The pursuit of time savings is the goal for all mortgage companies and borrowers alike. Eliminating any potential surprises with a house is one way to speed up and smooth out the lending process.

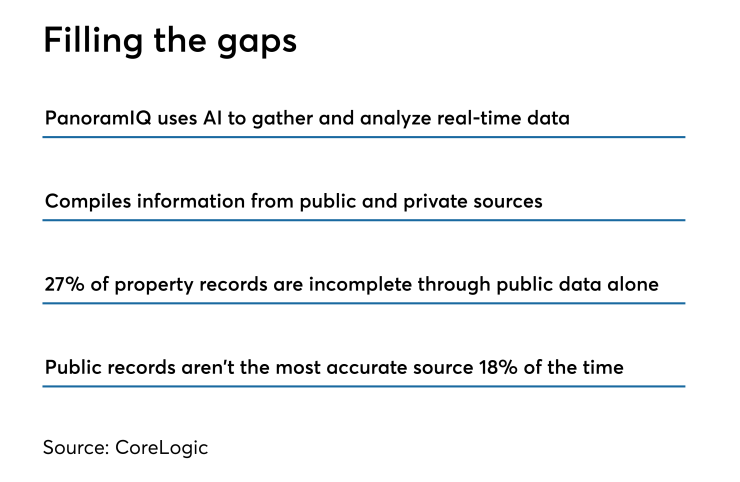

CoreLogic's PanoramIQ offering compiles and analyzes both public and proprietary property data, saving mortgage lenders time and costs by filling the gaps in property histories.

About 27% of property records are incomplete through public data alone, according to CoreLogic. Being able to accurately identify the entire past of a home means fewer surprises for the borrower and a smoother process for the lender.

"PanoramIQ brings a more complete and reliable source of property intelligence that fills gaps found in the traditional outdated systems. Based on an unmatched breadth of property information sources and sophisticated logic, CoreLogic is uniquely positioned to identify the most accurate sources of property data so clients have a more complete view of a property," Shaleen Khatod, executive GM at CoreLogic, said in a press release.

"As mortgage and refinance volumes continue to decrease, it's important for those in the mortgage industry to have instant and reliable information on a property so they can identify high-quality leads and make timely and competitive underwriting decisions."

Additionally, PanoramIQ uses artificial intelligence to find the most updated information available opposed to the yearly tax assessor data. CoreLogic found that public record data is only the most accurate source of property information in 82% of cases.

"When information on a property isn't reported accurately, it can have costly effects for those involved in the process. For those responsible for mortgage portfolios, an error in data reporting can lead to poor lending decisions or missed opportunities," said Sherrie Clevenger, principal of product management at CoreLogic.

"PanoramIQ is designed to turn data points into sales, change how property data is analyzed and improve decision making. It’s about changing the way property data is analyzed, so we can help lessen the amount of errors and build trust back into the system."