Rising refinance recapture and a widening split in borrower performance are redefining the servicing outlook, speakers at a Mortgage Bankers Association conference in Dallas said Wednesday.

The latter, which has stemmed from what's been referred to as

While the economic growth rate in the U.S. is historically strong, it's been uneven, Kan said, noting that this is primarily driven by consumers with equity wealth and some limited support is coming from business investment.

"You have a different story for households that maybe don't have the same level of assets or income," Kan added, noting that consumer debt levels have been rising with mixed repayment performance.

Also, home inventory levels vary across the country with

Employment levels are still strong overall but like spending, the numbers here also have been uneven in some segments, he said. Unemployment has been higher this year, particularly for younger workers, with the percentage of joblessness for more than six months trending up.

"Inflation has slowed a little, I would say maybe more than a little," Kan said. However, the recent numbers are still elevated and not ideal.

That adds up to a wait-and-see stance for monetary policy, with Kan forecasting at most one more short-term rate cut in the early part of this year.

Kan said the market has seen what he called

What the mortgage-specific numbers show

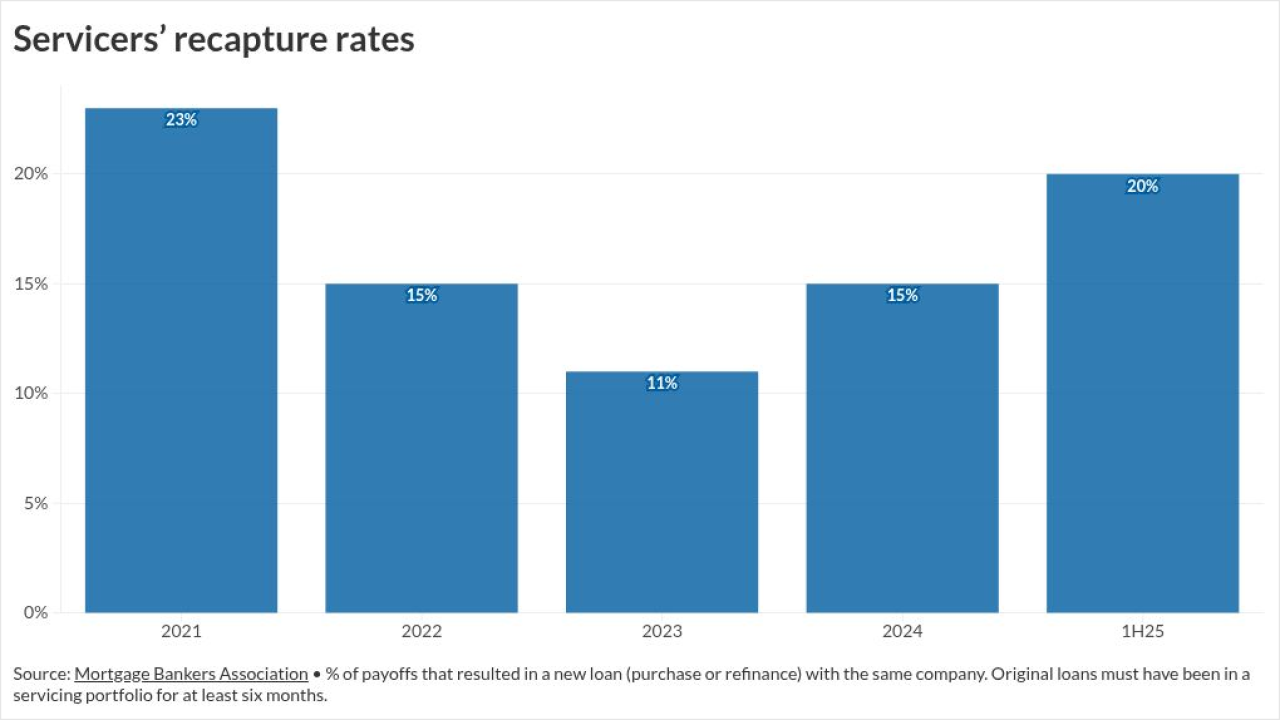

As refinancing picked up in the past year, recapture hit its highest rate since 2021, according to Marina Walsh, vice president of industry analysis at the MBA. The mid-2025 number shows around one-in-five customers were recaptured then and it's likely risen higher since, she said.

The K-shaped economy is evident in the

"We see a lot of variance between performance by product" she said, noting that "slowly but surely FHA delinquencies have started to go up."

In addition to the impact of a transition away from broader distressed borrower relief available during the pandemic, drivers of those higher delinquencies include labor market and affordability concerns, Walsh said.

Trends in serious or longer-term delinquencies that often are looked to as an indicator of how entrenched borrower distress is have been mixed and varied widely within metropolitan statistical areas, she said.

Walsh said she didn't want to overstate the rise in delinquencies, but indicated the increases in pockets of the market "will require additional resources on the part of servicers," whose per loan costs get considerably higher when mortgage borrowers experience hardships.

Forbearance hardships for government loans have shifted from being primarily disaster-related to other causes, which suggests some of the current distress in the market could be more long term, she said.

Delinquency rates also cover a wide range within the so-called non-qualified mortgage market, from the single-digits to as high as 10%, Jennifer McGuiness said during an MBA servicing conference panel on that sector.

"It's very program specific. It's hard to aggregate," said Michael Yanniello, chief operating officer, head of portfolio oversight and operations at Onity Group.