The companies aiming to pull off a hostile takeover of CoreLogic disputed the transparency of the process after sending the property data firm the required shareholder consents needed to call a special meeting.

Previously, CoreLogic announced a

But in a statement, Cannae and Senator said CoreLogic told them it could unilaterally cancel that meeting at any time unless they went through the "cumbersome" solicitation process.

"Games such as these — publicly announcing a meeting, while privately stating the company can cancel it and not allow shareholders to replace directors — are clear signs of CoreLogic's focus on entrenchment rather than shareholder value," the statement said.

"Hopefully the company will end these ploys and simply acknowledge they cannot cancel or delay the meeting, and hopefully the company will not seek to hold multiple meetings in a deliberate effort to sow confusion among investors," it read.

For example, Cannae and Senator claim CoreLogic gave proxy voting service providers two different record dates, Sept. 18 and Sept. 24, as the time at which they would determine eligibility to vote at the special meeting.

CoreLogic said that Cannae and Senator are looking to muddy the waters themselves.

"CoreLogic has publicly committed to holding the special meeting on Nov. 17," a statement from a company spokesperson said. "Senator and Cannae are persisting in running an unnecessary consent solicitation to call a special meeting that has already been called to address the business they propose. We believe this tactic is designed to confuse shareholders and distract them from the fact that the Senator/Cannae proposal

The hostile bidders disagreed and pointed to recent sales of CoreLogic's stock by its largest institutional shareholder, T. Rowe Price, as a sign of support for the transaction.

T. Rowe Price held 12.4% of CoreLogic stock as of June 29, according to Yahoo Finance. On Aug. 10, it disclosed in a Securities and Exchange Commission filing that its share was reduced to 2.5%.

Cannae and Senator argued that those buying CoreLogic's stock now are more interested in seeing the company to do a deal.

"If the company is under the impression that it is necessary to wait until after reporting third-quarter earnings to engage with us or run a sales process, we believe they are mistaken," the statement said.

"We, as well as the broader market, understand that third-quarter earnings will be extremely strong — just as we all knew

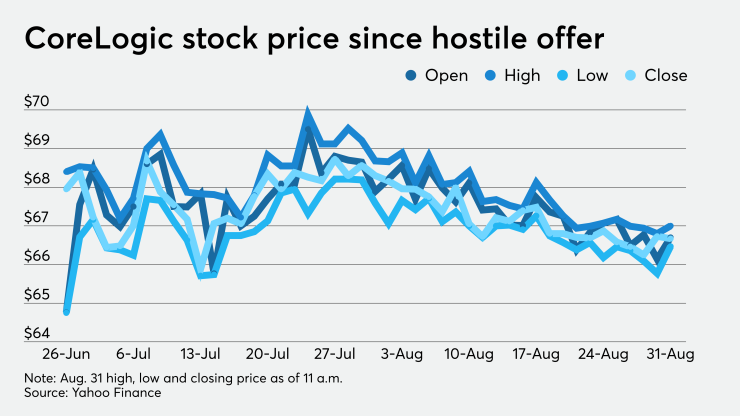

Only on June 26, after the hostile bid of $65 per share