Slowing price appreciation in several California housing markets has produced growing defaults in the state, according to ForeclosureS.com, a Fair Oaks, Calif.-based investment advisory firm.Alexis McGee, president of ForeclosureS.com, said notices of default totaled 10,247 in major Southern California counties in the third quarter, but only 3,150 in eight of the nine San Francisco Bay Area counties. "Defaults in California's southland are moving off the historic baseline because the housing markets there are finally cooling down," she said. Defaults are still low in the Bay Area because their price correction "had just barely begun," the company said. ForeclosureS.com can be found on the Web at http://www.foreclosures.com.

-

The government-sponsored enterprises' oversight chief severed ties with the AI firm following President Trump's dispute with it over boundaries on military use.

44m ago -

In the initial aftermath of the conflict, the 10-year Treasury rose by 10 basis points over a two-day period, pushing mortgage rates back above the 6% level.

1h ago -

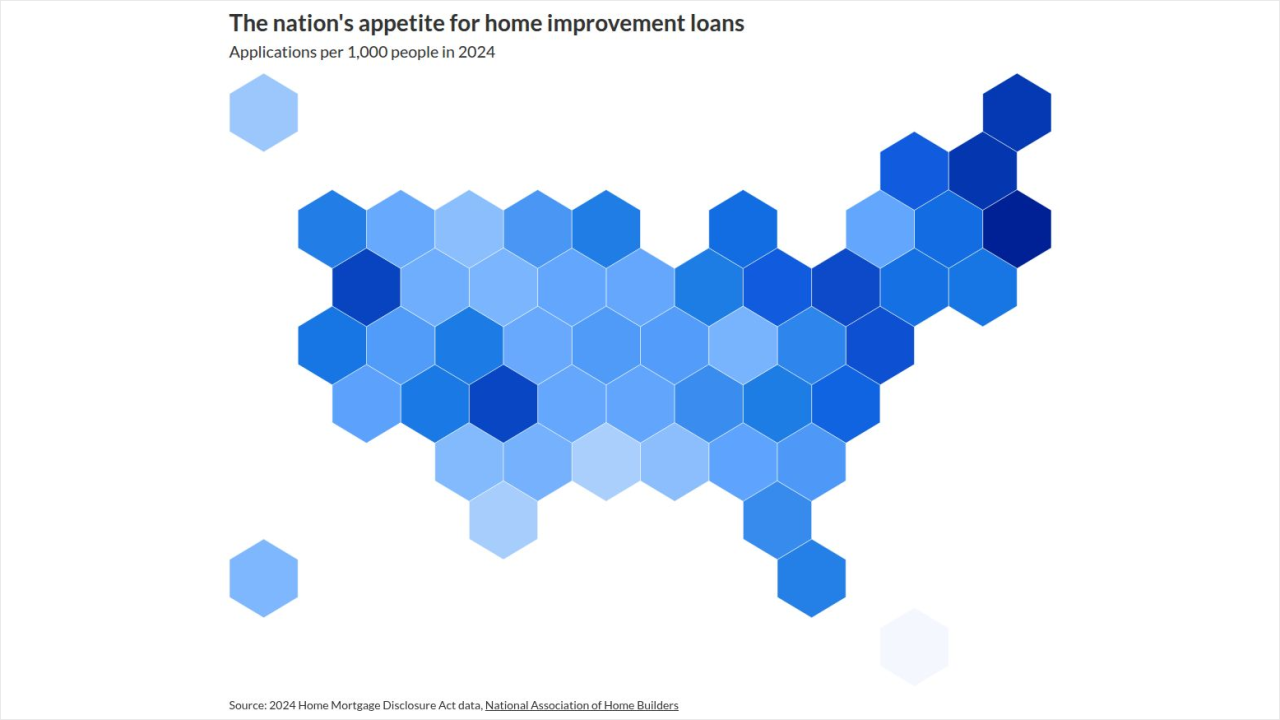

Applications for renovation financing in 2024 were more abundant in some of the nation's smaller counties and states, than in the largest housing markets.

1h ago -

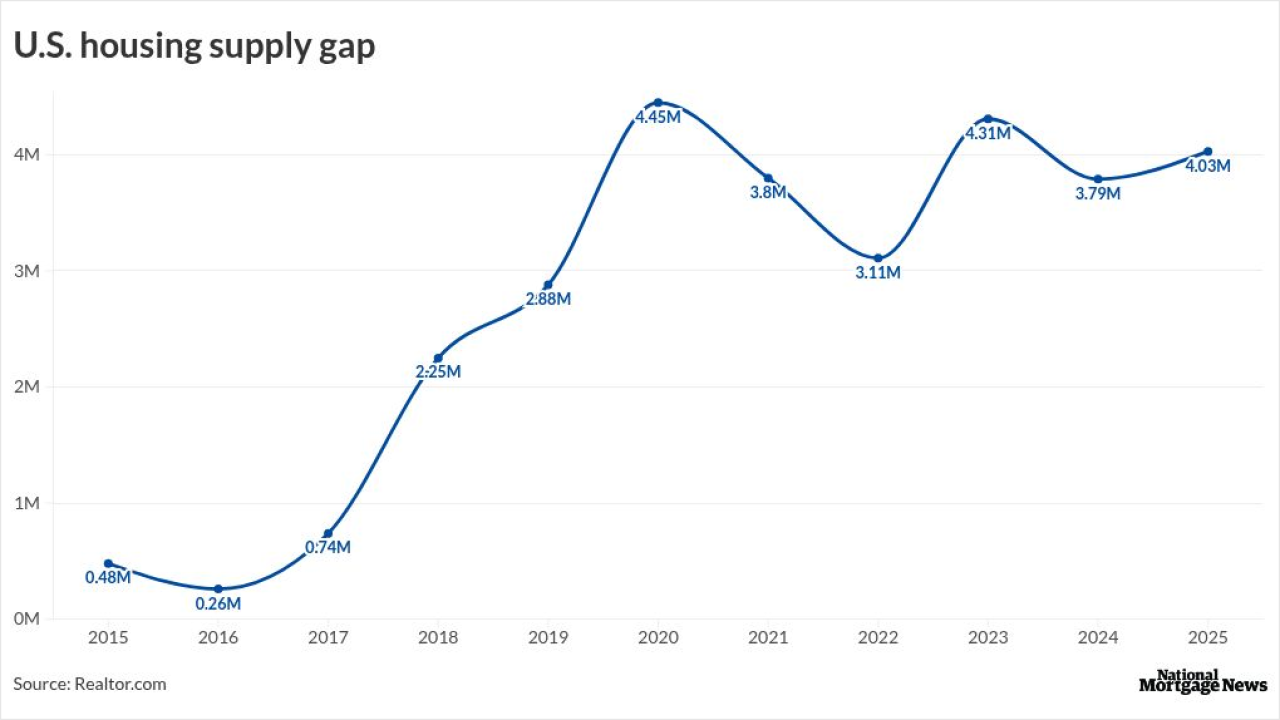

The housing supply gap hit an estimated 4.03 million, an increase from 3.8 million in 2024, as new construction fell short again, according to Realtor.com.

2h ago -

Mutual of Omaha, Finance of America and Longbridge Financial rank at the top of HECM endorsements over the past 12 months, Reverse Market Insight reported.

5h ago -

Sens. Tim Scott, R-S.C., and Elizabeth Warren, D-Mass., released new legislative language Monday night that includes a ban on institutional investors' purchase of single family homes and a temporary ban on the Federal Reserve issuing a Central Bank Digital Currency.

6h ago