After posting record revenue for the third quarter, CoreLogic's management team once again looked to make the case against the

"CoreLogic is firing on all cylinders," Frank Martell, president and CEO, said during the company's earnings call. "We are exiting 2020 with accelerating momentum and believe that we're well positioned to capitalize on the many value creation opportunities to drive continuing organic growth and margin gains."

Specifically addressing the hostile bid for the company, after reiterating CoreLogic's board is "open to all pathways to create value." Martell then said, "Senator's and Cannae's continuing shifting stream of misinformation in support of their opportunistic attempts to acquire CoreLogic deliberately ignores the facts."

"We plan to continue to provide significant transparency into our business, such that all of our shareholders can fully appreciate CoreLogic's substantial current and potential value creation."

CoreLogic did not take any questions on the bid nor the Nov. 17

On Oct. 21, the day before the earnings were released, Senator and Cannae sent a letter to CoreLogic shareholders to make its case.

CoreLogic, the letter stated, "underperformed peers by 145% over the past five years, consistently ranks in the bottom 4% of the entire Russell 3000 for missing market expectations, has not met any of its long-term targets and consistently produces negative organic growth.

"This same board has now denied diligence access, attempted to invite regulatory scrutiny around a potential transaction, done shareholders a disservice by playing games with the special meeting and has undermined multiple attempts at constructive engagement," Senator and Cannae wrote.

Total revenue growth for the quarter was 16% year-over-year, but if it was adjusted to remove the effects of 2019 business exits as well as the coronavirus, revenue growth would have been approximately 23%, Jim Balas, CoreLogic's chief financial officer, said during the earnings call. Strong market share gains across both of its operating segments contributed to an organic growth rate of 8%.

CoreLogic reported revenue of $436.7 million for the third quarter, up from $375.6 million one year prior. The comparison to the year-ago period that Balas referred to included $17 million of third quarter 2019 revenue attributable to noncore default technology units that the company sold and its

Net income was $113.1 million for the third quarter, compared with $59 million

But on Oct. 16, CoreLogic announced it was moving the reseller business — which marketed tenant screening along with credit and borrower verification services to mortgage lenders — into discontinued operations on its balance sheet effective with the third-quarter results. Therefore, CoreLogic's third-quarter net income from continuing operations was $102.5 million versus $31.7 million one year prior.

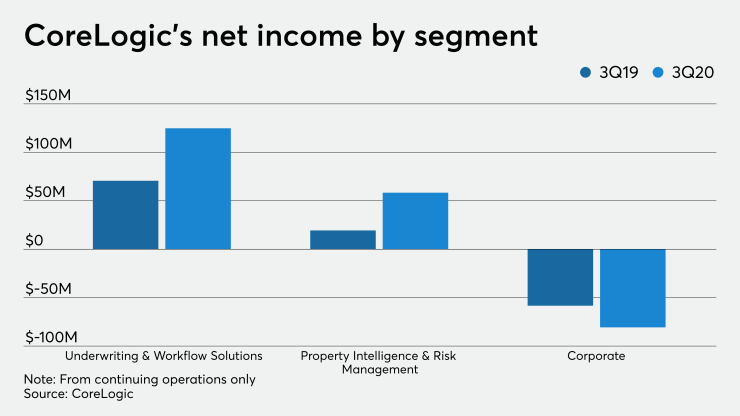

Its Underwriting and Workflow Solutions segment had net income from continuing operations of $124.8 million in the recent quarter, up from $70.6 million one year prior.

At the same time, the Property Intelligence and Risk Management segment saw its net income from continuing operations grow to $58.3 million from $19.4 million over the same period.

But the corporate reporting line lost $80.7 million, compared with a loss of $58.3 million in the third quarter of 2019.