Want unlimited access to top ideas and insights?

Mortgage rates descended through the onset of spring's home buying season, pushing up the share of refinance loans and volume of new-home purchase applications, according to

The average 30-year note rate dropped to 4.61% in April from

"We are seeing closing times drop across the board as our lenders leverage technology for a more efficient and streamlined loan origination process," Jonathan Corr, president and CEO of Ellie Mae, said in a press release. "And as the 30-year note rate continues to decline and closing rates remain high, we expect to see an active spring home buying cycle."

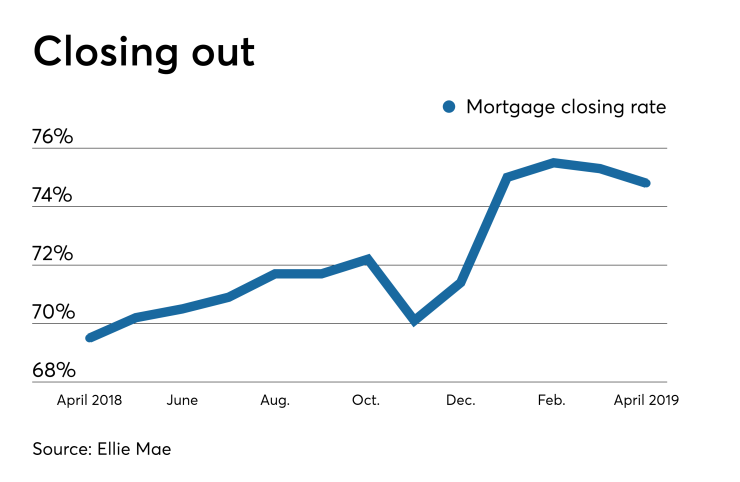

Mortgage closing rates increased to 74.8% from 69.5% the year prior. However, it dipped from March's rate of 75.3%.

The time to close on a mortgage trimmed in April, falling to an average of 40 days from 41 days a year ago and 42 days in March.

Average FICO scores across all loan types rose to 728 after holding at 726 through February and March, and grew from 723 year-over-year.

The data from Ellie Mae's

The report dovetails with the Mortgage Bankers Association's April Builder Application Survey, which shows new-home purchase mortgage applications jumped 15.6% annually and 3%

"There was a healthy increase in new-home purchase activity in April, boosted by the strong economic and employment conditions seen in the first quarter of 2019," said Joel Kan, the MBA's associate vice president of economic and industry forecasting.

"Applications for new-home purchases increased, as did our estimate for new home sales. After two months of declines, MBA estimates that April new home sales were 10% higher than last April and reached the highest annual pace since this survey’s inception in 2013."

In addition to the 10% year-over-year jump, new single-family home sales increased 6.8% on a seasonally adjusted basis and 4.5% on an unadjusted basis from March.