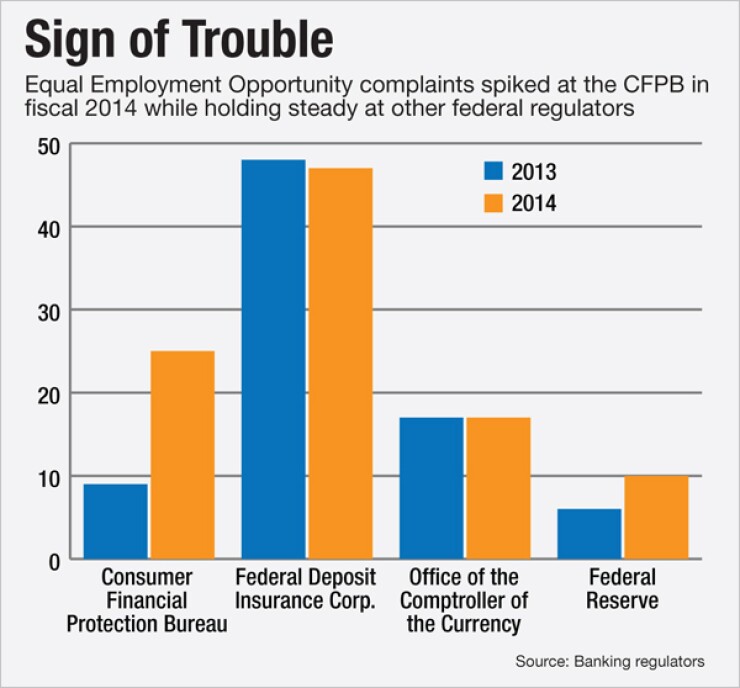

But the CFPB's actions did not stem charges of discrimination at the agency by employees. Instead, the agency has seen its number of EEO complaints increase, nearly tripling in fiscal year 2014 to 24. That level surpasses the level of EEO complaints during that time by Federal Reserve Board employees (10 complaints) and the Office of the Comptroller of the Currency (17).

The Federal Deposit Insurance Corp. was the only other bank regulator with a higher level than the CFPB, reporting 47 complaints. But it also has more than four times the number of employees, with 6,600 employees compared to the CFPB's 1,400 level.

Observers said the spike in EEO complaints should raise concerns about a potential broader issue.

Going from nine complaints to 25 in one year "is a big spike, which means they've got some kind of problem," said Robbin Hutton, an attorney at FordHarrison LLP who typically represents management in labor relations issues. "This could be all about perceptions, but the unresolved caseload can create a so-called 'chilling effect' on morale."

Brad Federman, a human resources consultant, said any increase in complaints needs to be handled with caution and thorough investigation.

"There are a lot of things that can cause that increase in complaints. For instance, if an organization is going through reorganization, if the bar is raised on expectations for the kind of work and amount of work employees must do; there are a variety of things like that which can raise issues," said Federman, the chief operating officer for the human resources consulting firm F&H Solutions Group. "But I do think you need to look at a spike with a critical eye and in many cases, where there's smoke, there's fire."

The CFPB said that many of these EEO complaints were tied to the old performance review system that was replaced last year with a temporary pass-fail system until the agency and the union can reach an agreement on a permanent grading scale. Talks are still pending.

"Without commenting directly on any individual cases, there are a number of factors that may have contributed to the increase in complaints filed between FY2013 and FY2014," CFPB spokesman Sam Gilford said in an emailed response. "Over that time period, the number of CFPB employees grew from roughly 1,000 to 1,400. Many of the EEO complaints filed in FY2014 were related to performance evaluation issues from FY2013, which the CFPB remediated."

Gilford added that evaluations and appraisals were a frequently raised issue: 13 times in the 25 formal complaints filed in fiscal year 2014 and three times in the 15 formal complaints filed so far in this fiscal year. (To read the CFPB's full response,

"This is consistent with moving away from the old performance rating system," Gilford said. "The bureau respects and protects the right of any person to raise an EEO claim and to file an EEO complaint. Through the second quarter of FY15, concerns were raised regarding harassment, pay, and promotion, among other items. These formal complaints are being processed neutrally by the Office of Civil Rights in line with EEOC regulations that apply in federal sector cases."

American Banker spoke to eight employees who had pending complaints, nearly all of whom had complained about things other than the performance review system. In some cases, their evaluation grades came up in the complaint process only because they allege they started receiving lower evaluations after they first complained about their managers to human resources and suspected retaliation thereafter.

Moreover, even after the CFPB scrapped its old performance evaluation system, the number of EEO complaints has continued to rise. In the first six months of fiscal year 2015, well after the evaluation system was dropped, the CFPB received an additional 15 complaints — more than any of the other three bank regulators.

One of the newer EEO complaints came from bank examiner Ali Naraghi, a whistle-blower who testified before a House Financial Services subcommittee last year. After testifying before Congress, Naraghi said he applied for 10 different examiner positions and was denied all of them with little to no feedback, eventually leading him to lodge an EEO complaint.

Emails dating back to September show that as of May 1, Naraghi was still waiting for further detailed explanation from the CFPB's human resources department on why he was denied those positions. Several employees shared similar experiences of not getting feedback on how to succeed after being denied a position or increase in their government employee grade. Some did receive feedback, but only after several months of prodding human resources and the EEO office, documents show.

"I've got 30 years of professional experience with 20 years in government and as an examiner," said Naraghi, a former examiner at the Fed. "And the CFPB absolutely won't let me lead an exam. I feel like I've been blackballed since I testified and believe CFPB management is retaliating in violation of whistle-blower protection requirements because of my testimony to the Financial Services subcommittee."

The CFPB's Gilford would not discuss individual cases, citing privacy concerns.

"It is difficult to respond to speculation stemming from individual employees' experiences and perceptions," Gilford said. "The CFPB takes any allegations of prohibited personnel practices seriously, and ensures they are investigated and handled through appropriate channels."

Most of the complaints shown to American Banker were related to being denied a promotion or a progression on the so-called career ladder for government employees. Others concern not being reassigned after complaining about a manager. Typically, any employer should take some form of "prompt remedial action," such as relocating an employee while an investigation is underway, so management can at least prove they responded quickly if the complaint reaches the EEO Commission, observers said.

The difficulty that some had in moving up at the CFPB — and most of the employees who complained had years of experience at other government agencies — is perplexing considering the consumer agency is still trying to build out its staff, making retention a key issue, employees said.

"You can't just keep hiring new people. You need to figure out what you are doing wrong because we have had some very intelligent people who've left this agency," said an employee who spoke on condition of anonymity. "A lot of people have just walked away."

The EEO process itself appears to vary widely for employees.

For example, Angela Martin, the first whistle-blower to testify before Congress in April 2014, had reached an agreement in June 2014 that resolved all of her complaints and placed her in a new position. But less than a month later, the CFPB sent an investigator to question Martin as part of a new investigation opened by senior managers — naming Martin as one of the subjects.

Various documents from management show that some senior officials claim the inquiry started because they were concerned the first investigation was invalid. Another senior official said they had reopened the inquiry with multiple people because of allegations coming from one department — a common practice in investigating multiple complaints, outside observers said.

Regardless of the reason, the timing of the new investigation alarmed Martin because it began a few months after she testified in front of Congress and after she settled with the CFPB and was satisfied with the resolution.

"I love my new job and I am happy with my boss and he's extremely happy with me and my work. I was healing emotionally after going through two settlement processes but it's like that scab was ripped off again when they decided to launch another investigation," said Martin, now senior enforcement attorney and military affairs liaison at the CFPB. "Most of my complaints were from things that happened in 2012 and 2013 and they want to investigate them now? Investigations are supposed to be done promptly."

Cauldwell, meanwhile, said that the CFPB acted inappropriately in handling his EEO case. The agency concluded he was not being treated unfairly or subjected to discrimination, adding that "sexual orientation is not a basis of discrimination" within the EEO process. The CFPB said a separate internal complaint process — one not appealable to the external EEO Commission — should be used to handle sexual orientation claims.

Cauldwell appealed the decision to the EEOC. Though it refused to hear the case, effectively upholding the CFPB's decision on discrimination, it said the CFPB was "incorrect" in trying to put sexual orientation claims through a separate internal process.

"The agency should henceforth take steps to ensure that it properly processes sexual orientation claims in accordance with Commission guidance and precedent," the EEOC said in its final decision.

The CFPB's Gilford said the agency has issued four final decisions on EEO cases since the CFPB opened its EEO office in February 2013 (the Treasury Department handled it before then) and none of those decisions found discrimination.

"Each case is assessed in line with relevant precedent and the record compiled, and is appealable to the EEOC if the filer disagrees with a finding of no discrimination," Gilford said. "Of those four, one was appealed to the EEOC, where the finding of no discrimination was upheld."

Some employees see a double standard in the CFPB's behavior, claiming that the agency makes it hard for them to prove discrimination compared with how the agency assesses banks and other financial firms for potential discrimination.

"If the CFPB can't stop their own discrimination claims, how in the world can they tell financial institutions to stop it?" said the anonymous employee. "They're supposed to be taking the lead on consumer harm and yet they fully deny any harm is going on internally, or even reprimand managers who have repeated complaints against them. It's like getting a Mexican drug lord to run the DEA."

Outside observers also noted that it's possible the CFPB faces deeper scrutiny from its own employees because the agency trained them to pursue consumer harm and discrimination.

"There is a heightened sensitivity to potential discrimination when you have employees who are more educated on these kinds of issues and all of the ways that consumers can file suits," Federman said. "The biggest thing companies can do is build a culture where there is respect, tolerance and a valuing of each and every employee if an organization has a big divide between management and employees where there's a lack of transparency and fear in the workplace, then it will have people raise more complaints. A lot of it comes down to good culture and good management."

American Banker obtained documents showing that Director Richard Cordray has been apologetic to employees during large employee meetings and internal memos since deciding to scrap the performance review system more than a year ago. The CFPB said earlier this year that it met nearly all of the recommendations on inclusion and diversity made by an inspector general's report. Another report from the Government Accountability Office is expected to come out later this year.

The CFPB's Gilford added that 91% of supervisors and managers have since taken a two-day mandatory EEO training, in addition to mandatory training all employees receive on the No Fear Act and harassment prevention.

"Supervisors and managers at the bureau have received extensive EEO training over the last year, including specific anti-retaliation training," he said. "The bureau has offered and now requires all employees take a diversity awareness course. A two-day diversity and inclusion training course for supervisors and managers was started earlier this year and more than 50% have been trained to date."

But the CFPB continues to undergo training on discrimination — which some observers say should not have taken four years to complete.

"It generally can take up to at least six to 12 months for a new organization to have a formal internal policies and training in place but I would think four years is a lot of time," said Hutton, the labor relations attorney. "As any new organization, you need to have good bones there" and "you don't want to outgrow policy because that's when troubles occur."

Hutton said even if discrimination is not proven against a manager, it behooves the organization to show employees that management is proactively taking some type of action, like training, when multiple complaints have been filed against the person.

Some employees said it was ironic that the CFPB has taken so long to get its own house in order, but it expects the financial services companies it oversees to come into compliance much quicker with new and complicated rules.

"The industry is asking for a grace period" on the incoming mortgage disclosure rule "and yet, the bureau needs four years to comply with federal laws that have been around since the '60s," Martin said. "The management training itself does not do anything without consequences for wrongdoers."

For their part, the employees who talked with American Banker were eager for the agency to address problems with the EEO process and its own culture.

"The director said it's getting better and it has not. It's gotten worse," Cauldwell said. "There are good people here who are trying to do a good job and most of them are happy. But for the people who have had to go through this complaint process, it's heartbreaking."