Black homeownership inched up nationwide in the first quarter, but individual municipalities tracked some larger disparities in homeownership by race, which could be intensified by the

Year-over-year, the Black homeownership rate is up 2.9 percentage points nationwide at 44%, according to

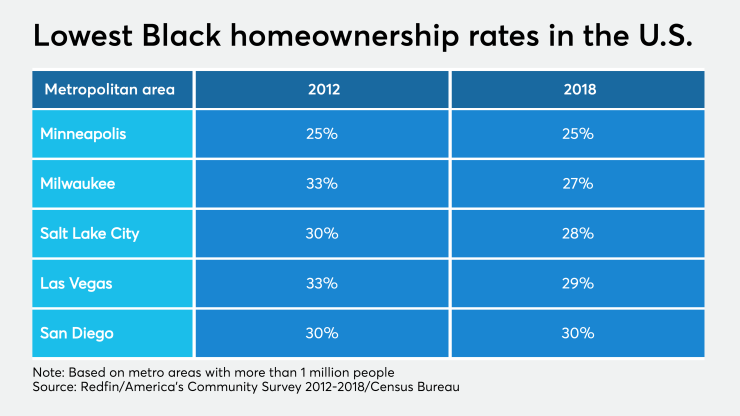

Minneapolis, which has a history of pronounced housing discrimination, has the lowest Black homeownership rate in the country at 25%.

On the other end of the spectrum, Washington, D.C., has the highest Black homeownership rate at 51%.

But even Washington's Black homeownership rate remains far below the national white homeownership rate, which is above 70%.

Whether there can be much improvement in the Black homeownership rate while the coronavirus is hurting the economy remains to be seen.

On top of that, banks have reduced their footprint in the market of more affordable government loans that more recently have helped fuel homeownership in the Black community. At the same time, nonbank influence in the overall mortgage market is shrinking.

Nondepositories' market share dropped to 56.4% from 57.2% in the most recent Home Mortgage Disclosure Act numbers, which reflect lending in the past year. In addition, the coronavirus has increased

On the other hand,

For example,