Credit repair companies had been a particular focus over the past year for Frank McKenna, the chief strategist at Point Predictive, a risk management technology company.

A certain case on the matter recently caught his eye. The credit washing injunction issued against Alex Miller Credit Repair by the Federal Trade Commission in a

Pictures and testimonials from Alex Miller's Instagram page show how those that use the company’s services were able to buy cars and make other purchases, including houses.

"That's when originally I said there is a big link here to the mortgage industry because he’s using the same technique to help people get homes,” McKenna said.

In a joint filing with the Department of Justice, the FTC alleges that Alex Miller Credit Repair’s methods were not above board.

"Through Internet websites, social media, and telemarketing, Defendants falsely claim that, for a fee ranging from several hundred dollars to more than $1,500, they can improve consumers' credit scores," the federal complaint filed in the U.S. District Court for the Southern District of Texas reads. "Defendants attempt to improve the credit scores of their customers by filing false identity theft reports on the FTC's identitytheft.gov website and by other means, all of which are either ineffective or unlawful."

Lenders have not reported a sudden increase in applicants with credit-washed files, largely because of the difficulty in detecting this, said McKenna. "We just know a lot more of it is happening and it's probably getting missed."

Banks and other lenders have been reporting increased instances of credit washing in other forms of lending, including auto and credit card, he added.

"There's no reason why mortgage lenders would be immune to this, because they're part of the credit life cycle," McKenna said. "In fact, there would probably be more incentive to do his because the benefit is so high."

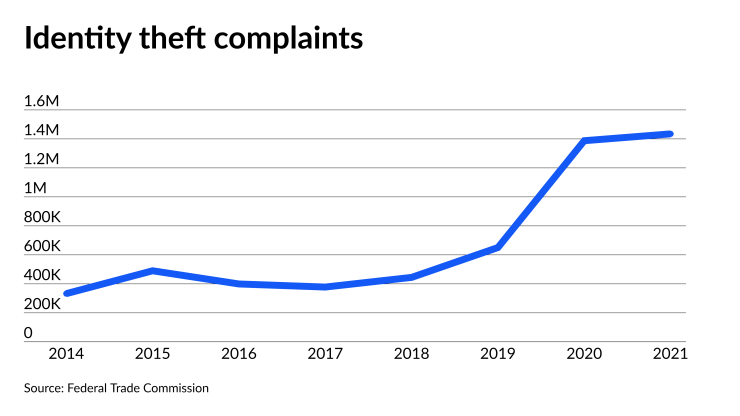

Credit washing activity is likely to have skyrocketed starting in 2017, following a policy change from the FTC. The commission lifted the requirement for victims of identity theft to produce police reports or other records.

Less reputable firms pounced on the opening. While more reports would be a natural result of the easing the process, the sheer numbers are indicative of some abuse of the system. In 2016, just shy of 400,000 identity theft reports were made according to FTC data. That amount was typical of the range for the years prior. But by 2019, the number of identity theft reports rose to over 650,000, then to 1.39 million in 2020 and 1.43 million last year.

Credit washing "always happened to some extent, but I think the bad actors in society are realizing just how easy this is to do," said Naftali Harris, CEO of SentiLink, a provider of identity theft protection software. "And I expect these sorts of tactics to spread in the future."

Bad actors either coach or trick consumers into making those false claims, even though it's illegal, Harris said.

"Sometimes you'll see particular loan officers buddy up with a specific credit repair company," said Bridget Berg, principal, fraud solutions at CoreLogic. "So you might see clusters of it, but it would still be really difficult for a lender to identify those unless they just noticed that people have a whole lot less credit than you would expect," because the file has been washed.

Credit washing is just one piece of what McKenna called "fraud for hire services" some of the

They may also be involved in the creation of synthetic identities; offer credit boosting and have fake trade lines up for sale.

And even if you remove derogatory credit it might not be enough to get the credit score high enough," added Berg. "So then the other thing that they do is they will add you on to somebody else's [credit card] account as an authorized user."

Experts cautioned that the credit washing could have happened years ago, with the original intent not specific to buying a home.

Take for example someone whose actual credit score really should be 500, "but because they've successfully removed everything negative on their credit reports, they end up with 750 or 800 even, and they fit into the mortgage lender's box where they otherwise would not if the lender knew what their actual credit history was," Harris said. A second flavor of this is "occasionally you will see consumers that are disputing literally everything on their credit report, including their mortgage trades," Harris said. "And I think most of those get rejected because it's like, 'Hey, you literally went through a mortgage process.' "

For lenders, these are more of an annoyance to deal with.

How to spot credit washing

Picking up credit washing in the underwriting process can be difficult, although a few hints do exist, the experts said. Point Predictive is able to alert lenders when it sees a borrower's credit profile significantly improved in a very short period of time, McKenna said.

And SentiLink is also working on a solution to detect credit washing, Harris said.

Underwriters should look at the income in the applicants' pay stubs because it is likely fraudulent as part of the overall scheme, McKenna suggested.

"The credit bureau is a very good place to look for all sorts of anomalies because in a fraud, the borrower's credit bureau profile is never going to really match what you would think," McKenna said.

For example, "I'm 40 years old, and I come to a lender. I have been working for 20 years, and I've got almost nothing on my credit report," Berg said. "That's usually a red flag that somebody might have cleaned something."

The credit-cleansed consumer might also accelerate their credit use very quickly once that the file has been cleansed. This ramp up is a "dead giveaway" of a credit washed file, McKenna continued.

Checking public record data for civil legal judgments and tax liens can also help to ferret out credit washing, Harris suggested. These items are no longer contained in

These same red flags can signal other types of fraud, such as the use of a synthetic identity.

However, lenders do need to be cautious not to go overboard rejecting anyone who used a credit repair company. "There are some legit credit repair companies out there," Berg noted. "It would be very, very difficult to deny somebody alone for that."

Still when it comes to detecting credit washing, "honestly, it's a big challenge," Harris said.