Three classes of Commercial Mortgage Acceptance Corp. commercial mortgage pass-through certificates, series 1997-ML1, have been downgraded by Moody's Investors Service and four others have been placed on review for possible downgrade.The downgrades were as follows: class F-1, from B1 to B3; class F-2, from B2 to Caa1; and class G, from Caa3 to Ca. Classes B, C, D, and E were placed on review for possible downgrade, Moody's said. The rating agency attributed the downgrades to the decline of the Shilo Inns Hotel Portfolio Loan ($89.2 million, 12.0% of the pool) and the Newton Oldacre McDonald Loan ($83.1 million, 11.2%). Moody's said the other classes were placed on review because of concerns about the operating performance of four loans: the Farb Investments Portfolio Loan, the Four Seasons Biltmore Hotel Loan, the Brookfield Loan, and the Four Seasons Hotel Austin Loan. Moody's can be found online at http://www.moodys.com.

-

Federal Reserve Vice Chair for Supervision Michelle Bowman said in comments Wednesday that the central bank plans to publish its Basel III endgame capital proposal for public comment before the end of March.

5h ago -

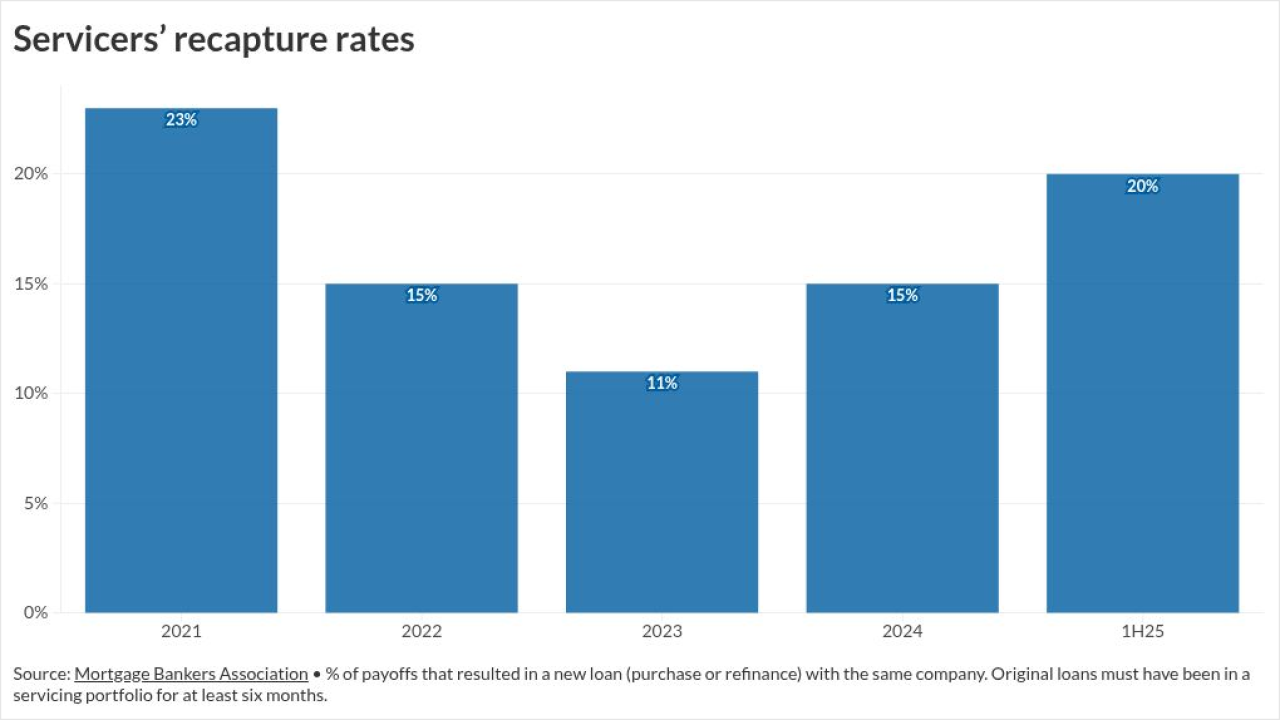

Some market sectors face growing challenges related to a K-shaped economy as servicers play an increasingly important role in keeping customers.

5h ago -

Loans will continue to be originated and closed in the name of Firstrust Bank but the MortgageCountry will oversee lending end-to-end and provide its leadership.

6h ago -

Data breach extortion group ShinyHunters used social engineering to steal customer names, addresses and phone numbers from the blockchain lender.

6h ago -

Residential lending remains steady in select cities as resilient housing markets, strong employment, limited supply, and migration trends shape borrower demand.

7h ago -

A White House Council of Economic Advisers report published Tuesday found that the CFPB cost consumers between $237 and $369 billion since its creation, an analysis that consumer advocates and some financial academics say is flawed.

8h ago